This paper highlights the likely impact that the Trump energy policy reset may have on Washington’s approach to energy transitions domestically and globally. It seeks to identify any recalibration that this changed approach may have triggered in the long-term agenda of US partners. The paper focuses on the United Arab Emirates (UAE)—a country that has substantiated its commitment to clean energy pathways with sizeable investments of political and financial capital. The analysis is based on perspectives relating to two specific concerns: the inherent value of energy transitions into a hydrocarbon-based economy such as the UAE, and the country’s possible intent and ability to mitigate any gaps that a potential US retraction may have on clean energy objectives globally. The paper makes a case for the UAE to demonstrate initiative in furthering the cause of energy transitions and climate action, particularly in its engagement with the Global South.

Attribution: Cauvery Ganapathy, “The Impact of Trump’s Energy Policy Reset on the UAE’s Transition Agenda,” ORF Occasional Paper No. 487, Observer Research Foundation, July 2025.

Introduction

United States (US) President Donald Trump’s stated energy policy, framed in the context of an “energy emergency”,[1] is expected to have a substantial impact on the trajectory of international energy transitions and global warming redressal pathways. Given the US’s previous commitment to the Paris Climate agenda,[2] its retraction will arguably result in dampening the momentum to meet emission reduction targets internationally while creating disruptions in the mitigation architecture. The gaps thus created, whether in terms of abandoning climate finance modules supporting the green agenda in developing countries, or by way of curbing the systematic integration of renewable energy into its large-scale infrastructure, can effectively compromise the international community’s efforts towards energy transition and the redressal of climate change.

This paper contextualises the likely impact of this policy reset both nationally and internationally. It makes the case that middle powers such as the United Arab Emirates (UAE)—[3] a country that harbours a robust multifaceted partnership with the US based on considerable alignment of multi-sectoral interests, while also demonstrating a commitment to the cause of transitioning its fossil-fuel-based economy—may be uniquely positioned to mitigate some of the gaps thus created through proactive and targeted initiative.

The paper builds on four areas of consideration. First, identifying the implications of the energy policy reset on American government and non-government entities connected to the energy transition agenda. Second, it makes the case for incorporating the energy transition into the UAE’s future plans, given the country’s commitment to economic diversification. Third, should this emerge as a viable rationale undergirding the UAE’s energy transition, this paper will evaluate whether it would be reasonable to expect the state to remain committed to its climate agenda regardless of how US policies may transform. Finally, the paper will delineate that the UAE should build on its momentum in the energy transition space instead of underplaying its ambitions. The analysis will explore the possibility of the UAE positioning itself at the heart of the energy transition agenda, by ingraining a more equitable system of burden-sharing while mitigating the gaps left by the US. This can be accomplished through climate finance models that are better anchored in the ideas of just and sustainable energy transitions.

Why the Reset?

President Trump’s announcement of the country’s withdrawal from the Paris Climate Agreement, and the subsequent freeze on the Bipartisan Inflation Act (BIA), the Inflation Reduction Act (IRA), and the Department of Energy’s (DoE) clean energy programmes, along with the parallel reinvigoration of fossil fuel exploration marks not just an incremental change but an overhaul of the US’s place in the international energy and climate change equation. The calculus behind the “unleashing of American energy”[4] is two-fold: first, that the US should not remain vulnerable to any external shocks born of supply chain bottlenecks and energy market disruptions; and second, the equating of energy dominance with strategic autonomy and critical leverage.

Two compelling threads tie together the Trump administration’s problematic assessment that prompts such a reset:

First, the US’s exigent concerns, something that the Trump administration is perhaps more cognisant of, differ from the obvious urgency of climate change dilemmas. For instance, while it is true that clean energy options are competitive, especially when economies of scale are achieved, fracking presents a more immediate solution for the country given its substantial shale reserves.[5] This is because the Levelized Cost of Energy (LCOE)[6] of utility-scale clean sources such as onshore wind and solar energy in the US is much lower than fossil fuels, although data for 2023 and 2024 indicates a marginal increase.

Also, the continued insufficiency of grid capacity has been aggravating the headwinds that renewables have been facing in the US,[7] just as cost overruns are being questioned. The undeniable lacunae in the pace and form of transition pathways are among the issues that the Trump administration has flagged with the energy transition.[8] Differing viewpoints within the US DoE leadership have also highlighted a clear causality between the investments in climate science and the less-than-ideal pace in energy development in a manner that would address issues of affordability, accessibility, reliability, and energy poverty.[9] Further, the Trump administration’s budget cuts suggest a particular reluctance against investment in climate science. Energy Secretary Chris Wright has, for instance, argued before the Congressional Committees looking into the funding cuts to the clean energy programmes, that climate science is “highly politicized.”[10]

While the issues with renewable energy options and the transition itself have been magnified in Trump’s energy doctrine, the obviousness of shale gas and its use as a platform well-suited to the stated economic goals of the Trump administration have been amplified, and not always inaccurately. By being integral to the country’s energy self-sufficiency as well as the Trump administration’s hopes for energy dominance, the shale-gas revolution has led to dramatic changes in the US’s geo-economic and geopolitical calculations.

A second pertinent concern and prudent strategic calculation that this policy reset hopes to address is the need to de-risk the US’s supply chains based on the recognition that the clean energy pathways grant lopsided leverage to China, since they have a monopoly on rare-earth raw materials supplies[11] as well as renewable energy hardware—both of which are essential inputs in the transition. This concern can also be tied to the administration’s demands for reshoring energy manufacturing locally.

On the grounds of national interest, when an administration harbours both of these beliefs, and not always erroneously, the Trump energy reset is a natural progression. Combining to underwrite this policy reset are: the strategic calculus inherent in the disagreement that the Trump administration has with the implications of the energy transition supported by the IRA; the calls for ceasing the pursuit of renewable energy integration into the Department of Defense’s (DoD) future plans; concerns regarding the vulnerabilities that China’s rare-earths monopoly may introduce into the US’s energy infrastructure and supply chains; and finally, the continuing and enhanced commitment to fracking.

