The United Arab Emirates (UAE) has a clear goal to achieve AED 4 trillion (US$1.1 trillion) in foreign trade by 2031 as part of its national economic goals. While full trade data on 2024 has not been published yet, the country’s Vice President and Ruler of Dubai, Sheikh Mohammed bin Rashid, has given indications as to the progress towards that goal by sharing that 75 percent of that target has already been achieved as of year-end 2024 at US$816.7 billion, adding that “while global trade grew by just 2 per cent in 2024, the UAE’s foreign trade expanded at seven times that rate, achieving an impressive 14.6 per cent growth”. Much of the credit for this can be owed to the Comprehensive Economic Partnership Agreements (CEPAs) that the UAE has been proliferating since setting the national economic goals in 2021.

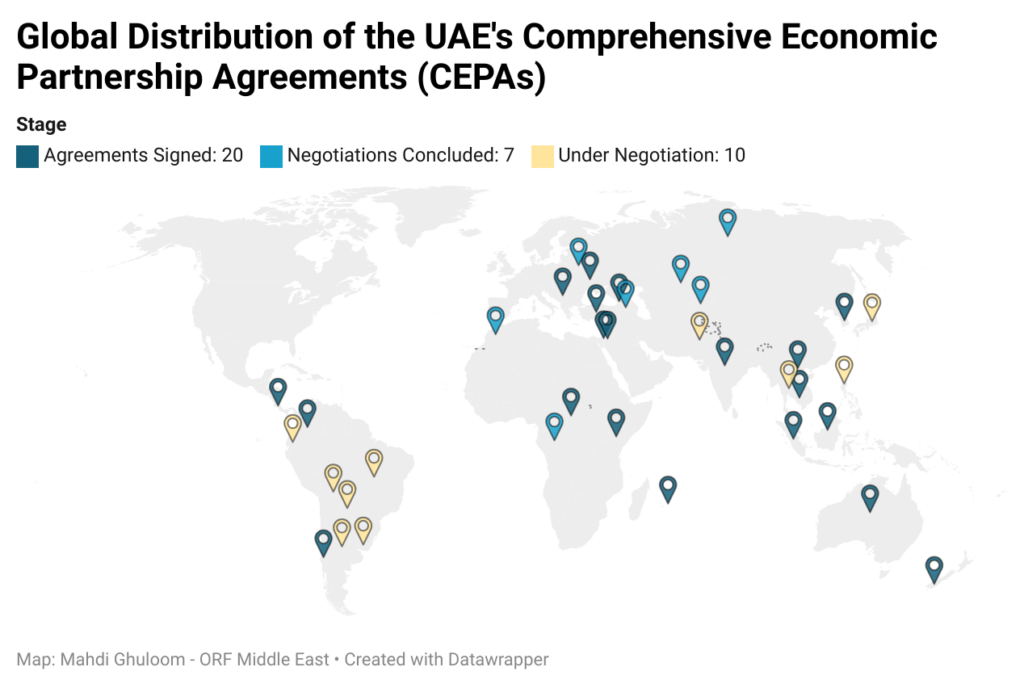

The UAE has signed CEPAs with at least 20 countries, and at least a further seven have completed negotiations and are due to be signed. Moreover, it is important to also note that Dr Thani Al Zeyoudi, the UAE’s Minister of State for Foreign Trade, has said the UAE will continue to expand the programme in 2025. At least 10 more countries have been explicitly reported to be in negotiation with the UAE for CEPAs: these are Ecuador, Japan, Pakistan, Philippines, Thailand and the Mercosur bloc countries—Argentina, Bolivia, Brazil, Paraguay and Uruguay—but the list is likely longer.

