The United Arab Emirates (UAE) recently celebrated its 53rd anniversary. From a small desert nation in the Arabian Gulf to a regional power with global ambitions, the rapid transformation of the UAE has been remarkable. During this time, the country saw unprecedented growth, with the nominal GDP increasing from US$939 million in 1971 to US$514 billion in 2023. While several factors have contributed to UAE’s evolution, the country’s focus on business and innovation have been central factors in enabling rapid growth.

Innovative technologies have enhanced the ease of doing business and enabled the UAE’s integration into global supply chains, thereby stimulating the economy. However, this progress has been dependent on imported expertise and technologies, with foreign firms leading major developments. To sustain this trajectory, the UAE must pivot from being an adopter of innovation to becoming a creator and exporter of transformative technologies. As the UAE celebrate its 53rd National Day, this article outlines how imported innovation has aided past successes and how indigenising innovation is needed to ensure future competitiveness.

Importing innovation to establish regional relevance

The UAE has leveraged innovative technologies to become a global investment hub by improving the ease of doing business, relying on imported technological capital for rapid implementation. This technology has streamlined establishing businesses and processing visas, which has been a strong focus for the Emirati leadership. HE Sultan Ahmed bin Sulayem, Chairman of the Ports, Customs, and Free Zone Corporation highlighted, “Adopting modern technologies like blockchain will significantly contribute to improving the business environment and enhancing Dubai’s position as a major center for global trade.”

This vision has translated into action with the time required to start a new business reducing from 19 days (2003) to 4 days (2019). Through the Basher platform, a new company can now be registered in 15 minutes, utilising digital documents and AI-driven approvals. Further, using the Work Bundle platform which consolidates services from multiple government entities, now work visas can be processed in five days versus 30 days previously. These policies have boosted investor confidence and Hatem ElSafty, Founder and CEO of Business Link, stated, “The UAE’s business-friendly policies and forward-thinking approach have made it a hub for foreign investment.” Improved investor confidence has resulted in FDI net inflows (percent of GDP) increasing from 1.6 percent (2008) to 6 percent (2023) and enabled UAE to rank 16 in the World Bank’s Ease of Doing Business Report 2020, climbing from rank 68 in 2008. Positioned in the intersection of Europe, Asia, and Africa, this technology-driven ease of doing business has facilitated UAE’s integration into global supply chains. Again, the Emirati leadership has been intentional in achieving this transformation. During COP28, HE Dr Thani Al Zeyoudi, UAE Minister of State for Foreign Trade announced, “[F]rom the development and deployment of new technology to building consensus for integration into global supply chains, the UAE welcomes the chance to lead this essential transformation of trade.”

Building on this vision, the UAE has developed high-capacity and technologically advanced airports and ports. For example, Jebel Ali, one of the largest ports globally, handled 14.5 million Twenty-Foot Equivalent Units (TEUs) in 2023—60 percent higher than the busiest container port in the U.S (Port of Los Angeles), which moves 9 million TEUs annually. Further, Khalifa Port is also ranked as one of the most advanced ports internationally. Biometric systems and AI-driven logistics have expedited passenger and cargo processing, making the UAE a convenient centre of trade. The physical infrastructure is aided by digital systems like the Dubai Trade Portal that utilise blockchain to digitise customs systems, reducing clearance times to 5 minutes. Innovations like Smart Gates and AI-powered passenger flow management have significantly improved the tourist experience. These investments led Dubai Airport to become the busiest airport for international passengers, welcoming 89.1 million passengers in 2016. UAE’s focus on advanced technologies has positioned it as an indispensable leader in an increasingly multipolar world. The India-Middle East-Europe Economic Corridor (IMEC) highlights this relevance, as the UAE’s geographic and logistical prowess is key for connecting regions. What makes the UAE a successful model and a desired destination is that the UAE leadership knew how to maximise the nexus of business acumen, leveraging geopolitical positioning and advantageous expediency—this could not have happened without the importation of innovation.

Exporting innovation to establish global competitiveness

While the UAE trajectory has been one of the greatest successes of modern times, certain shifts in strategy might be needed to continue this growth. The UAE’s top exports are dominated by mineral fuels and oil (62 percent). While the Ministry of Economy states that innovation is a key focus industry, it does not feature in the top 10 exports from the UAE. Thus, the UAE is currently an importer of innovation, with advancements being achieved through international collaborations. For example, UAE airports were automated by French firms like Groupe ADP and advancements in AI were achieved in partnership with firms like Microsoft.

Vision documents such as the National Innovation Strategy, have highlighted the intent for innovation and the leadership also echoes this commitment. “We want to be among the most innovative nations in the world,” said Shaikh Mohammad, Ruler of Dubai. While the Abu Dhabi Department of Economic Development (ADDED) made significant efforts to promote such growth in digital competencies by establishing a Competence Center, it was also developed in partnership with the Italian Ministry of Economic Development. Further, the UAE’s technology partnerships with the U.S., have also been key to advancing its technological capabilities. As the UAE charts a strategy to become “the most innovative nation”, the strategy should gradually decrease importing innovation through international partnerships and increase indigenizing innovation. This process will bring about a great deal of benefits that complement the National Innovation Strategy. This can help address a critical gap and make the UAE’s innovation ecosystem more independent and mature. A focus on indigenising innovation will enable the UAE to move from being a consumer of innovation to a global leader driving transformative change.

