India could leverage evolving ties with West Asia to expand on muli-modal links from Mumbai to Europe, via the Arab world

The virtual meeting on October 18 between the Foreign Ministers of India, Israel, the United Arab Emirates (UAE) and the United States (US) adds an important new dimension to India’s engagement with West Asia and beyond. To start with, the timing of the meeting is significant. It took place while the Indian Minister for External Affairs, Dr. S. Jaishankar, was in Israel on an official visit and photographs show him standing alongside Israel’s Alternate Prime Minister and Foreign Minister Yair Lapid, while US Secretary of State Antony Blinken and UAE Foreign Minister Sheikh Abdullah bin Zayed al Nahyan joined virtually. Equally important, the confabulations took place just days after the US-UAE-Israel trilateral meeting in Washington DC on October 13. Initial read outs of the four-way meeting suggest that its principal focus will be on promoting economic and commercial ties between states that see a growing convergence in their outlook on several key regional issues. There is a specific reference to strengthening transport infrastructure, an emphasis on active follow-up and an indication that a physical meeting of the four ministers could take place on the sidelines of the ongoing Dubai Expo. But it also opens up a more ambitious dimension. Professor Michael Tanchum had recently written about the possibilities of an India-ArabMed corridor that could leverage the evolving geopolitics of the region to create a multi-modal link between Mumbai and the European mainland via the Greek transhipment port of Piraeus. On a first reading, some of his projections about the proposed India-UAE food corridor and cooperation in the energy and petrochemicals sector appeared excessively optimistic. The ground realities in these areas have been quite different from the extrapolations made by him based on initial announcements and media reports. That does not, however, detract from his essential thesis on the possibility of a new trade corridor that connects India with Europe, and it is useful to look at some of the recent developments that could make it a reality.

Professor Michael Tanchum had recently written about the possibilities of an India-ArabMed corridor that could leverage the evolving geopolitics of the region to create a multi-modal link between Mumbai and the European mainland via the Greek transhipment port of Piraeus.

Recent developments

- UAE’s Etihad Rail has recently completed a new 139-km track that connects UAE with the Saudi Arabian Railway (SAR) network at Al-Ghuwaifat. This is a part of the ambitious GCC rail network on which work is underway and is expected to be operational by 2024. A link from Al-Ghuwaifat on the Saudi-UAE border to Haradh is included in Stage 3 of the project.

- A 1392-km long Saudi North-South line from Haradh in southeast Saudi Arabia via Al-Kharj, Riyadh, Buraidah to Al-Haditha on the Saudi-Jordan border is already in place.

- A 300-km stretch from Al-Haditha to Israel’s major port at Haifa is required, of which a 70-km section from Beit She’an near the Israel-Jordan border to Haifa is already functional. The rest of the section will pass through Jordan, which could be a major beneficiary of the emerging corridor. Jordan has diplomatic ties with Israel, and the US may have an interest in pushing this final stretch. It remains to be seen if UAE, which has close ties with both Saudi Arabia and Jordan, steps forth to provide the capital needed for this section.

- The Chinese have already carved out a role in the project. China’s Shanghai International Port Group has invested US $1.7 billion to establish the Bay Port container terminal in Haifa to handle some of the largest ships. They have also floated the idea of a Persian Gulf to Mediterranean Peace Railway Project as part of their Belt and Road Initiative (BRI). Moreover, the state-owned China Ocean Shipping Co. (COSCO) has a 60 percent share in the Greek railway company Piraeus Europe Asia Rail Logistics (PEARL) to take up to 80,000 cargoes a year to Central Europe and beyond.

- DP World (DPW), Dubai’s global logistics company, could be another key player in the corridor. It owns and operates the massive Jebel Ali port and free zone in Dubai. In the wake of the Abraham Accords, it has also signed a Memorandum of Understanding (MoU) with Israel’s Bank Leumi to invest in further expansion of Haifa port. It is worth noting that there is no love lost between DPW and the Chinese shipping giants. DPW had invested US $485 million in the Doraleh container terminal in Djibouti port but was unceremoniously ejected by the government once the China Merchants Port Holding Co. took a 23.5 percent stake in the port’s holding company. DPW went to court and has so far won seven rulings in its favour, including the most recent one by an arbitral court in the London Court of International Arbitration in July 2021 which termed the Djibouti government/Chinese takeover illegal.

- DP World also brings in an India angle because it operates major container terminals in India’s west coast ports of Mundra, Nhava Sheva, and Kochi. Having established a US $3-billion investment fund in partnership with India’s National infrastructure Investment Fund, DP World has made several key investments in India since 2019, to emerge as an integrated logistics and supply chain company. These include acquisition of majority stakes in Continental Warehousing Corporation, in the rail operations of KRIBHCO and in the coastal shipping operations of Transworld Feeders. They are also building a major special economic zone near their Nhava Sheva terminal in Mumbai that could facilitate exports.

- Israel has signalled its enthusiasm for the rail network, and this was first mooted by former Transport Minister Yisrael Katz in 2017 and repeated by him during his visit to Abu Dhabi in July 2020 as a way to promote peace in the region and strengthen trade and economic ties between the Gulf and the Mediterranean. Subsequently, Israel’s Ministry of Transport announced in March 2021 that the railway project was officially moving ahead in the National Planning Commission.

