Economic engagement through logistics and big-ticket infrastructure investments are the cornerstone of the UAE’s Africa policy, coming toe-to-toe with China in Africa

In FY23, the United Arab Emirates (UAE) is poised to emerge as Africa’s largest development partner and investor (US$ 110 billion) in a five-year timeline, overtaking historically strong economic partners like the European Union, the United States and China. Collectively, Abu Dhabi invested/pledged US$ 97 billion in FY22 and FY23 in critical economic sectors such as logistics, energy, minerals and mining. Due to these sizable investments, the UAE emerged as the continent’s fourth largest investor in the past decade behind the EU, China and the US. The UAE is also the largest GCC investor in the continent. These massive investments also helped expand non-energy trade between the African countries and UAE from US$ 20 billion in 2012 to US$ 60 billion in 2022.

The UAE’s deepening economic cooperation with the African continent comes at a time when China’s economic engagement is sliding and the EU and the US are viewed as paternalistic, pushy and slow in releasing funds. Abu Dhabi’s investments and economic cooperation are critical as the continent faces an infrastructure development gap of US$ 150 billion, which is widening every year. These sizable investments by the UAE have yielded Abu Dhabi with significant geopolitical and geoeconomic heft in Africa. This article analyses the UAE’s geoeconomic strategy in Africa and the strategic and economic reasonings behind it.

Emirati economic strategy and investments

The economic and security priorities of the Emirates have driven UAE-Africa relations for over two decades. Beginning in 2000, investors and banks from the Dubai Emirate have been prominent economic partners in many countries of Africa. For Dubai, in the 2000s, this was a strategic priority as diversified investments hedged against its limited oil and gas reserves—as compared to Abu Dhabi. Africa’s untapped natural resources, markets, and promising and burgeoning middle class offered appealing opportunities in the logistics, tourism, infrastructure development, energy, gold and agriculture sectors. Over the past two decades, the Horn of Africa, Maghreb and Central Africa emerged as priority regions for Emirati investors.

The UAE’s geoeconomic strategy for investing in Africa is three-pronged: strategic, economic and financial. Concerns about the long-term relevance of oil-rich countries in the global economic order and the financial returns thereof in the era of the green transition; maintaining its relevance as a haven of globalisation and as a global financial connector; and establishing its economic heft and gaining political currency in East Africa and along the Red Sea are the respective economic, financial and strategic priorities of the UAE in Africa.

Following these strategic and economic imperatives, the UAE consolidated its economic heft in Africa between 2000 and 2023. In 2023, the UAE’s total FDI stock (US$ 60 billion) in Africa surpassed China (US$ 42.1 billion), which has been the largest bilateral creditor alongside the US (US$ 56.29 billion) for the past decade. The most significant sectors of Emirati investment were logistics (port development, roads, railways, land ports), energy (oil, gas, solar, wind, hydel) and mining (gold, CRMs, steel, iron and aluminium).

