Introduction

The increasing capabilities of artificial intelligence (AI) tools are positioning it as a driver of innovation in fields ranging from logistics to healthcare. However, the ongoing global AI race is being interrupted by speed bumps caused by the increasing strain on energy infrastructure. During a US Congressional hearing held in April 2025, Google ex-CEO Eric Schmidt stated that the AI-powered “technological revolution and the prosperity it promises depend entirely on a modern, resilient, and vastly expanded energy infrastructure.” Bolstering energy infrastructure for data centres is a priority for all economies looking to sharpen their competitive edge. Research from McKinsey suggests that data centres will require US$6.7 trillion by 2030 to match the growing demand for compute. Simultaneously, the demand for energy and compute is challenging countries’ net-zero commitments and sustainability goals while negatively affecting communities located in the vicinity of data centres. Offsetting the carbon footprint and environmental runoffs of the AI-driven demand spike has led to the exploration of alternative energy sources, such as nuclear and solar power. However, expanding nuclear infrastructure requires regulatory permissiveness that is absent in many jurisdictions, and solar power plants face storage capacity issues and a capped efficiency due to weather patterns and day-night cycles. Such problems are leading to investment in celestial solutions. Shortly after his US Congressional testimony, Schmidt bought the medium-lift rocket manufacturing company Relativity Space, which aims to rival Elon Musk’s SpaceX. The ostensible goal of Schmidt’s investment is to launch data centres in low Earth orbit (LEO), a solution to the energy bottleneck that is generating increasing interest. This article will explore the potential benefits of LEO data centres and outline obstacles that need to be overcome.

Launching data centres in space offers the potential to significantly reduce the environmental costs of frontier AI development.

Computational Lift-Off

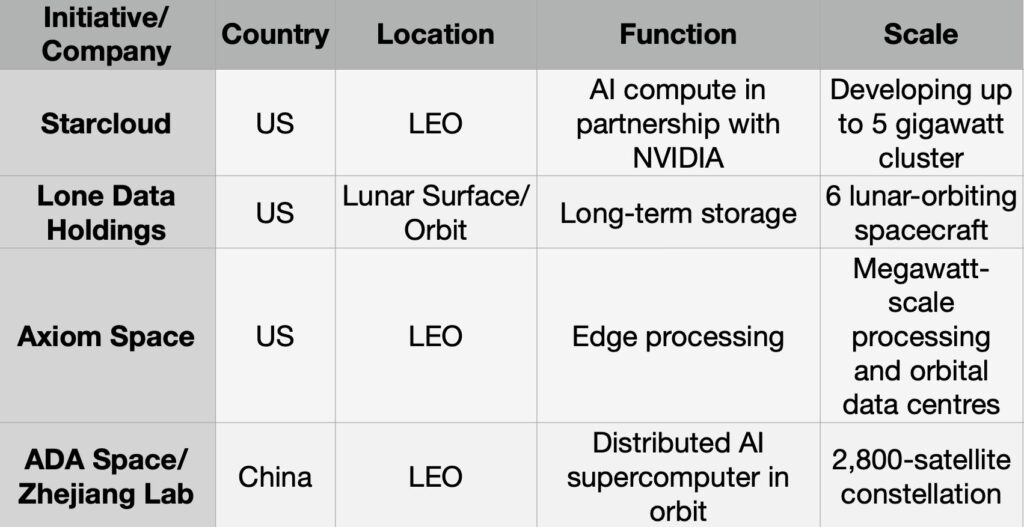

The feasibility of LEO data centres and the carbon emissions caused by successive launches are currently being tested. In 2024, the European Commission launched the Advanced Space Cloud for European Net Zero Emission and Data Sovereignty (ASCEND) project in partnership with Thales Alenia Space as part of Horizon Europe programmes. The objective was to study the technical feasibility and environmental impact of launching large-capacity data centres in space with an aim to meet the EU Green Deal objective of net-zero carbon by 2050. Although the studies have not concluded, several private sector enterprises have already emerged in the field. These include Starcloud, Lonestar Data Holdings, Axiom Space based in the US, and ADA Space operating from China in partnership with the state-backed Zhejiang Lab.

Sources: Starcloud, DatacenterDynamics, Axiom Space, Orbital Today

LEO data centres offer advantages in three primary domains: water and land use, energy, and security. Terrestrial data centres require large amounts of land for hyper-scale facilities in close vicinity of energy grids to maintain close to a hundred percent up-time, adding pressure on energy and water supply. Launching data centres in space offers the potential to significantly reduce the environmental costs of frontier AI development. In orbit, solar arrays can operate at a 40 percent increased efficiency due to the lack of atmospheric hindrances such as weather changes and day-night cycles. Also, since light travels approximately 31 percent faster in a vacuum compared to fibre optic cables, the use of optical inter-satellite links can reduce latency if data is routed through LEO satellite meshes. LEO data centres also promise to improve cybersecurity, particularly for sensitive information. First, they insulate compute from terrestrial disasters such as earthquakes, hurricanes, and floods that can devastate infrastructure. Second, by operating in space, they remain physically separated from land-based internet and network infrastructure, substantially reducing their exposure to common cyberthreats and forms of network-based exploitation.