The Broad Impact of the Reset

In an interdependent world, the change in the US’s energy policy can broadly be expected to have compounding ramifications on three clusters of actors. These are discussed in turn in the following paragraphs.

The first and most potent impact of this changed policy landscape will be on public and private entities within the US, which have benefited from supply-side incentives under previous administrations. This assumption is based on the twin problematics of the Trump administration’s funding and tax credit freezes under the IRA on proposed and ongoing clean energy projects, as well as the repercussions of the imminent trade war with China—a nation with a higher concentration of rare-earths raw materials and processing capabilities.

There are three caveats to this expectation. First, the renewable energy industry in the US is mature today, and the substantial sunk costs in the field make a complete reversal and shunning of the cleaner pathways highly unlikely. Given the investments already made and the employment numbers tied to it, while it would be reasonable to expect a recalibration in the US’s funding commitments internationally, the complete or arbitrary abandonment of ongoing domestic projects only because they belong to the clean energy vertical may be unlikely. What could happen, however, is a slowdown in the pace and an increase in costs.

Another consideration that may also offset the anticipated losses to the industry and the limitations on the clean energy transition is the state and federal policy demarcations inherent in the US polity. States that insist on keeping to their transition trajectories may face a spate of litigation. The creation of California’s US$25-million fund in January 2025 to underwrite litigation to challenge the IRA rollbacks under Trump is symptomatic of this.[12]

The second set of actors likely to feel the greatest impact of the Trump energy reset are the countries for which the clean energy transition was underwritten by the US’s commitments and mobilisation of funding. The Trump administration has, for instance, withdrawn from the Just Energy Transition Partnership (JETP)[13] and Power Africa initiatives, impacting both the energy transition process and access to electricity for millions in South Africa (US$1.063 billion) and Indonesia and Vietnam (US$3 billion).[14] While partners like the European Union (EU) and the United Kingdom (UK) remain committed to the initiatives, the withdrawal by a progenitor of the initiative will compound adverse repercussions on the fulfilment of the agenda.

A third group that can be expected to feel the domino effect of the Trump reset is those engaged in climate research, with organisations, institutes, and researchers reporting a withdrawal, since February 2025, of federal grants and funding to any studies with even the term “climate and clean energy” in their proposal.[15]

Impact on the UAE

The UAE does not feature on either of these three indices, and could reasonably be expected to bypass any ripple effect from the reset. This is primarily because the UAE has built its renewable energy industry proactively in a top-down approach and remains committed to the cause of clean energy for reasons that are independent of the US’s approach. This is despite the considerable collaboration that the two partners have had over the last few years.

Just as the Trump energy policy is based on the administration’s interpretation of what the US’s urgent concerns are,[a] the UAE has come to a different conclusion when faced with a similar, though not identical, problem set. For a petro-economy to invest in clean energy in the manner that the UAE is committed to,[16] reveals a recognition that the essence of energy security remains in the diversification of resource supplies alone—whether in terms of the country of import or the particular kind of energy it chooses to prioritise in its energy basket. The multidimensional strategy adopted by the UAE represents the kind of dichotomy inherent in the global energy consumption patterns. The year 2024 saw the simultaneous installation of 600GW of solar energy plants worldwide,[17] alongside global clean energy investment that reached more than US$2 trillion for the first time.[18] The same period also saw a record-high coal consumption registered at 8.7 billion tonnes.[19]

With the US shifting gears from its role as a development finance and clean energy facilitator, the gaps that will be created in the international transition and mitigation portfolios will need a group of committed actors to come together to fill the space. The UAE could position itself as one of the principal actors in such a framework, and may do well to rally more stakeholders to the cause so as to maintain momentum in the domain. The country has simultaneously evolved as a node of connectivity, an innovation hub, and a responsible investment facilitator with a very different risk calculus than actors in traditional development finance. This places the UAE in a position where it could serve as a practical fulcrum for pushing the clean energy agenda effectively in the absence, temporary or otherwise, of the US.

While the centrality of the US to the transition over the past decades means that no actor can expect to remain insulated by the changes originating in DC, the UAE’s continuing commitment to the transition pathways, born more organically from its own long-term goals and ambitions, is unlikely to suffer due to any drawdown from the US. It could only accelerate further, given the value that the country sees in the enterprise. This proposition could be explored through the bilateral partnerships continuing between the two sides in the clean energy sector presently, and also the inherent value that the energy transition has for the UAE’s long-term diversification agenda.

US-UAE Partnerships in Clean Energy

The UAE-US engagement in the field of clean energy is founded principally on three levers, viz., the value of the UAE as an investor underwriting renewable energy and clean-tech funding internationally in collaboration with and in the US. Second, on the sharing of research and best practices in the field of clean energy, particularly solar, batteries, and now, nuclear. Third, on the two countries forming a partnership to propel the climate change mitigation order, with a commitment to working on subjects of climate finance and methane reduction, among others.[20]

Furthering their comprehensive bilateral partnership on multiple fronts, the high mark of the US-UAE collaboration in the field of clean energy came in 2023 through the announcement of the Partnership for Accelerating Clean Energy (PACE) with a commitment of US$100 billion to fund 15 GW (new) of renewable energy projects by 2035.[21] The arrangement proved complementary due to the deliberate intent of the UAE’s sovereign wealth fund to enhance the scope of investment in innovations and technologies of the renewable energy space, and the US’s receptiveness to investment in the field while enabling assistance through the provisions of the IRA. The first tranche of US$20 billion consisted of a commitment led by MASDAR and a consortium of private American investors. The funding arrangement was agreed as a mix of private sector cash and debt financing from the American side.[22]

Although the Trump administration’s energy reset can be reasonably expected to affect the UAE’s investments in the US by way of the drawdown on the IRA, which may increase the cost of projects, in addition to factoring in any potential litigation. The status of the joint collaborations has been stable, as shown in Table 1.