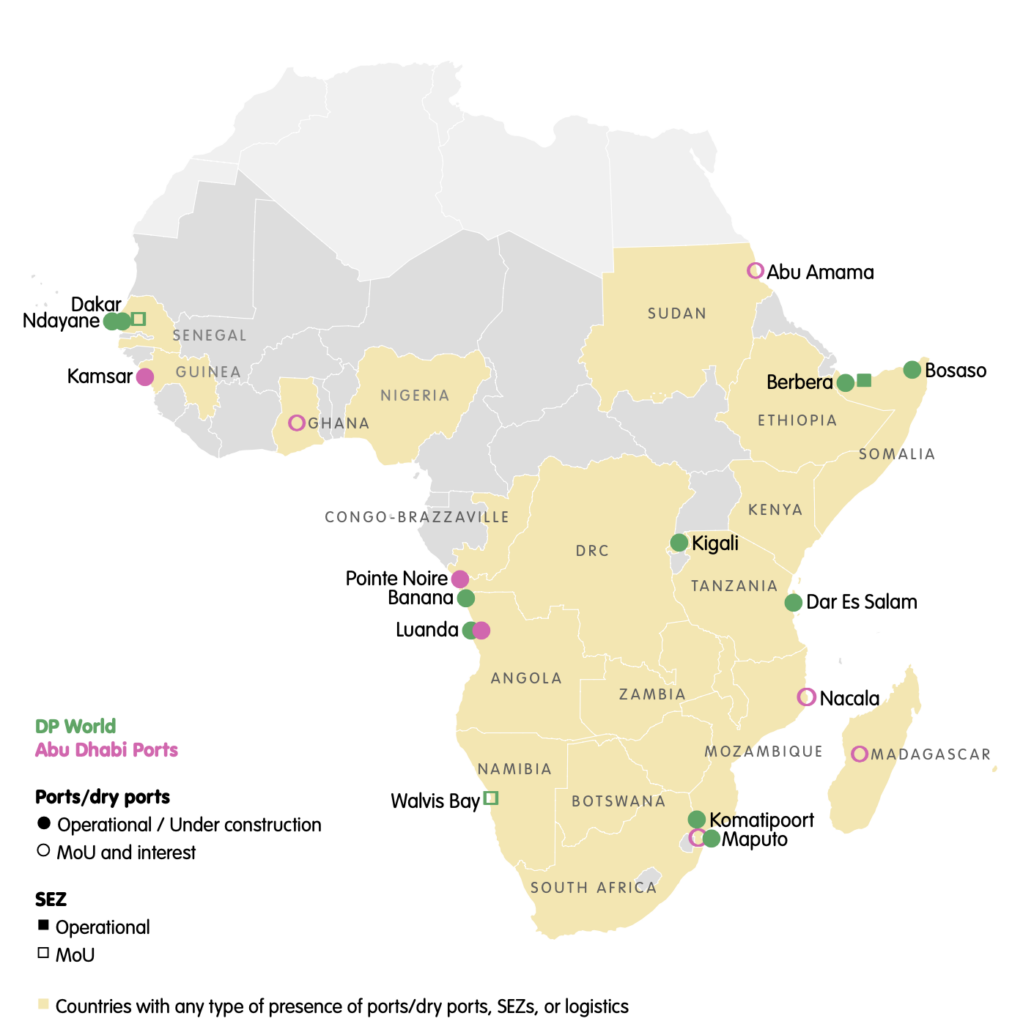

Map 1: The UAE companies’ ports in Africa

Source: DataWrapper

In the logistics sector, the UAE’s DP World and the Abu Dhabi Port Group manage ten and three ports, respectively, across thirteen countries. The Abu Dhabi Port Group is also in talks with Ghana, Madagascar, Mozambique and Sudan to manage and develop their ports. The aim is to establish the Emirates as a logistics connector between Asia, Africa and Europe, instrumentalising the UAE’s geostrategic location. These investments build into the economics-driven foreign policy approach of the UAE. Its connectivity investments in Africa build economic partnerships with resource-rich African nations and emerging markets, and ‘friendshore’ emerging and established trade routes, critical for Emirati trade.