Table 1: CEPA Partners the UAE has signed with: 20 in Total

| Country | Signing | Enforcement |

| India | Feb-22 | May-22 |

| Israel | May-22 | Apr-23 |

| Indonesia | Jul-22 | Sep-23 |

| Türkiye | Mar-23 | Sep-23 |

| Cambodia | Jun-23 | Jan-24 |

| Georgia | Oct-23 | Jun-24 |

| Colombia | Apr-24 | – |

| Costa Rica | Apr-24 | – |

| South Korea | May-24 | – |

| Chile | Jul-24 | – |

| Mauritius | Jul-24 | – |

| Vietnam | Oct-24 | – |

| Jordan | Oct-24 | – |

| Serbia | Oct-24 | – |

| Australia | Nov-24 | |

| Malaysia | Jan-25 | – |

| Kenya | Jan-25 | – |

| New Zealand | Jan-25 | – |

| Ukraine | Feb-25 | – |

| Central African Republic | Mar-25 | – |

Table 2: CEPA Partners the UAE has concluded negotiations with: 7 in Total

| Country | Date |

| Congo-Brazzaville | Dec-23 |

| Morocco | Jul-24 |

| Russian Federation | Dec-24 |

| Armenia | Dec-24 |

| Kazakhstan | Dec-24 |

| Kyrgyzstan | Dec-24 |

| Belarus | Dec-24 |

Benefits of the UAE’s CEPAs

According to Etihad Credit Insurance, the UAE’s official export credit company which aims to facilitate and insure trade transactions between the UAE and the CEPA countries, the agreements have common benefits between them: 1) Elimination or reduction of customs duties and tariffs; 2) Removal of technical trade barriers; 3) Improved market access for UAE exporters; and 4) Accelerated investment into priority sectors. This is because the specific scope of the CEPAs goes beyond mere trade agreements and includes rules for investment, competition, and public procurement. In a nutshell, CEPAs are “more ambitious” than traditional FTAs.

Another crucial element of the CEPA landscape is trade diversification. Mohammed Alhawi, Undersecretary at the UAE’s Ministry of Investment, said “The name of the game is diversification … we are diversifying in terms of partners as well as sectors”. Indeed, according to the International Monetary Fund (IMF), UAE trade diversification is likely to help the UAE “further diversify capital and trade flows and supply chains by accessing new markets and mitigating negative shocks from a specific trading partner.”

Therefore, if one is to analyse CEPAs, one way to do so is through the lens of its trade effects, while acknowledging that CEPAs are more than just trade agreements. Indeed, when UAE officials have discussed the positive effects of the CEPAs in force to date, they have mostly referenced its positive effect on trade.

Tier 1 vs Tier 2 CEPAs

With trade in mind, one can propose that there are two tiers of CEPAs, were we to categorise the CEPAs according to the share of the total trade between the UAE and a given partner, out of the UAE total trade with the world (which stood at US$711.7 billion in 2023). This is the combination of imports, re-exports and non-oil exports.

Table 3: Tiers of UAE CEPAs based on 2023 trade data

Note:

Tier 1: Share of 0,5% and higher

Tier 2: Share of under 0.5%

| Country | Category | Share of UAE’s Global Trade (2023) | Total Trade Value with the UAE (US$ Billion – 2023) | Current Stage |