Table 1. Status of Clean Energy US-UAE Partnerships (as of March 2025)

| US-UAE Partnership (Entities) | Project | Quantity of Generation | Status |

| US Government’s Power Africa Initiative-UAE’s Averi Finance ( US$10 billion) | Connecting 500,000 homes in Sub-Saharan Africa to enhance clean energy access. | 8GW of power generation projects | Ongoing |

| US Government’s Power Africa-UAE’s AMEA Power (US$5 billion) | Renewable Energy capacity acceleration in Africa | 5GW | Ongoing |

| MASDAR (Acquisition of 50 percent stake in Terra-Gen) | 30 renewable power sites of wind, solar, and battery storage (California, New Mexico, Nebraska, and Texas) | 3.8GW (with 5.1GWh of energy storage) | Ongoing |

| ADNOC’s 35 percent stake acquisition of ExxonMobil’s clean energy facility in Texas | Proposed hydrogen and ammonia production | 900,000 tonnes of low-carbon ammonia | Ongoing |

| UAE’s G42 and Microsoft (US$1 billion) | Development of a state-of-the-art green data centre campus in Kenya, run entirely on renewable geothermal energy and designed with state-of-the-art water conservation technology. | Part of a comprehensive digital package working on the facilitation of clean energy transitions in the country | Ongoing |

| ADNOC (XRG) and Occidental | Carbon dioxide capture and storage | 500,000 tonnes/year* | Ongoing |

Based on data from MASDAR and ADNOC project status on official websites, March 2025.

*The quantity was announced in May 2025, when this paper was under review.

The Value of Energy Transition to the UAE’s Diversification Agenda

In addition to climate change mitigation objectives, the UAE recognises the renewable and clean energy space to be an industry of the future and bases its strategy on this clear premise.[23] The finite nature of its fossil fuel reserves serves as a sobering reality—however muted and distant—which means that the diversification of the economy from its hydrocarbon-reliant model is non-negotiable. If the UAE is to achieve its own goals vis-à-vis the net-zero commitments at COP28, it will have to transition away from fossil fuels and triple its renewable energy capacity by 2030.[24] By this marker, the country cannot afford to slow down, much less temporarily halt, its pursuit of the clean energy transition.

The UAE has developed a segmented policy framework which recognises that only a multidimensional energy transition will be able to ensure energy security while being cognisant of its clean energy commitments. There is an institutional recognition that the traditional energy choices of oil and gas must be phased out, albeit gradually, and that their displacement would have to be comprehensive without being disruptive, with an eye on a timeline.

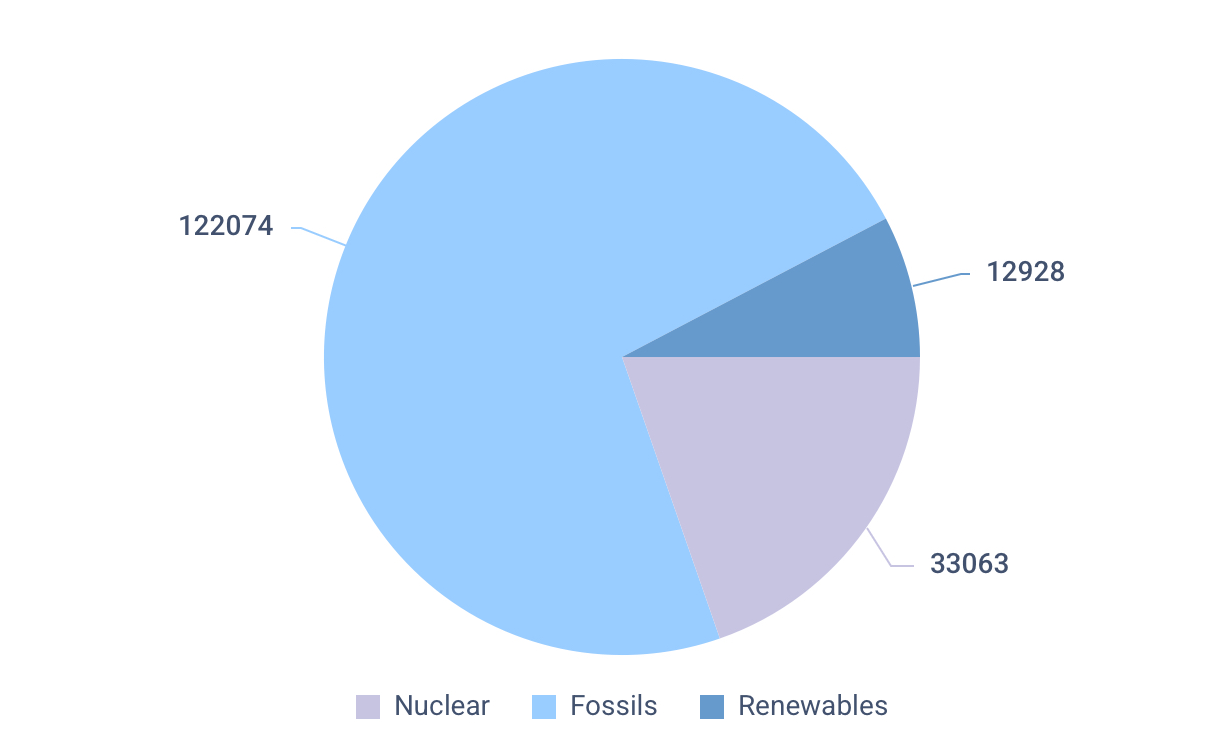

Figure 1. UAE Electricity Production, by Source: Electricity Supplied [GW (e)*h]

Source: IAEA, 2024[25]

Given that natural gas is a mainstay of the UAE economy and its national energy plans,[26] its use as a bridge fuel will continue for the foreseeable future. Simultaneously, the country is committed to investing in more gas and nuclear power over the next decade to power data centres, as well as allocating more chemicals to provide liquid coolants for such systems.[27]

The country’s commitment to achieve 100GW of clean energy by 2035 and a net-zero target by 2050 is fundamental to their operational goals, and not just a simplistic normative preference. The energy transition pathway that the UAE has set up for itself[28] must be considered as part of an economic transformation and not just an energy diversification strategy. It makes fiscal sense for the UAE to make the substantive CAPEX investments due to the competitive costs from the economies of scale that stem from the comprehensive expansion of clean energy options to its entire economy.