Although LEO data centres have the potential to address major AI development bottlenecks, they also face a series of challenges.

Obstacles

Orbital data centres face three primary categories of threats unique to their environment: cyber attacks, physical attacks, and natural causes. Cyber attacks may originate from foreign adversaries or independent actors aiming to disrupt up-down communications, decode encrypted data, or implant malware into the data centre’s software. Physical threats include kinetic energy anti-satellite (ASAT) weapons, designed to destroy orbital objects through collision, and directed energy ASATs that use concentrated electromagnetic energy to jam satellite communications. Nuclear-armed satellites may be deployed as a form of sabotage by a foreign adversary, disrupting LEO data centres through direct impact or through collision with debris from other shattered orbital objects. Natural causes such as geomagnetic storms, meteor showers, and solar flares can damage the hardware of the data centres.

LEO data centres may represent a regulatory challenge as there are no current international treaties regarding data privacy regulations in space. The 1967 Outer Space Treaty (OST), a foundational legal framework for extraterrestrial exploration, was drafted in an era without private space-focused entities. Further, while the OST covers jurisdictional issues pertaining to physical space structures, it does not cover data being processed in space. This raises a key question. Are orbital data centres subject only to the legislations of the nations whose citizens’ data they process? Or will they be subject to multinational regulation, given that space is a shared global domain?

Gulf Investments in Space-Tech

Major economies in the Gulf, such as the UAE and the Kingdom of Saudi Arabia, are increasing investments in developing their space economies. Both the UAE and Saudi Arabia are signatories to the Artemis Accords, an agreement that establishes safeguards for collective space exploration. Saudi Arabia has attempted to stimulate the private sector by reducing regulatory barriers to entry. Under the broader umbrella of the ‘Saudi Vision 2030’ plan, Saudi Arabia’s space goals include improving Internet of Things (IoT) connectivity and geospatial intelligence, as well as launching LEO satellite infrastructure and space tourism. Its space programme comprises three major governmental bodies: the Saudi Space Agency, which serves as the primary space development entity; the Communications, Space and Technology Commission, the key regulatory body; and the Public Investment Fund, a sovereign wealth fund responsible for investment.

The UAE’s space program includes the UAE Space Agency, in charge of regulation and investment; the Mohammed Bin Rashid Space Centre, focused on research and development; and private sector companies such as Yahsat and Space42. The goals of the UAE’s ‘National Space Strategy 2030’ are passing regulation that promotes space-focused manufacturing and R&D, launching space exploration missions, and engaging in space-focused local and international partnerships. Part of this strategy includes a commitment to collaborate with and sponsor the private sector, create space safety measures, and reinforce its commitment to international space treaties. The UAE’s Space Economic Zones programme offers stimulus packages, access to government space resources and networking opportunities for participating space-focused private sector businesses.

Given that the energy-AI nexus can be the inflexion point for deciding the digital destinies of forward-looking economies, exploring orbital solutions in the long run may be a viable strategy for Gulf countries trying to sharpen their technological competitiveness.

In 2024, Saudi Arabia’s Public Investment Fund launched a space and satellite-focused company, the Neo Space Group (NSG). NSG was the first company in Saudi Arabia to be awarded a regulatory permit to develop Earth-observation services. Soon to launch is an NSG venture capital fund, which will direct investments to space-focused startups. The UAE Space Agency is developing two projects: Sirb, a Synthetic Aperture Radar-enabled satellite constellation, and Arab Satellite 813, a hyperspectral LEO observation satellite designed to study climate change. Meanwhile, the Gulf’s first AI space technology company, Space42, was formed through the merger of Yahsat and Bayanat. Given that the energy-AI nexus can be the inflexion point for deciding the digital destinies of forward-looking economies, exploring orbital solutions in the long run may be a viable strategy for Gulf countries trying to sharpen their technological competitiveness.

Going Forward

The ongoing AI race is already fracturing global tech governance and cooperation as great powers bundle their respective tech stacks with geoeconomics strategies. As technology becomes a tool for economic statecraft, supply chains and tech infrastructure are becoming geopolitical fault lines. The age of bipolarity is making way for mini- and plurilateralism, where focused groupings of countries are able to strategically cooperate based on shared interests. The Middle East enjoys a geographic location at the heart of global corridors as well as coalitions, allowing it to leverage its positioning to promote a shared understanding in emerging high-impact issues such as orbital cooperation. Tech-focused economies such as the UAE and SaudiArabia should lead efforts to establish physical and cybersecurity norms for data-processing space assets. As the Gulf steadily works towards economic diversification, investing in orbital solutions for AI-driven energy demand can help meet sustainability goals and alleviate pressure on utilities such as water. To achieve this, governments should prioritise the creation of public-private partnerships and financial vehicles focused on developing technologies required for operating data centres in space.

Siddharth Yadav is a Fellow with the Technology vertical at the ORF Middle East.

Ambika Sondhi is an independent researcher with a focus on international security.