The United Arab Emirates’ (UAE) pursuit of a cleaner and more efficient energy architecture, along with its aspiration to become a hub of the Fourth Industrial Revolution, are among the most distinctive features of its evolving global identity, and in many ways, represent a crucial part of the country’s value proposition.

Given their focus on domains such as power generation and transition infrastructure, the digital revolution and AI ambitions of countries, battery components in clean mobility options, and defence manufacturing, the relevance of critical minerals is arguably sector-agnostic. For the UAE, secure and reliable access to these scarce and highly-valued minerals will determine whether they fully actualise their economic diversification strategy or merely add a vertical alongside their legacy hydrocarbon-wealth-based economy.

While securing reliable access to these minerals is integral, the energy demands of the data centres highlight a fundamental paradox inherent in the otherwise complementary paths of the energy transition and the digital revolution.

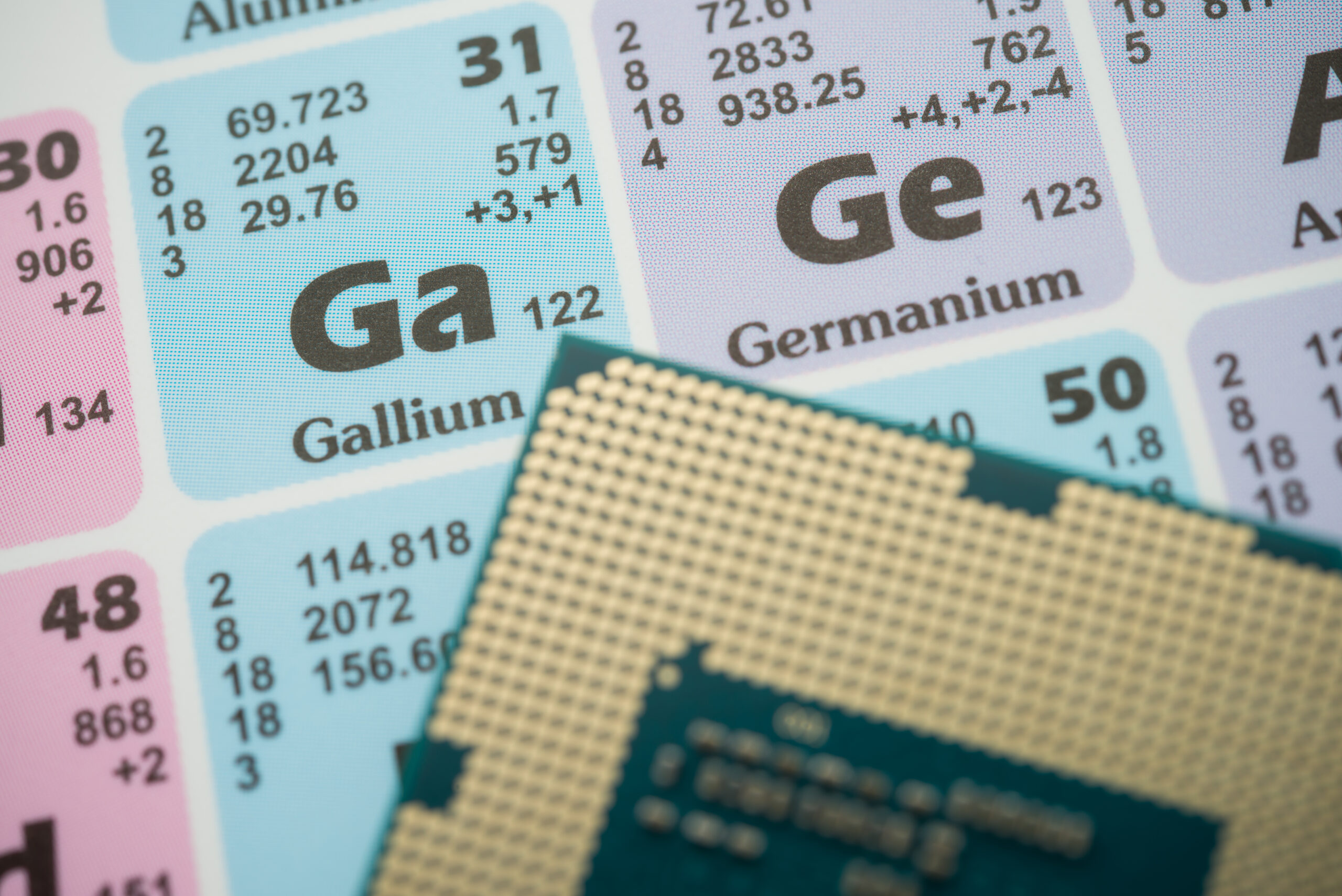

Value of critical minerals to data centres

The UAE’s ambitions of integrating AI and the digital ecosystem into every aspect of its national life will be underpinned by a vast network of data centres. These data centres generate a substantial demand for critical minerals due to their operational, structural, and energy requirements.

Generic list of critical minerals commonly used in data centres

| Gallium | Neodymium |

| Copper | Aluminium |

| Beryllium | Dysprosium |

| Manganese | Lithium |

| Hafnium | Palladium |

| Barium | Zinc |

For instance, the high-density computing ecosystems in data centres need highly conductive materials which have robust structural integrity and can ensure thermal stability, helping with heat dissipation and efficient power distribution. Copper is an invaluable raw material in this regard, with palladium, silver, and bismuth being among the other options.

Similarly, the magnetic storage technologies that ensure efficient data storage and retrieval are tied to the use of highly specialised materials such as barium, which are central to ferrite magnets. These help achieve data integrity objectives by guarding against Electromagnetic Interference (EMI)─an essential characteristic for resilient data architectures and maintenance of signal integrity.

Again, the centrality of lithium-ion batteries to the back-up systems of data centres places the UAE right in the middle of a very competitive market with high concentrations.