In line with this logic, the country has been diversifying its energy portfolio. It is home to one of the world’s largest solar generation facilities at Al Dhafra.[29] This single-site solar park carries at its full capacity the ability to offset 2.1 million tonnes of CO2 annually.[30] It is, however, yet to reach the same amount of power output as the Xinjiang and Golmud plants of China and India’s Bhadla, respectively,[31] which are recognised as the largest solar power producers in the world. The country has also been investing in R&D for carbon capture technologies, with projects for the largest Integrated Carbon Capture project in the MENA region.[32] Additionally, the Barakah nuclear facility, with its four nuclear reactors endowed with a capacity of 5,321 Mwe, accounts for 20 percent of the country’s electricity supply at present. Once fully operational, the facility is expected to produce 40 TWh of clean energy for at least six decades.

Energy efficiency is a central deliverable in the UAE’s energy transition projects. Due to the lack of any massive demonstrations of this principle, energy efficiency rarely gets its due during discussions. However, it is a crucial variable that could make a substantial difference, and one that the leaders of the clean energy space in the UAE take cognisance of. The integrated smart grids and smart metering in the deployment strategies of the UAE focus on this aspect, and are something that companies like MASDAR[33] and ADNOC[34] see as key deliverables in their business models.

The UAE’s architecture in the industry also makes a case for an expansion and entrenchment of the co-location energy systems model. Price invariably directs activity in the energy industry, so the co-location option alongside integrated energy efficiency pathways creates a circular subset in the sector, which can offset both cost and emissions. The UAE’s establishment of the first Battery Energy Storage System (BESS) giga-scale unit in the world[35] appears to streamline this understanding. By adopting co-location, the country could generate considerable value through the capture of waste heat in existing energy infrastructure and funnelling this byproduct into long-duration energy storage.

The UAE’s Comparative Strengths in the Domain

It is in the twin areas of Battery Energy Storage (BESS) and civilian nuclear energy that the UAE could capitalise on its comparative advantages forged by three interlinkages in its economy that a deliberate policy architecture has generated.

- As a country with the first AI ministerial role in the world,[36] the Emirates has positioned itself at the centre of the next-generation technology disruption that can be ushered in through Artificial Intelligence (AI) and High-Performance Computing (HPC). The UAE has been building credibility as a leader in the international data industry and ecosystem.[37] Its role in the mining of data and the digital economy necessitates that the UAE ensure reliable grid-scale energy to meet the mammoth energy and cooling demand that such facilities generate. Apart from the technical logic, policy and demand signalling suggests that there is a clear preference that this energy be of a low-carbon form.[38] There is a recognition that the kind of sizeable pressure on the grid[b] that a single data-mining sector can impose[39] makes it entirely impractical to meet this demand through renewable forms of energy alone by completely shunning fossil fuel. The majority of the electricity generation for this purpose has been low-carbon.

- This low-carbon pathway to undergird the data-mining ecosystem commends nuclear energy as a reliable grid-scale low-carbon option, making it an excellent answer for the pursuit of the UAE’s digital as well as clean energy goals and targets. As a baseload guarantor option, it is also a form of energy that is relatively impervious to market fluctuations. Primarily due to their modular nature and capacity customisation options, Small Modular Reactors (SMRs) are uniquely suited to underwriting the energy requirements that data mining has. While SMRs remain an ambition pending design standardisation and operational modalities being tested, it is a domain that the UAE is deeply invested in. The Emirates Nuclear Energy Corporation is at the centre of this effort and is presently working on the development of SMRs, advanced nuclear reactors, and hydrogen fuel cells under their ADVANCE programme.[40]

- It is in the vertical of storage solutions (batteries) that the UAE could capitalise on its comparative advantages most, and establish a formidable clout, if it continues to build on the momentum. The country recognises that batteries are the next frontier, and it has the potential to actualise many of the clean and sustainable energy transition objectives through a recognition that different types of storage solutions cater to different problems. The UAE is demonstrating impressive foresight and capacity-building in the domain. Emblematic of this is the country’s establishment of the world’s first giga-scale Solar and BESS project that couples solar energy generation with storage capacity, which will generate 1GW of baseload power from renewable energy.[41] The 6GWh ENERCAP factory in the Dubai Industrial City[42] is another example of this drive.

Seeking Complementarities with the US in a New Policy Landscape

There is a temporal context within which the policy approach emerging from the US must be situated. The Trump administration’s energy policy reset, while expected to have a substantive and long-lasting impact on global energy transitions, could undergo an equally dramatic reversal with a change of guard in Washington. What is more abiding, however, is the value that the US and the UAE see in partnering with each other across multi-domain questions.

While there have been differences between the Republican and Democratic approaches to the country in the area of sharing of advanced technology, on the issue of cooperation in the renewable and clean energy sphere, there has been a bipartisan commitment in the US towards the partnership with the UAE. Given the bipartisan nature of the engagement in the sphere, it would be reasonable to expect a continuing partnership in the domain, which could build on the following complementarities between the two sides:

- The Abraham Accords reworked the narrative of engagement beyond that of politics to one of connectivity and investment in the Gulf, and the UAE-US collaboration could substantially enhance this potential. Under its outlay, the UAE is poised to play a critical role in the facilitation of the multi-modal India-Middle East-Europe Economic Corridor (IMEC),[43] for one, and become an important node of connectivity which the US can benefit from in sustaining viable inroads in the region. Through this mode of engagement, the nation can also participate in the multi-modal interlinkages from Asia through Europe.

