In 2020, Bahrain, Morocco, and the United Arab Emirates (UAE) normalised relations with Israel, becoming the first Arab signatories of the Abraham Accords. The UAE’s and Bahrain’s foreign ministers stood alongside President Trump and Prime Minister Netanyahu in the White House to sign the historic declaration, sending shockwaves across the Gulf countries. In December, Morocco followed suit in and signed the declaration. Five years on, the economic outcomes of the accords tell a complex story. While the UAE has leveraged normalisation to establish a robust trade relationship with Israel, Bahrain and Morocco’s economic ties with Israel remain limited, shaped by domestic sensitivities, weak structural alignment, and the absence of formal trade deals. This piece examines how trade between Israel and its Abraham Accords partners has evolved since 2020, and why, despite diplomatic success, the economic dividends have been asymmetrical.

Today, the Abraham Accords have remained intact despite the challenges. None of the countries has rescinded on the declaration, and bilateral relations continue to flourish with the embassies operating in each country. Bahrain is expected to announce a new ambassador to Israel after its first ambassador, Khaled Yousef Al Jalahma, was promoted to the role of Undersecretary of Political Affairs in the Bahraini Foreign Ministry. Meanwhile, a new Israeli ambassador to the UAE, Yossi Shelly, was received by Emirati officials in February.

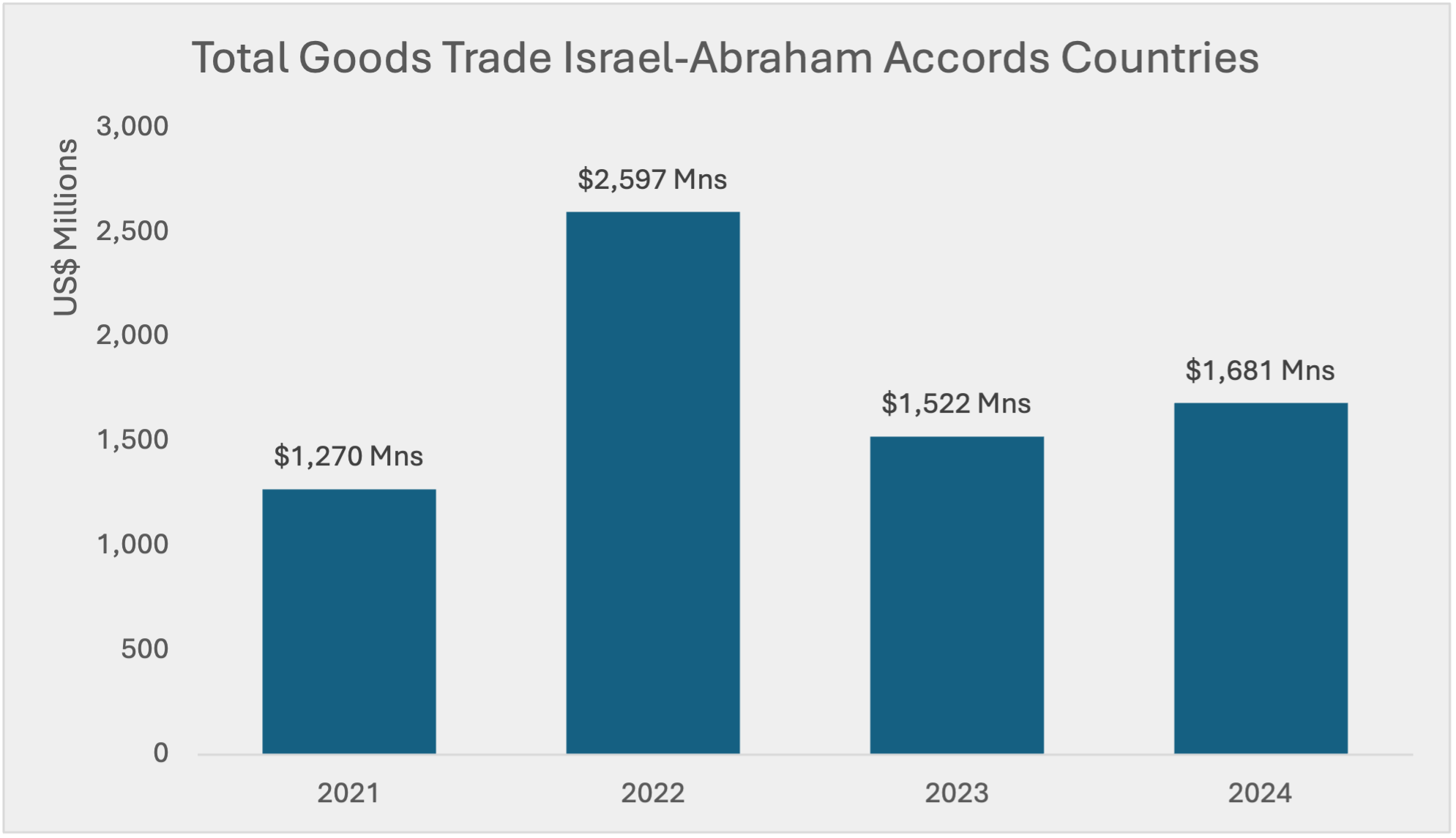

As for the economic relationship, total goods trade between Israel and the Abraham Accords countries did appear to dip in 2023, seemingly because of the aftermath of October 7, yet it has gained more than US$ 1 billion. However, this figure only offers a partial insights. Beneath it lies key asymmetries and structural trends that merit closer scrutiny. The following sections delve into these dynamics.