Estimates suggest that by 2030, the demand exclusively from data centres could lead to an increase of global demand for copper and silicon by 2 percent, 3 percent for REEs, and 11 percent for minerals like gallium.

Value of critical minerals to energy transitions

Arguably, climate concerns are not yet the organising principle in the policy formulations of the UAE, akin to any other hydrocarbon-based economy. They may be appreciated as a value-addition and an ambitious supplement to a well-thought-out economic diversification policy. Regardless of the origins of this agenda, net zero remains a robust national pursuit and thereby invokes a preoccupation with critical minerals.

Generic list of critical minerals important for the energy transition

| Aluminium | Chromium |

| Gallium | Copper |

| Selenium | Boron |

| Neodymium | Molybdenum |

| Cobalt | Nickel |

| Lithium | Dysprosium |

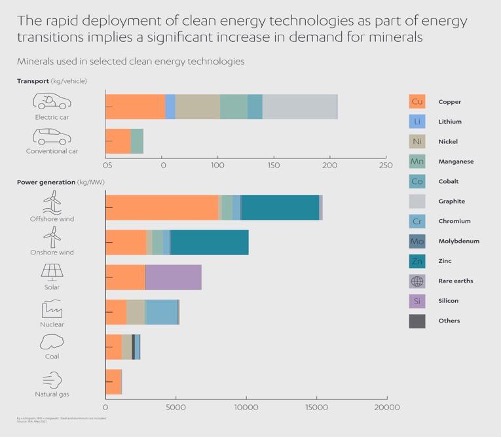

The essential use of critical minerals, including rare earths, in the whole spectrum of low-carbon pathways central to the transition makes the reliable and assured availability of these minerals a pressing concern for the UAE.

Source: IEA, May, 2021

Copper and aluminium, for instance, are essential raw materials in renewable infrastructure and the power transmission lines and grids. Lithium is essential for high-efficiency lithium-ion batteries. Cobalt and copper are important for energy storage and performance. Similarly, neodymium is central to the permanent magnets used in wind turbines and EVs.

Paradox

The essential benefits of combining the two pathways are undoubtedly abundant for the UAE-

- The use of data and AI is integral to how efficiency drivers could be induced into the mix within energy utilities.

- By transforming energy production and management, this digital architecture could effectively help integrate renewables into the power sector and the grid.

- Furthermore, AI can also help decarbonise the hard-to-abate sectors by introducing energy efficiency.

Yet, ironically, the use of AI and the necessarily uninterrupted functioning of data centres lead to considerably higher energy consumption by a country. A single prompt through ChatGPT3, for instance, consumes 10 times more energy than a simple Google search. Even when AI becomes less energy-intensive, it would be reasonable to expect that the number of applications based on it will increase even further, thereby compounding the potential paradox.

