The Indian electorates have given the National Democratic Alliance (NDA) government, under the leadership of Prime Minister Narendra Modi, another five-year term to govern. Prior to the announcement of election results, there were discussions centred around the likely focus of the government’s foreign policy, and in that, India’s West Asia (Middle East) policy was one of them. India’s relations, particularly with the Gulf Cooperation Council (GCC) member states and Israel, saw significant improvements during Modi’s previous two terms. Strong convergences of interests, supported by his ‘personal diplomacy’ had contributed immensely towards transforming the ties. Suffice to say that Modi’s ME policy was one of the most successful stories of his foreign policy. The region’s geostrategic-economic importance has, once again, been underscored by the visit of External Affairs Minister, Dr S. Jaishankar, to Abu Dhabi on 23 June 2024, the first one to the ME under the new government. This signified the vital comprehensive strategic partnership between the two countries.

The new government will likely strengthen the existing partnerships and also explore potential areas of cooperation. India’s bilateral cooperation with the ME has expanded to other areas, including military-security, maritime cooperation, science and technology, medicine and healthcare, space, food security, cyber security, artificial intelligence, civil nuclear cooperation, fertiliser, climate change, renewable energy, etc. Notwithstanding this expansion, energy and economic cooperation remain important hallmarks of the Indo-ME ties. The succeeding sections briefly assess the likely trajectory of the ties in three specific areas—energy (hydrocarbon trade & renewable), economic cooperation, and maritime cooperation, particularly with GCC countries.

The ME remains crucial from the standpoint of India’s economic and energy security calculus and cooperation in these traditional domains will be a priority. Lately, bilateral trade volume with countries, such as Saudi Arabia, the United Arab Emirates (UAE) and Israel, have witnessed a considerable growth. In the fiscal year (FY) 2023, the figure touched US$52.76 with the kingdom, while it was US$85 billion with the UAE, US$4.42 billion with Israel (excluding defence) and US$1.7 billion (2023-24) with Bahrain. Moreover, the India-UAE Comprehensive Economic Partnership Agreement (CEPA), signed in February 2022, will strengthen commercial partnership, and will assist both sides touch the bilateral trade figure (in non-oil) of US$100 billion by 2030. To achieve this target, CEPA is believed to have ushered in “cuts in tariff, fast-tracked approvals for business, access to trade zones etc.”, and mutual investment opportunities are opening up. The implementation of a “local currency trade settlement agreement, the launch of UAE’s domestic credit/debit card based on India’s RuPay card stack” will facilitate more bilateral financial engagements.

The new government will likely strengthen the existing partnerships and also explore potential areas of cooperation. India’s bilateral cooperation with the ME has expanded to other areas, including military-security.

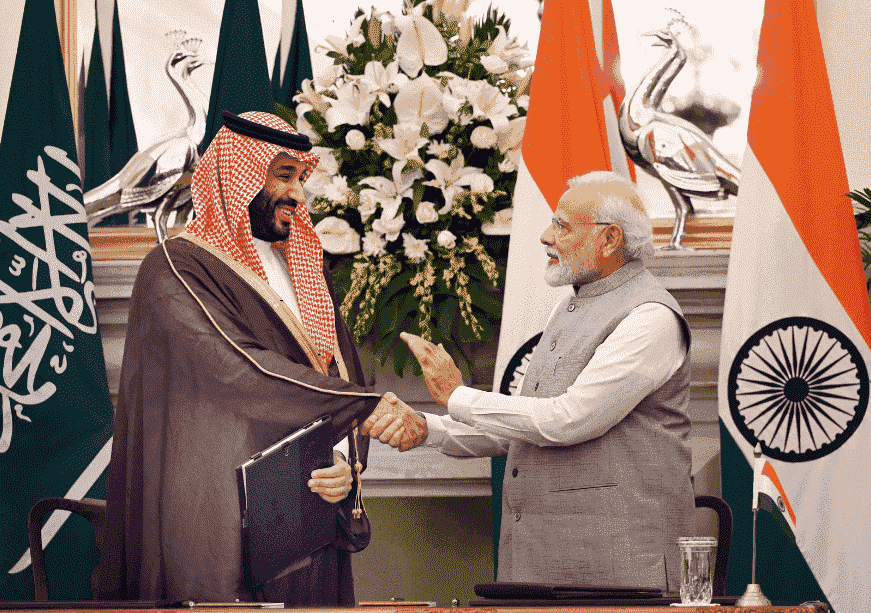

A similar trend can be expected with Saudi Arabia, India’s 19th-largest investor, and its fourth-largest trading partner. Their robust bonds are characterised by growing trade and investment ties, financial and business partnerships, and increasing cooperation in infrastructure development, renewable energy, food security, and the military-security spheres. The Strategic Partnership Council (SPC), established in 2019, and convened its first meeting in September 2023 in New Delhi, will play a pivotal role in steering the trade and security ties between the two countries. The SPC is an important bilateral institutional mechanism that will facilitate policy formulation, discussions, and coordination between stakeholders as well as implementation of the initiatives. Under the visionary leadership of Modi and Saudi’s Crown Prince, Mohammed bin Salman (MbS), both sides aim to take the trade to as high as US$100 billion.

The growth in the economic ties has come at a juncture when India is focusing on increasing its economic status by forging partnerships with its international partners. Simultaneously, the Gulf states are also looking towards the Asian economies for investments and joint collaborations to align with the missions and visions, and to achieve their targets of several socio-economic reform plans being introduced by them (such as the Saudi Vision 2030). As interests are converging, the NDA government and the regional bloc – GCC – must make efforts to materialise the Free Trade Agreement (FTA), which is pending. In the FY 2022-23, GCC became India’s largest regional trading paper, comprising 15.8 per cent of the latter’s total trade. The appointment of chief negotiators, however, towards the end of last year could be construed as a signal from both sides to clinch this agreement. It, therefore, looks promising that economic relations will continue to flourish.