-

A trilateral connect between India, UAE and Israel is already taking shape without having a formal institutional framework. Rony Yedidia-Clein, Israel’s Deputy Chief of Mission in Delhi indicated on October 20 that a meeting between the three foreign ministers may take place soon on the sidelines of Dubai Expo. Meanwhile, the Consuls General of India and Israel in Dubai have already taken the initiative of hosting an India-Israel-UAE business meet in October 2021. And the International Federation of Indo-Israel Chambers of Commerce (IFIICC), has launched at its international headquarters in Dubai. It describes itself as an innovative global organisation committed to empowering trusted sustainable strategic partnerships and with a mission to ‘foster innovation, commerce, investment, cultural exchange and goodwill between the diasporas of India, Israel and world citizens.’

-

Having established a US $3-billion investment fund in partnership with India’s National infrastructure Investment Fund, DP World has made several key investments in India since 2019, to emerge as an integrated logistics and supply chain company.

The road ahead

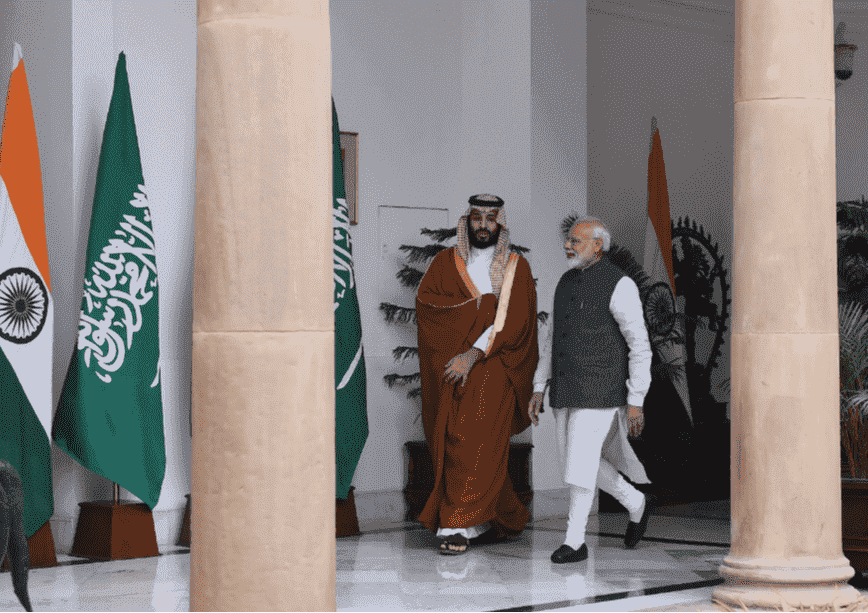

While there is little doubt that the geopolitical landscape in West Asia is changing rapidly, formidable challenges will have to be overcome if the multi-modal corridor linking India with Europe is to become a reality. At the political level, Saudi Arabia would have to agree to allow Israel-bound shipments through its North-South railway. A small but symbolic step was taken in March 2018, when Air India’s inaugural Delhi-Tel Aviv flight was given permission to overfly Saudi Arabia. A lot has happened since then, including the Abraham Accords and former Israeli PM Netanyahu’s supposedly secret visit to Saudi Arabia. There are indications that the US is urging Riyadh to move forward in establishing diplomatic ties with Tel Aviv, and some progress on the Palestinian front may just be the catalyst needed for this to happen. Jordan has been reluctant to comment on the proposed railway corridor but may take a pragmatic position once there is greater clarity on the funding of the Jordanian section. And Egypt will need some reassurance that it won’t have too much of an impact on its Suez Canal revenues. Michael Tanchum has calculated that the India-ArabMed corridor would cut shipping times between Mumbai to Piraeus from 17 days at present to 10 days via the multi-modal link. That is an attractive proposition in itself but the economic viability of a project of this nature will depend largely on freight volumes. This is where India’s nimble foreign policy moves in the region and its evolving trade policy could play an important role. After dragging its feet for years, India has now placed its Free Trade Agreement (FTA) negotiations with UAE, Israel, and the EU on a fast track. India’s foreign trade will cross US $700 billion in the current year and the EU remains one of our largest trading partners. The moves currently underway to build supply chain resilience by reducing dependence on China and moving some manufacturing facilities to India, combined with India’s own programme of Performance-Linked Incentives (PLIs) to attract global majors to manufacture in India is likely to give a strong impetus to these trends.

India’s foreign trade will cross US $700 billion in the current year and the EU remains one of our largest trading partners.

India has the opportunity to take a long-term, strategic view of this project. Companies like IRCON can bid aggressively to participate in the unfinished legs of the project in Saudi Arabia and Jordan on the assumption that funding will come from local or international financial institutions. A starting point could be a detailed study carried out over the next few months to examine the viability, impact, and trade potential of the proposed India-ArabMed corridor in comparison with established shipping routes, and an attempt to quantify the direct and indirect benefits of plugging more effectively into supply chains in West Asia and Europe.