- Deployment of AI and the necessary expansion of data centres is a central policy prerogative of both the US[44] and the UAE,[45] and one in which the partners appear to be actively seeking synergies. There is a demonstrable receptiveness on the part of the Trump administration to the UAE’s ambitions of becoming an industry leader in data and AI, marked by the willingness to share advanced chips technology[46] with the Gulf nation. It is also playing a role in facilitating the building of the world’s largest AI campus outside of the US.[47] These specific deals, such as the ones involving nuclear commerce, tend to have a much longer engagement timeline in terms of investments and project lead times. A commitment to such strategic pathways could thus be interpreted as developing a well-assessed stake in the long-term growth of each other.

- Again, the US has a military presence internationally which, even when reduced, is likely to persist. As part of this, the US DoD has a mandate to ensure energy resilience in the face of any potential [48] As part of this, establishing microgrids across all military installations is a prudent investment. The smart grids that the UAE is developing and deploying effectively at the domestic level could offer modular support options to these efforts at a fraction of the cost. While the Trump administration has made it clear that emissions reduction is no longer a target, cost savings and a faster turnaround timeline will undoubtedly remain desirable priorities. The degree of collaboration that the two partners could have in the field of propelling energy technologies through the funding and standardisation of the results of expensive R&D is substantial. It is not one that the Trump administration’s energy reset automatically eschews, given the economic benefits and competitiveness it could introduce.

- Hydrogen, which is currently the only viable option for long-duration energy storage, presents another important area of potential collaboration between the two countries. There is also considerable value in the derivatives of green hydrogen, such as ammonia and synthetic methane, particularly in hard-to-abate sectors such as construction, shipping, and aviation, although the substantially non-competitive pricing and the lack of supply make Sustainable Aviation Fuel (SAF) a less viable option at the moment.

- Relatedly, the coincidence of interests that the US and the UAE have in engaging with India on issues of connectivity, green hydrogen, and perhaps, the enhancement of a cooperative framework relating to nuclear commerce, could evolve as another mutually beneficial subject for the two countries to consolidate collaboration in. Similarly, collaborating with the UAE could generate a lasting impact on the US’s ability to access raw materials critical to its supply chains from the Global South at a time when China and Russia have increased their presence in the Middle East-North Africa (MENA) region and other parts of Africa.

- Finally, the UAE, alongside its Gulf Cooperation Council (GCC) partners, is today consciously working to position itself as a networked region building prosperity across different regional and sub-regional clusters. This makes it a valuable partner for the US at a time when Washington appears to be refashioning its engagements internationally. The UAE brings considerable experience through its logistics network into multi-modal connectivity models. This could prove particularly beneficial to countries looking to engage with Africa.

The African continent, with 18 percent of the world’s population and only 2 percent of air travel is about to finalise the African Continental Free Trade Area Agreement (AfCFTA) which, when realised, is expected to increase intra-African maritime trade by 62 percent—this roughly translates to a demand for nearly 100 vessels capacity addition.[49] The role that companies such as MASDAR and ADNOC can play alongside entities like DP World and the Abu Dhabi Ports (ADP) group, which already has a sizeable presence in the logistics of the continent—[50] with a presence in ports, dry ports, and SEZs—is substantial. The benefits of this engagement can accrue to the UAE’s partners equally if the focus remains on finding areas of cooperation despite differences.

The pursuit of energy security as well as clean energy pathways is rooted in specific spatial and temporal contexts, rarely ever uniform across borders. A universality in response to even exigent concerns stemming from them thus becomes an unrealistic expectation. While the UAE and the US differ on the need, urgency, and modalities to act on global warming through the facilitation of the energy transition, it is reasonable to expect that the two could cooperate, and even expand collaboration on technologies of the future, where the national and strategic international interests of both converge.

Recommendations: UAE’s Distinguishing Proposition

Showing up for the Global South

The country’s template of transition which builds on a supplementing or phasing out of fossil fuels instead of any immediate overhaul of national energy systems driven by an exclusively green agenda, resonates far more with the ecosystem of countries of the Global South where economic development and energy access issues continue to be the preponderant motivations. In its engagements with the Global South, the UAE builds on the COP26 commitments of wealthier and more industrialised nations to provide technology transfers and financial assistance, but distinguishes itself from the positions of these countries that insisted on fossil-fuel-bereft pathways to growth. The long-term aversion of countries such as Germany, for instance, to fund fossil-fuel-based projects in the African continent[51] is, by any metric, an expensive compulsion to impose on countries with abysmally low per capita incomes and large-scale gaps in energy access.

It may be reasonable to expect that in a climate finance regime where countries like the UAE assume a greater role, such impositions would not proliferate, given the segmented energy transition policy that the country has repeatedly committed to in its own net-zero ambitions. The clean energy projects undertaken by Emirati entities such as MASDAR as they participate in Africa’s transition story[52] reflect this approach. Just as the UAE’s Etihad 7 programme,[53] while being committed to providing 100 million people on the African continent with clean energy by 2035, works on the premise of gradual transition towards cleaner forms of energy while recognising the developmental needs of these countries. By building on these models, the UAE could play a singular role in facilitating energy access animated by principles of a more equitable, sustainable, and just transition in the Global South.

Extrapolating the lessons from such templates, the UAE and its partners could help redesign the normative considerations of the forms of energy that countries of the Global South choose for themselves, by helping underwrite funding mechanisms that pay heed to these urgent and contextual concerns of the developing countries. Importantly, the abject energy poverty and access issues on the continent offer the UAE an avenue for expanding its stake in the energy markets as well, while opening avenues for the country to introduce energy efficiency and clean energy pathways into the hard-to-abate sectors, such as logistics.