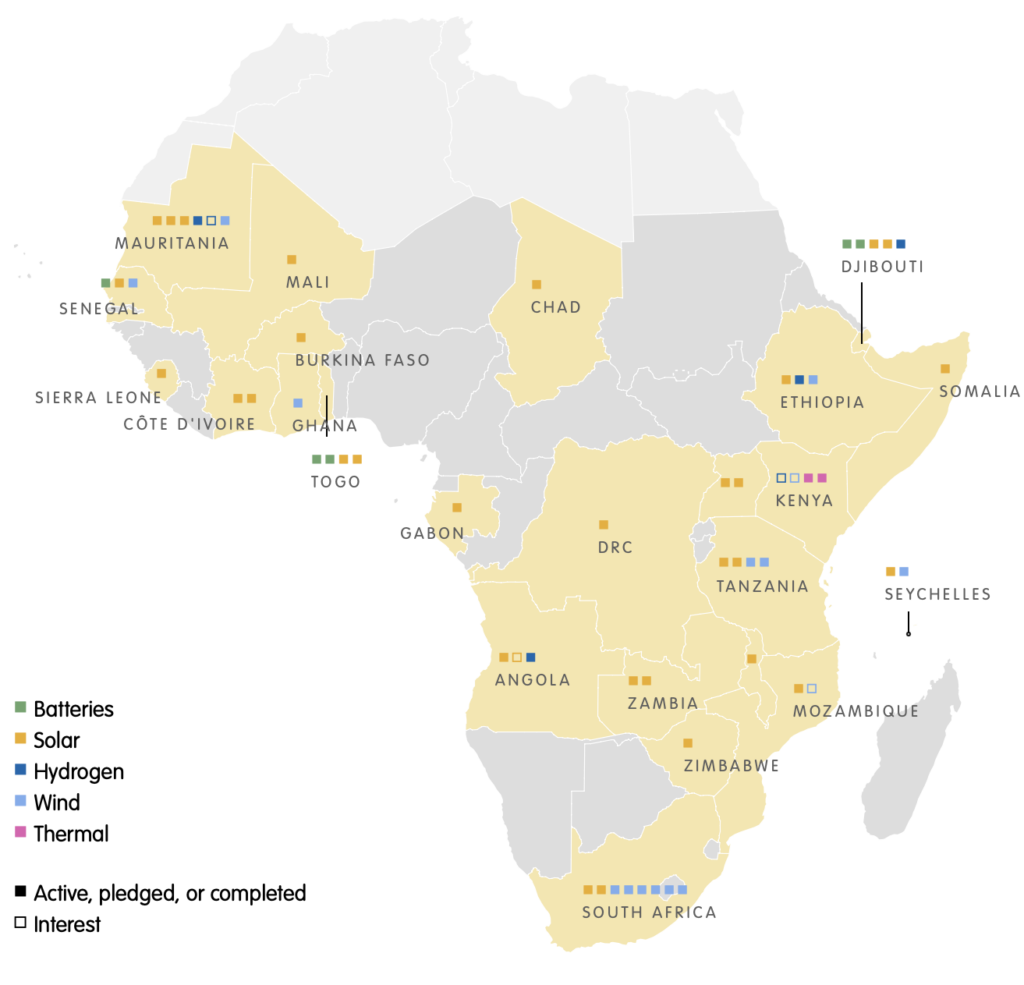

Map 2: The UAE’s renewables investments in Africa

Source: DataWrapper

The UAE is also investing in new and old energy sources in Africa. Abu Dhabi has invested approximately US$ 9 billion in Africa in the past decade and pledged another US$ 4.5 billion for the rest of this decade. Spanning solar, wind, batteries, hydrogen, wind and thermal power, the UAE invested/pledged approximately US$ 14 billion in 23 countries of the continent (see Map 2). The UAE’s approach to renewables is two-pronged: advocacy for a slow phase-out of fossil fuels and investment in CRM, s and metals sectors to secure/build the resources necessary for powering the green transition. In an economy uplifted largely by energy trade and development, these investments are hedging mechanisms for the future.

Geopolitical and geoeconomic implications

Naturally, as with the Chinese BRI, the UAE’s sizable investments accorded it with economic and political heft in Africa. Investments in the Horn of Africa and along the Red Sea route were as strategic as they were economic. Close to US$ 110 billion worth of UAE-Europe trade passes through the Red Sea. Countries along the Red Sea and in the Horn are also politically fragmented, fragile and prone to coups and regime changes. Establishing interdependent economic partnerships is one way of ensuring access to the Red Sea. Another trend emerging from the UAE’s economic engagements in Africa and the political instability of these countries is Abu Dhabi’s growing defence partnerships in Africa.

Abu Dhabi pursues a three-pronged security strategy with African nations where the UAE has sizable investments. This strategy focuses on capacity building, defence industry collaborations and equipment procurement, and establishing Emirati military outposts in Africa. Today, seven African countries (Yemen, Eritrea, Somaliland, Somalia, Chad, Libya, and Egypt) have Emirati military bases. In other countries (Rwanda, Nigeria, Mauritania, Algeria, Tanzania, etc.), the UAE instrumentalises capacity building and defence industry collaborations to protect its economic interests in Africa.

Another notable geoeconomic development pertains to the UAE’s logistics and connectivity strategy in Africa. The Emirates aims to establish itself as a logistics connector between Asia, Africa and Europe, instrumentalising the UAE’s geostrategic location. Its investments in Africa build into Abu Dhabi’s economics-driven foreign policy approach. Its connectivity investments in Africa build economic partnerships with resource-rich African nations and emerging markets, and ‘friendshore’ emerging and established trade routes, critical for Emirati trade. Additionally, DP World and the ADP Group are controlled by Emirati royal families, thus making it easier for the government to align UAE’s geopolitical aims with economic investments.

ADP Group is a relatively newer player in the logistics sector as opposed to the established and larger DP World. Yet, since 2022, the ADP Group has expanded operations on the eastern African coast of Africa, in Sudan, Tanzania, Angola, Egypt and Congo-Brazzaville through concession and cooperation agreements. Concession agreements and public-private partnerships are the instruments utilised by these two logistics companies to expand the UAE maritime connectivity, logistics and connectivity brand in Africa. Instances can be found in Tanzania (Dar-es-Salaam), Somalia (Bosaso) and Senegal (Dakar) where 20 or 30-year concession agreements were signed after these companies funded the expansion of ports therein.

Notably, the Eastern and Central African regions are also areas of geopolitical interest for China and Russia. In many nations such as Rwanda, Puntland, Mozambique, Guinea, Senegal, etc. UAE’s economic engagement predates even the BRI, China’s transnational connectivity initiative. However, the trends of Sino-Emirati competition and collaboration in Africa indicate that their relationship is one of shared interests in the continent. The UAE and China quietly compete over concessions and projects in Africa, alongside complementarity and mutual interests. Economic growth and increased trade with Africa are in both their interests.

Conclusion

The UAE’s foreign policy in Africa is unique. Economic engagement through logistics and big-ticket infrastructure investments are the cornerstone of the UAE’s Africa policy. As of 2025, the UAE seems to be the only country which can go toe-to-toe with China in Africa. However, the UAE’s economics-driven foreign policy is rather complementary than confrontational to China, its largest trading partner. The UAE is also part of the India-Middle East-Europe Economic Corridor and a member of the BRICS+ Group – some members of which are part of the International North-South Transport Corridor (INSTC). The UAE has expressed interest in the INSTC as well. However, geopolitical problems with Iran and the US sanctions on Iran and Russia are substantial hurdles. Nonetheless, the UAE seems to be poised to play a pivotal role in global connectivity paradigms and the emerging global order due to its economic heft, geopolitical non-alignment and economic multi-alignment.

Prithvi Gupta is a Junior Fellow with the Strategic Studies Programme at the Observer Research Foundation.