For the longest, the depth of India-ME ties was measured by the volume of oil/energy trade. Despite a slight decline in recent years, the Gulf region still alone accounts for over 50 percent of India’s total crude oil imports and nearly 70 percent of its gas imports. The dip was caused by India’s diversification policy, resulting in oil/energy imports from suppliers such as the United States (US), and also Russia which had begun to sell crude oil at a discounted price following its invasion of Ukraine in 2022. India’s diversification has been necessitated by its roadmap for energy transition, comprising of the use of “multiple fuels from a wider source base to ensure availability and affordability.” Nevertheless, traditional cooperation in the hydrocarbon sector will continue with the Gulf suppliers for the next few decades.

The growth in the economic ties has come at a juncture when India is focusing on increasing its economic status by forging partnerships with its international partners.

Currently, Iraq, Saudi Arabia (third-largest oil supplier) and the UAE (fourth-largest supplier) are among India’s top five crude oil importers. For instance, following the Red Sea crisis, Indian refiners turned to Iraq as US supply was disrupted due to the spurt in freight rates, and there is no guarantee that Russia will continue to sell crude oil at a favourable price. Given these uncertainties, the Gulf will account for a major percentage of India’s oil/energy imports for a long time. In the energy sector, Qatar is India’s largest supplier of Liquified Natural Gas (LNG) (catering to 35 percent of LNG imports), accounting for 29 percent of total Liquified Petroleum Gas (LPG). The centrality of ties in this domain is that they both signed a 20-year deal in February 2024, enabling India to purchase 7.5 metric million tonnes per annum (MMTPA) of LNG from Qatar. Modi’s Doha visit in mid-February 2024 was necessary to strengthen the bilateral ties, which, otherwise, remained lacklustre for a while, especially following the arrest (in 2022) of eight former Indian navy officials for alleged spying. As opined by a scholar, the release of these officials “is a testament not only to the strength of India-Qatar bilateral ties but also to the distinct ability of Prime Minister Narendra Modi to forge strong personal bonds with leaders of other nations to secure Indian interests.” The Gulf exporters take cognisance that India is a lucrative market with its growing energy demand due to which they will prioritise their hydrocarbon trade with it.

A relatively new area of cooperation in which progress is expected is renewable energy. Both India and ME countries are working towards lessening their dependency on fossil fuels and opting for a transition to clean energy based on solar and wind. To this end, Saudi Arabia and the UAE signed agreements with India in late 2023. India has a National Solar Mission while the UAE has Energy Strategy 2050, which is pivotal in promoting renewable energy. As India calls for investments and technological assistance from its foreign partners, UAE’s Masdar is seeking to acquire Ayana Renewable Power—a clean energy company owned by India’s National Investment and Infrastructure Fund (NIIF). Likewise, the UAE also seeks investments from the Indian side for similar projects. Partnerships with Israel, another country with abundant renewable energy potential, known for manufacturing some of the world’s advanced technologies, have been established. The objectives of these countries to meet decarbonisation goals and also to mitigate the challenges of climate change are paving the way for further partnerships to foster a sustainable future.

With India’s growing role in the Indian Ocean Region (IOR), and its interest to include the western Indian Ocean and the Arabian Sea in the ‘Indo-Pacific Policy’, one can expect a surge in maritime security and naval cooperation with a few GCC countries. Naval forces of Oman, Saudi Arabia, Qatar, Kuwait and the UAE conduct maritime exercises with India. Their interest in strengthening cooperation is especially strong in the western IOR, home to some of the world’s busiest shipping lanes, including those in the Red Sea, the Gulf of Aden, the Gulf of Oman, the Gulf and the Arabian Sea. Lately, such an exercise has also been expanded to a trilateral maritime partnership exercise (in June 2023), involving France (along with the UAE).

Now, in the wake of the increasing missile/drone attacks by the Yemen-based Houthi rebels in the Red Sea region, India must increase its naval footprints and such exercises. They are crucial to achieving interoperability between forces, addressing traditional and non-traditional threats in the maritime environment, enhancing collaboration in ensuring the safety of mercantile trade and freedom of navigation at high seas in the region and learning from the best-fit practices adopted by the respective navies. Tellingly, within the framework of defence industrial cooperation between India and the Gulf countries, collaborations in maritime technology for both military and civilian applications can also be explored.

With India’s growing role in the Indian Ocean Region (IOR), and its interest to include the western Indian Ocean and the Arabian Sea in the ‘Indo-Pacific Policy’, one can expect a surge in maritime security and naval cooperation with a few GCC countries.

Given the strong convergence of economic and security interests, it is certain India-Middle East ties are going to flourish further. Significant formal groundworks have been laid since 2014 by the respective governments to take the bilateral ties to newer heights. Further, India’s new-found interest in forging mini-lateral partnerships should widen the scope for establishing partnerships, involving third countries to work collectively in areas of mutual interests, a perfect example being the India-Middle East-Europe-Economic-Corridor (IMEEC) and the I2U2 initiatives. India should, however, be mindful of the challenges that lie ahead, particularly the emerging complex security dynamics in the region, and also be cognisant of the speedy inroads being made by its regional rival—China—into the ME region. Beijing could be a competitor, if not a security threat for now, in some of the sectors identified above. While India is presently doing well in terms of its bilateral cooperation with the ME countries, it should start looking at the region holistically.

____________________________________________________________________________________________________________________________

Alvite Ningthoujam is an Assistant Professor at the Symbiosis School of International Studies (SSIS), Symbiosis International (Deemed University), Pune.