To help achieve the UAE’s goal of being an exporter of innovation, it needs to become technologically autonomous, where local firms develop innovations for home consumption and international export. Currently, the UAE spends only 1.5 percent of its GDP on R&D compared to the United States, which spends 3.5 percent. With the U.S. economy 54 times larger than the UAE, the divide in dollar amounts is even larger. Every dollar invested in R&D has been found to generate US$3.5 in economic activity. Importing economies lack the same multipliers, as imported technologies come with usage restrictions and do not stimulate domestic innovation ecosystems. To achieve this, an attitudinal shift towards innovation is needed where firms are encouraged to not view the UAE as a market for the technologies that have been developed in their home countries but to begin innovating new technologies in the UAE. Largest global companies should be incentivised to move their global headquarters to the UAE, and local firms need to develop exportable world-class technologies.

Along with redesigning strategic partnerships, current capacity gaps need addressing, too. The UAE Ministry of Industry and Advanced Technology outlined six pillars to service investors: ‘Ease of Doing Business’; ‘Utilities & Infrastructure’; ‘Access to Market’; ‘Technology’; ‘Financing’; ‘Talent’. While the country has fared well in most of these categories, there is still an overreliance on external talent.

Thus, the most important enabler of technological autonomy will be building the capacity of the workforce. Nearly 92 percent of the UAE’s total workforce is international, and only 4 percent of Emiratis are employed in the private sector. Self-reliance is key to becoming an exporter of innovation, and skills need to be transferred from international to local labour. While the UAE leadership has developed incentive programmes like the Emirati Salary Support Scheme and Merit Program to enhance the skills of Emiratis, according to a Victoria University study, “Expatriates are not keen to pass on their experience to the UAE national employees or that UAE nationals do not get enough training”.

Thus, well-intentioned initiatives like “Emiratisation” have faced certain challenges as the private sector resists Emiratis due to higher costs, skill gaps, and Emiratis’ preference for public-sector roles. Further, these policies of boosting Emirati presence in the workforce have had inadvertent effects, as they are often focused on numerical quotas, resulting in Emiratis being hired in administrative roles that limit skill-building. Implementation of standardised quotas across 14 industries also does not account for industry-specific dynamics. Private companies need 3 percent of their workforce as Emiratis across industries like finance to hospitality, and this industry-agnostic policy ignores the unique skill needs and workforce capacity of each sector. Shifting to outcome-based metrics like career growth and retention with sector-specific policies is needed. Evaluation systems tracking job satisfaction and contributions should be introduced, and this data should be dynamically fed into programming.

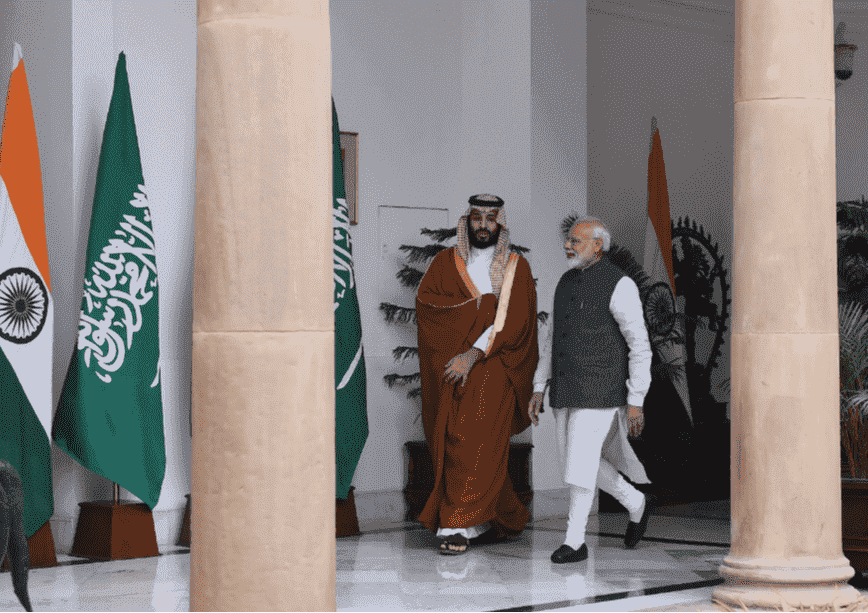

Even beyond Emiratisation, scholarship programmes that send Emirati students for education and training abroad highlight the government’s commitment to improving citizen capacity. However, according to the World Bank, the UAE employs 6.7 million individuals. With a total Emirati population of 1.5 million, reliance on international labour is inevitable. Thus, the UAE needs to increase the number of high-potential citizens to improve its permanent capacity. This is exceedingly important as other Gulf countries begin to attract labour, and KSA has mandated companies to move their regional headquarters to Riyadh. Crafting policies that provide enhanced benefits and social protection to permanent residents will help retain skilled international talent. These high-potential individuals understand the UAE economy, and retaining them by creating a lasting stake in the country is key to fostering sustainable innovator flow. Without such benefits, talent might leave for countries that offer more financial compensation. Even in advanced economies like the United States, immigrants are responsible for around 36 percent of innovation. While provisions were made for foreigners to acquire Emirati citizenship, this remains limited. Expanding these policies will help domesticate innovation and enable the UAE’s transition to an exporter of innovation. As the UAE looks to become a global competitor, it needs to transform from an importer to an exporter of innovation by indigenising innovation and developing a highly skilled citizenry. The process of exporting innovation cannot happen quickly, but the UAE’s track record of quick transformations suggests that the UAE can be a tech exporter much quicker than other states with the same goal.

Samriddhi Vij is a Research Assistant at ORF Middle East.