| India | Tier 1 | 7.62% | 54.2 | Signed |

| Türkiye | Tier 1 | 5.11% | 36.4 | Signed |

| Japan | Tier 1 | 2.44% | 17.33 | Under Negotiation |

| Vietnam | Tier 1 | 1.71% | 12.17 | Signed |

| Russian Federation | Tier 1 | 1.53% | 10.88 | Negotiations Concluded |

| Pakistan | Tier 1 | 1.12% | 8 | Under Negotiation |

| Thailand | Tier 1 | 0.98% | 6.96 | Under Negotiation |

| South Korea | Tier 1 | 0.83% | 5.9 | Signed |

| Malaysia | Tier 1 | 0.68% | 4.87 | Signed |

| Armenia | Tier 1 | 0.66% | 4.73 | Negotiations Concluded |

| Indonesia | Tier 1 | 0.65% | 4.62 | Signed |

| Brazil | Tier 1 | 0.62% | 4.38 | Under Negotiation |

| Australia | Tier 1 | 0.59% | 4.2 | Signed |

| Jordan | Tier 1 | 0.58% | 4.16 | Signed |

| Kazakhstan | Tier 1 | 0.54% | 3.87 | Negotiations Concluded |

| Kenya | Tier 2 | 0.44% | 3.14 | Signed |

| Congo-Brazzaville | Tier 2 | 0.42% | 3 | Negotiations Concluded |

| Kyrgyzstan | Tier 2 | 0.38% | 2.7 | Negotiations Concluded |

| Israel | Tier 2 | 0.33% | 2.34 | Signed |

| Philippines | Tier 2 | 0.16% | 1.14 | Under Negotiation |

| Morocco | Tier 2 | 0.14% | 0.98 | Negotiations Concluded |

| Bolivia | Tier 2 | 0.13% | 0.928 | Under Negotiation |

| New Zealand | Tier 2 | 0.11% | 0.77 | Signed |

| Ecuador | Tier 2 | 0.10% | 0.68 | Under Negotiation |

| Belarus | Tier 2 | 0.09% | 0.673 | Negotiations Concluded |

| Colombia | Tier 2 | 0.08% | 0.55 | Signed |

| Central African Republic | Tier 2 | 0.07% | 0.53 | Signed |

| Georgia | Tier 2 | 0.07% | 0.52 | Signed |

| Argentina | Tier 2 | 0.06% | 0.45 | Under Negotiation |

| Cambodia | Tier 2 | 0.06% | 0.41 | Signed |

| Ukraine | Tier 2 | 0.05% | 0.38 | Signed |

| Chile | Tier 2 | 0.04% | 0.31 | Signed |

| Paraguay | Tier 2 | 0.02% | 0.176 | Under Negotiation |

| Mauritius | Tier 2 | 0.02% | 0.17 | Signed |

| Serbia | Tier 2 | 0.02% | 0.12 | Signed |

| Costa Rica | Tier 2 | 0.01% | 0.067 | Signed |

| Uruguay | Tier 2 | 0.00% | 0.03 | Under Negotiation |

On the top of the ‘Tier 1’ list is India, which was the UAE’s second-largest trade partner at US$54.2 billion in total trade in 2023, surpassed only by China at US$86.7 billion. One ought to argue that these ‘Tier 1’ countries are the ones that have been deemed by UAE policymakers to be the most strategic trading partners, which it seeks to double down on and ensure growth as partners and continue to be majorly important for the UAE trade portfolio.

The picture becomes less clear with ‘Tier 2’ CEPA partners. While some in this tier are aiming to be ‘Tier 1’ trading partners; others are likely CEPA partners to stimulate trade, safeguard their position amid growing competition, or contribute to a diversified CEPA portfolio.

The GCC dynamic and the geopolitics of UAE’s CEPAs

The UAE’s CEPA landscape reflects geopolitical balancing, with agreements spanning Ukraine and Russia. It is also noteworthy that a significant share of the UAE’s CEPAs are with Asian countries, especially in the ‘Tier 1’ category—a trend that others have also noted much earlier in the development of the CEPA landscape. A growing number of countries are also from the African and South American continents. Meanwhile, Western countries are not represented as much. Some have argued that this is because larger economies prefer agreeing FTAs with the GCC, rather than bilaterally with the UAE.

Indeed, the GCC dynamic of the CEPAs has been high on analysts’ minds. By signing CEPAs bilaterally, questions have been raised regarding the UAE’s alignment with the GCC customs union. However, a deeper look at the CEPAs reveals that the picture is more complex. The United Kingdom (UK), for example, is exploring a GCC-wide FTA, but a senior official of the UAE-UK Business Council has said that the UK and the UAE could talk “bilaterally about doing additional agreements,” adding that “CEPA is a bit wider in scope than a free trade agreement”. Therefore, the mutually exclusive argument is not straightforward. New Zealand is an example of this, having agreed to a GCC-wide trade agreement months apart from concluding negotiations with the UAE for a CEPA, and even before signing one. Pakistan has also entered negotiations with the UAE for a CEPA but signed an initial FTA agreement with the GCC beforehand. Finally, South Korea signed an FTA with the GCC months before signing a CEPA with the UAE.

Others have taken a different direction: CEPA first, GCC next. Türkiye is an example of this, having started negotiations for a GCC FTA almost a year after signing a CEPA with the UAE. Meanwhile, some countries have submitted applications to conclude FTA negotiations with the GCC but have signed a CEPA with the UAE before reaching that stage: these are Australia, Malaysia and Chile. Others, like Japan and the Mercosur bloc, are negotiating simultaneously for a CEPA and a GCC FTA.

Conclusion

The UAE’s efforts to proliferate its CEPAs have been accelerating its progress towards national goals for foreign trade. It’s been able to balance geopolitical rivalries while expanding ties with its neighbours in the Asian continent primarily, but also in Africa and South America secondarily. One could argue there are two tiers of CEPAs based on the importance of partners for the UAE’s trade portfolio, with India topping that list. Moreover, arguments that the UAE is harming GCC trade prospects are short-sighted, with this mutual exclusivity being disproven in recent months, especially by New Zealand, South Korea, and Türkiye.

Mahdi Ghuloom is a Junior Fellow at the Observer Research Foundation (ORF) – Middle East.