Features of the paradox

- At present rates, data centres are indicated to be consuming a little more than 5 percent of the world’s electricity figure which is expected to double over the next five years.

- While it is emissions from such consumption that are the larger issue where the cost to the environment is concerned and not the consumption itself, there is nevertheless an inherent disjunct. The fossil fuel-based options are presently in play to meet pressure on the grid. SMRs and hydrogen fuel cells can, theoretically, introduce efficiency by standardisation, customisation and cost-optimisation into the operation of data centres. Yet, these options remain conceptual, and can most reasonably be expected to come up against issues of scalability and prohibitive CapEx commitments for deployment, even when the technologies are fool-proofed and design standardisation is achieved.

- Again, mining for critical minerals itself is a highly energy–intensive activity built on fossil fuels.

- Both the mining of critical minerals, which geographic realities place in areas of water scarcity, as well as the use of scarce water resources for the cooling of data centres, are equally counterintuitive to the sustainability pathways the UAE hopes to pursue.

Recommendations for a critical minerals strategy

- The creation of a National Critical Minerals Doctrine integrating the UAE’s foreign policy to domestic industrial and transition pathways that are committed to enmeshing clean energy goals with global investment strategies, such that resource allocation is more effective.

- Creation and declaration of a sector-wise qualification through a National Critical Minerals list would be a useful step for the country. IRENA’s list for the ranking of critical minerals for the global energy transition offers a good template to build on.

- Capacity building in recycling, reprocessing, and the development of alternative technologies and chemistries can be used to create a circular critical minerals ecosystem from older or stranded assets in the country.

- Building expertise in the development and deployment of engineered liquids can substantially reduce the amount of water consumption required for cooling data centres, in addition to the potential benefits from higher system density from the same-sized installations.

- The UAE could leverage investments made conditional on improvements in the mining, separation, processing, and alloying processes of critical mineral supply chains, and establish a dual-pricing mechanism with a green premium that may be preferred by countries seeking also to avoid the over-exposure to China in the domain.

- Initiate a binding agreement with regional and extra-regional partners to replicate Europe’s Climate Neutral Data Centre Pact and incentivise the private sector through preferential pricing to abide by it. Such an agreement could build on IRENA’s Collaborative Framework on Critical Minerals for the Energy Transition.

- Further harnessing simultaneous engagement with African and Latin American nations, Balkan and Central Asian countries that are rich in these minerals, alongside partnerships with India and France in the field, will prove a very effective hedge where access to critical minerals is concerned.

- To draw from a model such as Open Price Exploration for National Security (OPEN) AI metals programme, which enables transparency in actual costs, methods of extraction and processing, and labour policies, throughout the critical minerals value chain. This could also tie in with the World Economic Forum’s proposal on creating a market data sharing on critical minerals, and help with incentivising the adoption of best practices.

- Sustained R&D and human resource development based on upskilling cognizant of industry requirements should be central to any critical minerals strategy that the UAE adopts.

- Embedding manoeuvring room for course correction in investment pathways should be prioritised, given the possibility that progress in battery chemistry and emerging technology may change the value hierarchy of these minerals.

Use-case partnerships based on complementarities to implement the recommendations

| Strategy

|

Potential partners |

| Capacity building (recycling, reprocessing, alternative technologies and chemistries)

|

Japan, India and France |

| Development and deployment of engineered liquids

|

US, Germany, France, UK, Netherlands |

| Dual-pricing mechanism with a green premium

|

Saudi Arabia, India and France |

| Climate Neutral Data Centre Pact | GCC countries

|

| Supply chain diversification | Angola, Zambia, DRC, Kenya, Brazil, Peru, Chile, Montenegro, Albania, Uzbekistan, Kazakhstan, Tajikistan, Kyrgyzstan |

Conclusion

The UAE’s ability to harness critical minerals for its diversification goals will depend on how it leverages its comparative advantages, such as stable baseload capacity and lower sensitivity to short-term price shifts, while navigating the paradox between its twin transition pathways. Through the adoption of the suggested measures, it could develop a comprehensive approach that bridges the gaps between its aspirations and achievements, while mitigating some of the dichotomy in its twin pursuits.

Cauvery Ganapathy is a Non-Resident Fellow at the Observer Research Foundation Middle East