Source: UN Comtrade Database

Free Trade Agreements

Among the three Abraham Accords signatories, the United Arab Emirates (UAE) has emerged as Israel’s most engaged economic partner. It has also boasted more agreements, including one akin to a free trade agreement known as the Comprehensive Economic Partnership Agreement (CEPA). While security agreements between Israel and both Morocco and Bahrain have emerged, this has not extended to trade. Both countries have not hosted many public delegations, given that they have a vocal boycott social movement against Israel and companies viewed as serving Israeli interests. Even Bahrain’s Free Trade talks with Israel appear to have paused after some press attention in 2022. A similar move towards an economic agreement between Israel and Morocco appears to have fizzled out.

These differing levels of engagement are reflected in trade volumes. According to the United Nations (UN) Comtrade Database, total trade in goods throughout 2021-2024 between the UAE and Israel reached US$6.4 billion, while reaching approximately US$576 million between Morocco and Israel, and US$50 million between Bahrain and Israel.

Abraham Accords Countries’ Total Trade in Goods with Israel, US Dollars

| Country | 2021 | 2022 | 2023 | 2024 | 2021-2024 |

| Bahrain | $6,617,000 | $12,743,000 | $18,224,722 | $12,781,000 | $50,365,722 |

| Morocco | $41,755,000 | $56,169,000 | $238,356,873 | $239,622,000 | $575,902,873 |

| UAE | $1,221,410,000 | $2,528,309,000 | $1,265,753,252 | $1,428,880,000 | $6,444,352,252 |

Source: the UN Comtrade Database

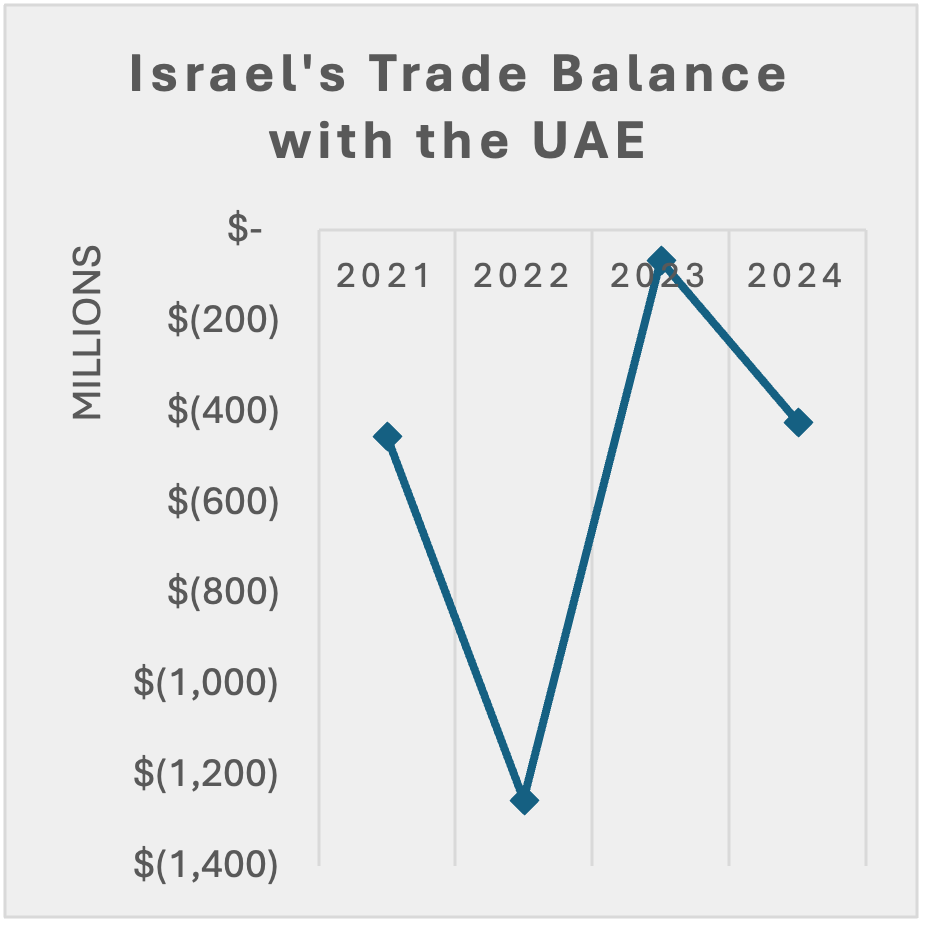

Trade Balance

When comparing the total trade figures between 2021 and 2024, Israel has a cumulative trade deficit with each of the Abraham Accords countries. This means on average, across these four years, Israel has been importing more than it’s been exporting to Bahrain, Morocco and the UAE. This may be due to geopolitical reasons, such as boycotts of Israeli products. Year-on-year, however, there have been ongoing shifts. As demonstrated in the graphs below, in some years, there is sometimes a trade surplus for Israel with each of these countries, and there has not been a long enough trading period for clear patterns to emerge and assess the likely trajectory of the trade balance.