Reimagining Transition Finance

The UAE’s championing of the Global Finance Framework launched at COP28,[54] and its commitment to meeting the financing gaps through the private sector banks in the country by 2030, could prove to be a valuable alternative at a time a major actor in the field, such as the US, is retracting from a similar erstwhile role. The UAE has been instrumental alongside partners such as Brazil[55] in coming up with ways to create reliable and affordable financing mechanisms and enhancing access to international climate funds. The country has included the provision of financial support to clean energy projects through instruments such as soft loans in countries of the Global South as an important part of its foreign policy and international outreach.[56]

The influence that the Trump administration is expected to wield on international financial institutions also means that for most countries, at least for now, transition finance could become difficult to avail of. The UAE could rally its GCC partners, along with the EU, to forge a more inclusive discussion around the subject of Climate Finance to try and offset the resulting gaps.

A combination of blended finance instruments that integrate private and public finance with the support of the Sovereign Wealth Funds of these countries could have a positive impact on the field. Similarly, the parameters of risk aversion and returns on investment (RoI) would also likely be different in the context of the UAE engaging with the developing world—in that perhaps the compliance sought by the UAE would be more stringent in technical terms and time deliverables instead of a focus on national socio-political contexts of these countries. Further, the long gestation period of the RoIs on renewable energy do not correspond to the bottom-lines that banks are looking at, and it is natural to expect that private capital/bank capital will flow to mature markets with lower risks. The UAE, through its ability to steer investments through its Sovereign Wealth Funds, for instance, could rally its partners and resources to the operation of climate investment funds such as the African Green Investment Initiative.[57]

Facilitating Public-Private Industry Policy Building Focused on Energy Transition

The UAE could build on two specific pursuits as the pillars of its distinguishing proposition in this changed energy policy landscape. First, it could systematically mainstream climate change concerns in its own public and private sector operations. This would help integrate clean energy options into the country’s production and consumption models. Second, the country could work on developing a model for incentivising adherence to climate change and clean energy commitments through price points that reward transition.

With its substantial institutional commitments to renewable energy projects nationally and internationally—as highlighted earlier in this paper—and its evolving techno-dominant approach to deployment of public goods, the country could aspire to benchmark a template where combinations of government accelerator programmes and private-sector-led innovation projects could benefit from industry-wide best practises to ease into the energy transition.

The UAE could also draw upon its partnerships with countries such as the US, France, and India to build on an industry-specific programme of training and upskilling that caters specifically to the needs of industries connected to the energy transition.[58] The fields of nuclear technology, the hydrogen economy, and the optimisation of battery technology offer avenues for exploring such cooperation.

Burden-sharing as an Invested Stakeholder

Contributing to the cause of burden-sharing need not be based on any inherently democratised approach to the issue of global policymaking. It could, instead, be a function of recognising that differentiated responsibilities and clusters of influence could be an effective component of burden-sharing. While the tenor and tone of the Trump administration may have overshadowed its fundamental message, arguably, a focus on equity without addressing the burden of debt is neither a wise nor a sustainable long-term template for cooperation between states.

The Trump years will necessarily cause disruption. Disruptions, however, have their own upsides. The normalisation of a different prism in International Relations, where issue-based congruence between countries is as palatable as ideological alignment, may become a more commonplace practice as a result of this particular approach of the Trump presidency. Sector-specific alignment of interests and a more equitable distribution of burden in particular domains may then consolidate progress in bilateral ties. The simultaneous expectation of burden-sharing as an essential part of the value addition a partner could bring to any equation is central to the Trump administration’s international outreach. As a committed stakeholder in global energy transitions and the provision of energy security and economic diversification at a local level, the UAE could deliver on such an expectation. The Gulf actor’s approach, both to this expectation as well as in service of its own interest and ambition in emerging as a clean energy forerunner, could be built on modelling itself into a viable alternative that could mitigate some of the gaps created by the Trump policy reset. Additionally, the nation could also induce elements of a more equitable and sustainable energy transition model into the process.

Conclusion

Transitions tend to not be uniform or linear.[59] This is true for the energy transition. Given that the US has three percent of the world’s energy resources and 16 percent of the world’s energy demand, an indefinite shunning of renewable energy is not likely to be a viable long-term option.[60] It is possible, therefore, that the “Trump energy reset” may eventually be limited to the temporal aspects of the incumbent government. Nevertheless, as of early 2025, and likely through 2028, the US and the UAE can be expected to continue looking at the issue through separate prisms. This difference in approach to a problem that is interpreted differently based on differing contexts lies at the nub of the apparent distinctions between the two on the subject.

What may thus serve both countries better is to identify areas of differentiated responsibilities and domains where cooperation based on even non-comparable asset classes, such as the ones flagged under complementarities earlier in this paper, could forge collaborations in the field of clean energy and its ancillary concerns, where they can and must.

Cauvery Ganapathy is Non-Resident Fellow, ORF Middle East.

Endnotes

[a] EIA expects that in 2026, the United States will begin importing more gasoline and jet fuel than it exports while remaining a net exporter of distillate fuel oil.

[b] Small data centres with about 500-2000 servers consume about 1-5MW of power while the larger ones (100,000 sq. ft.) consume anywhere between 20-100MW of power.

[1] The White House, “Declaration of a National Emergency,” January 20, 2025, https://www.whitehouse.gov/presidential-actions/2025/01/declaring-a-national-energy-emergency/

[2] Manjana Milkoreit, “The Paris Agreement on Climate Change-Made in USA?,” Perspectives on Politics 17, no. 4 (2019), pp. 1019-37, https://web.archive.org/web/20200305064542id_/https://www.cambridge.org/core/services/aop-cambridge-core/content/view/4687F2B504D5984BA7F5299CA3878DBF/S1537592719000951a.pdf/div-class-title-the-paris-agreement-on-climate-change-made-in-usa-div.pdf

[3] The Belfer Center for Science and International Affairs, “Project on Middle Powers,” Harvard Kennedy School, https://www.belfercenter.org/middle-powers

[4] The White House, “Unleashing American Energy,” https://www.whitehouse.gov/presidential-actions/2025/01/unleashing-american-energy/

[5] Washington, US Department of Interior, Order No.3418- Unleashing American Energy (Washington: 2025), https://www.doi.gov/sites/default/files/document_secretarys_orders/so-3418-signed.pdf

[6] US Energy Information Administration, “Levelized Costs of New Generation Resource in the Annual Energy Outlook,” March 2022, https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

[7] Lori Bird, Andrew Light, and Ian Goldsmith, “US Clean Power Development Sees Record Progress, As Well As Stronger Headwinds,” World Resource Institute Insights, February 21, 2025, https://www.wri.org/insights/clean-energy-progress-united-states

[8] Daniel Yergin, Peter Orszag and Atul Arya, “How to find a Pragmatic Path Forward,” Foreign Affairs, March/April 2025, https://www.foreignaffairs.com/united-states/troubled-energy-transition-yergin-orszag-arya.

[9] Ishan Thakore, “In Colorado, U.S. Energy Secretary Chris Wright Says Climate Change Alarmism Has Hurt Energy Development,” Colorado Public Radio, April 4, 2025, https://www.cpr.org/2025/04/03/chris-wright-golden-renewable-energy-lab-climate-change-energy-development/

[10] WVLT News, “U.S. Secretary of Energy Chris Wright Makes a Stop in Oak Ridge,” YouTube video, 26:20 min, February 28, 2025, https://www.youtube.com/watch?v=SuYX1bcU1do&t=870s

[11] Gustavo Ferreira and Jamie Critelli, “China’s Global Monopoly on Rare-Earth Elements,” Parameters 52, no. 1(2022), pp. 57-72

[12] Elizabeth Vella Moellar, Michael S. McDonough, and William E. Fork, “California v. Trump 2.0: Navigating Policy Collisions and Business Opportunities,” Pillsbury Law, March 12, 2025, https://www.pillsburylaw.com/print/v2/content/1054052/california-trump-conflicts-business-opportunities.pdf

[13] Tim Cocks, Francesco Guarascio and Fransiska Nangoy, “US Withdraws from Plan to Help Major Global Polluters Move from Coal,” Reuters, March 7, 2025, https://www.reuters.com/sustainability/climate-energy/us-withdrawing-plan-help-major-polluters-move-coal-sources-2025-03-05/

[14] A. Anantha Lakshmi, Attracta Mooney, and Rob Rose, “US Pulls out of $45bn Global Climate Finance Coalition,” Financial Times, March 6, 2025, https://www.ft.com/content/e8b7f9cf-063b-45bc-a861-6d46047738d7

[15] “Outcry as Trump Withdraws Support for Research That Mentions ‘Climate’,” The Guardian, February 21, 2025, https://www.theguardian.com/environment/2025/feb/21/trump-scientific-research-climate

[16] U.ae, “UAE Energy Strategy 2050,” Telecommunications and Digital Government Regulatory Authority, https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions/environment-and-energy/uae-energy-strategy-2050

[17] IRENA, World Energy Transitions Outlook 2024: 1.5°C Pathway, Abu Dhabi, IRENA, 2024, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2024/Nov/IRENA_World_energy_transitions_outlook_2024_Summary.pdf

[18] United Nations Climate Change, “COP29 UN Climate Conference Agrees to Triple Finance to Developing Countries, Protecting Lives and Livelihoods,” United Nations Framework Convention on Climate Change, https://unfccc.int/news/cop29-un-climate-conference-agrees-to-triple-finance-to-developing-countries-protecting-lives-and

[19] IEA, Coal 2024, Paris, IEA, 2024, https://www.iea.org/reports/coal-2024

[20] UAE-USA United, “US-UAE Partnership on Clean Energy,” https://www.uaeusaunited.com/story/uae-us-partnership-clean-energy

[21] U.S. Embassy and Consulate in the United Arab Emirates, “US-UAE Partnership to Accelerate Transition to Clean Energy,” United States Government, https://ae.usembassy.gov/fact-sheet-u-s-uae-partnership-to-accelerate-transition-to-clean-energy-pace/

[22] Embassy of the United Arab Emirates, “A Shared Vision for Energy Security and Innovation,” UAE USA United, https://www.uae-embassy.org/uae-us-shared-vision-energy-security-innovation

[23] U.ae, “UAE Energy Strategy 2050”

[24] U.ae, “UAE Energy Strategy 2050”

[25] Country Nuclear Power Profiles, “United Arab Emirates Country Highlight: 2024,” International Atomic Energy Agency, https://cnpp.iaea.org/public/countries/AE/profile/highlights

[26] U.ae, “UAE Energy Strategy 2050”

[27] “The United Arab Emirates First Long-Term Strategy Demonstrating Commitment to Net Zero by 2050,” UNFCC, https://unfccc.int/sites/default/files/resource/UAE_LTLEDS.pdf

[28] U.ae, “UAE Energy Strategy 2050”

[29] World Economic Forum, “UAE’s Al Dhafra Solar Plant Is the World’s Largest,” Video, 01:40 min, November, 2023, https://www.weforum.org/videos/solar-plant-uae-al-dhafra/

[30] World Economic Forum, “UAE’s Al Dhafra Solar Plant Is the World’s Largest”

[31] Tom Gill, “The 15 Biggest Solar Farms in the World,” The Eco Experts, March 2024, https://www.theecoexperts.co.uk/solar-panels/biggest-solar-farms

[32] Abu Dhabi National Oil Company, https://www.adnoc.ae/en/News-and-Media/Press-Releases/2023/ADNOC-to-Invest-in-One-of-the-Largest-Integrated-Carbon-Capture-Projects-in-MENA,

[33] “Masdar-The Greenest City in the World,” Energy Digital, May 17, 2020, https://energydigital.com/smart-energy/masdar-greenest-city-world

[34] “ADNOC’s Decarbonization Drive: Targets 25 Reduction by 2030,” Oil & Gas Middle East, July 9, 2024, https://www.oilandgasmiddleeast.com/news/adnocs-decarbonisation-drive-targets-25-reduction-by-2030