Israel’s Trade Balance with the Abraham Accords Countries, US Dollars

| Country | 2021 | 2022 | 2023 | 2024 | 2021-2024 |

| Bahrain | $1,011,000 | $(8,425,000) | $(13,598,266) | $323,000 | $(20,689,266) |

| Morocco | $19,683,000 | $20,329,000 | $(3,126,397) | $(43,486,000) | $(6,600,397) |

| UAE | $(452,398,000) | $(1,253,615,000) | $(65,610,994) | $(421,512,000) | $(2,193,135,994) |

Source: the UN Comtrade Database

Trade Structure

Still, the picture of trade is unclear from simply looking at cumulative values. It is in Israel’s and the US’s interest to ensure the economic dividends of the accords are tangible across the board, should it remain future-proof, and more policy attention ought to be directed towards the reasons these trade figures are panning out as such. One way to analyse where attention should be paid more to is by exploring the breakdown of trade by products.

Using the same UN Comtrade data but aided by calculations from the International Trade Centre (ITC) Trade Map, we can find out whether the export and import profiles of Israel and its partner Abraham Accords countries are complementary.

Starting with Bahrain, which has the lowest trade value with Israel, we find that the top three defined imports that Bahrain gets from the world as of 2024: “Ships, boats and floating structures”, “Inorganic chemicals; organic or inorganic compounds of precious metals” and “Ores, slag and ash” are not exported by Israel to Bahrain at all. Instead, the top export from Israel to Bahrain is “Articles of iron or steel”, which is ranked as the 15th type of product imported into Bahrain in 2024. Similarly, of the top 10 products which Bahrain exported to the world in 2024, only four were exported to Israel and small quantities. Israel has, however, found a limited market from Bahrain in both aluminium and Textiles, but even then, both these products, which represent Israel’s top imports from Bahrain, did not exceed US$3 million in trade value in 2024. This could indicate a mismatch between Bahrain and Israel’s trade structures, and has been joked about, “it’s like getting a cat and dog to mate”.

Moving on to Israel’s trade with Morocco, the picture appears to be more complementary: the top two products Israel exported to Morocco in 2024: “Electrical machinery and equipment and parts thereof”, and “Plastics and articles thereof”, are within the top five imports of Morocco from the world in 2024. Similarly, the top Moroccan export to Israel: “Articles of apparel and clothing accessories, not knitted or crocheted”, is within the top five of its total exports to the world in the same year. Moreover, the second top Moroccan export to Israel: “Sugars and sugar confectionery” represented 8 percent of Israeli imports of this product from the world in 2024.

Lastly, moving on to the UAE, Israel’s top 2024 export to the Emirati market, in the form of Jewellery: “Natural or cultured pearls, precious or semi-precious stones, precious metals, ..” represented 4 percent of Israel’s exports of that product in the same year. Interestingly, the same product was the top export of the UAE to Israel, representing 10 percent of Israeli imports of the product from the world in 2024. This indicates that trade between the two countries is complementary, especially as the same could be said about most of the other top products these two countries trade with each other: they go in both directions and play to the comparative advantage of each country in each of the product categories.

Conclusion

While the Abraham Accords have endured diplomatically and many analysts have tackled the various dimensions of the relationships between Israel on the one hand and Bahrain, Morocco, and the UAE on the other, the trade dimension remains underexplored. The UAE-Israel relationship dominates in scale and institutional depth, benefiting from formal agreements like the CEPA. In contrast, Bahrain and Morocco’s trade ties with Israel remain limited, shaped by trade structure mismatches and perhaps domestic sensitivities. While Israel tends to run trade deficits with the UAE, Morocco, and Bahrain, this represents a net gain for the Abraham Accords countries, especially the UAE, which has effectively leveraged normalisation to secure a favourable cumulative trade surplus and diversify its economic partnerships. Bahrain, by contrast, has not seen meaningful trade gains and its limited volumes and structural mismatch with Israeli demand point to an economic relationship that remains largely symbolic. As the Abraham Accords enter their fifth year, their economic promise will depend not only on political continuity but also on targeted policies that address structural trade gaps and enhance complementarity. This is a necessary step if normalisation is to translate into economic dividends for all signatories.

Mahdi Ghuloom is a Junior Fellow, Geopolitics at the Observer Research Foundation (ORF) – Middle East.