[35] “UAE President Witnesses Launch of World’s First 24/7 Solar PV Battery Storage Gigascale Project to Be Built in Abu Dhabi,” MASDAR, January 14, 2025, https://masdar.ae/en/news/newsroom/uae-president-witnesses-launch-of-worlds-first-24-7-solar-pv-battery-storage

[36] “‘Not Repeating Same Mistake’: World’s First AI Minister Says UAE’s Tech Journey Is a Learning from the Past,” Khaleej Times, January 21, 2025, https://www.khaleejtimes.com/uae/not-repeating-same-mistake-worlds-first-ai-minister-says-uaes-tech-journey-is-a-learning-from-t

[37] World Economic Forum, Inclusive Deployment of Blockchain: Case Studies and Learnings from the UAE, January 2020, https://www3.weforum.org/docs/WEF_Inclusive_Deployment_of_Blockchain_Case_Studies_and_Learnings_from_the_United_Emirates.pdf

[38] Jennifer Aguinaldo, “Nuclear Power Will Help Region Achieve AI Ambitions,” Middle East Business Intelligence, May 6, 2024, https://www.meed.com/artificial-intelligence-key-to-regions-power-projection

[39] Thomas Spencer and Siddharth Singh, “What the Data Centre and AI Boom Could Mean for the Energy Sector,” IEA Analysis, October 18, 2024, https://www.iea.org/commentaries/what-the-data-centre-and-ai-boom-could-mean-for-the-energy-sector

[40] Emirates Nuclear Energy Company, “ENEC launches ADVANCE Program to Accelerate Decarbonization through Advanced Nuclear Technologies,” November 29, 2023, https://www.enec.gov.ae/news/latest-news/enec-launches-advance-program-to-accelerate-decarbonization-through-advanced-nuclear-technologies/

[41] “UAE President Witnesses Launch of World’s First 24/7 Solar PV, Battery Storage Gigascale Project to Be Built in Abu Dhabi”

[42] “Enercap Holdings and Apex Investments Form Supercap Energy Storage Joint Venture,” The National, September 16, 2024, https://www.thenationalnews.com/advertorial/2024/09/16/enercap-holidings-and-apex-investments-form-supercap-energy-storage-joint-venture/

[43] Navdeep Suri et al., “India-Middle East-Europe Economic Corridor: Towards a New Discourse in Global Connectivity,” Observer Research Foundation, April 2024, https://www.orfonline.org/research/india-middle-east-europe-economic-corridor-towards-a-new-discourse-in-global-connectivity

[44] OpenAI, “Announcing the Stargate Project,” https://openai.com/index/announcing-the-stargate-project/

[45] US-UAE Business Council, The UAE’s Big Bet on Artificial Intelligence, February 2024, https://usuaebusiness.org/wp-content/uploads/2024/02/SectorUpdate_AIReport_Web.pdf

[46] Mackenzie Ferguson, ed., “UAE and US Forge Landmark Deal for Cutting-Edge AI Chips,” Opentools AI, May 17, 2025, https://opentools.ai/news/uae-and-us-forge-landmark-deal-for-cutting-edge-ai-chips

[47] “Trump Agrees for UAE to Build Largest AI Campus outside the US,” The Guardian, May 16, 2025, https://www.theguardian.com/us-news/2025/may/15/trump-artificial-intelligence-uae

[48] US Government Publishing Office, Congressional Record Volume 170, no. 190 (2024), pp. S7318, www.gpo.gov

[49] “Review of Maritime Transport 2023: Facts and Figures on Africa,” UNCTAD, September 27, 2023, https://unctad.org/press-material/review-maritime-transport-2023-facts-and-figures-africa

[50] Melissa Cyril, “UAE Dominates GCC Investments in Africa, Port Infrastructure and Renewables a Key Area of Focus,” Middle East Briefing, March 18, 2024, https://www.middleeastbriefing.com/news/uae-dominates-gcc-investments-in-africa-port-infrastructure-renewables-a-key-focus-area/

[51] Kyra Bos and Joyeeta Gupta, “Stranded Assets and Stranded Resources: Implications for Climate Change Mitigation and Global Sustainable Development,” Energy Research & Social Science 56 (2019), https://doi.org/10.1016/j.erss.2019.05.025

[52] “Masdar Advances 10GW Africa Growth Plan to Advance Energy Transitions in 6 Sub-Saharan African Nations,” MASDAR, December 7, 2023, https://masdar.ae/en/news/newsroom/masdar-advances-10gw-africa-growth-plan

[53] “UAE Launches Etihad 7 Renewable Energy,” Dubai Eye, January 18, 2022, https://www.dubaieye1038.com/news/local/uae-launches-etihad-7-renewable-energy-programme

[54] COP28 UAE, COP28 Declaration on a Global Climate Finance Framework, December 2023, https://www.cop28.com/en/climate_finance_framework

[55] “UAE, Brazil Align on G20 Agenda,” Zawya, November 18, 2024, https://www.zawya.com/en/economy/gcc/uae-brazil-align-on-g20-agenda-dz19hwou

[56] The Official Portal of the UAE Government, UAE Net Zero 2050, https://u.ae/en/more/uae-net-zero-2050

[57] UAE Consensus, “African Green Investment Initiative,” COP28, https://www.cop28.com/en/african-green-investment

[58] Hala Abou Ali and Atif Kubursi, “The Green Energy Transition: Employment Pathways for MENA,” The Economic Research Forum, https://theforum.erf.org.eg/2025/01/28/the-green-energy-transition-employment-pathways-for-mena/

[59] Daniel Yergin et al., “The Troubled Energy Transition-How to Find a Pragmatic Path Forward,” Foreign Affairs, February 25, 2025, https://www.foreignaffairs.com/united-states/troubled-energy-transition-yergin-orszag-arya

[60] Centre for Sustainable Systems, “US Energy System Factsheet,” University of Michigan, https://css.umich.edu/publications/factsheets/energy/us-energy-system-factsheet