A sustained US$6 LNG world could lift India’s gas demand from short-term price-led rebounds to a structurally higher long-term trajectory, provided policy and infrastructure keep pace

Global gas markets are entering a period of structural loosening. New liquefaction capacity expected through the late 2020s, alongside muted demand growth in Europe and a levelling-off in China, is easing the global supply–demand balance. As highlighted in the Oxford Institute for Energy Studies (OIES) report, these dynamics could anchor LNG prices around US$6/MMBtu (Metric Million British Thermal Unit) by the end of the decade.

For India, the implications of a sustained US$6 LNG world extend well beyond short-term price relief. While earlier episodes of low prices produced largely episodic and reversible demand responses, prolonged affordability could begin to alter investment decisions, fuel choices, and infrastructure utilisation across sectors. In contrast to short-term switchability, a stable US$6 environment has the potential to support structural demand formation.

While earlier episodes of low prices produced largely episodic and reversible demand responses, prolonged affordability could begin to alter investment decisions, fuel choices, and infrastructure utilisation across sectors.

With a policy ambition to raise natural gas’s share to 15 percent by 2030, the key question is whether sustained low prices can underpin a lasting expansion in gas use beyond temporary price-led rebounds.

This article examines how sustained low prices, when combined with enabling policy and infrastructure conditions, could unlock additional demand across key sectors in India over the 2035–2040 period. It builds on an earlier article assessing India’s short-term gas demand response in a US$6 world and draws from the broader analysis in the OIES report.

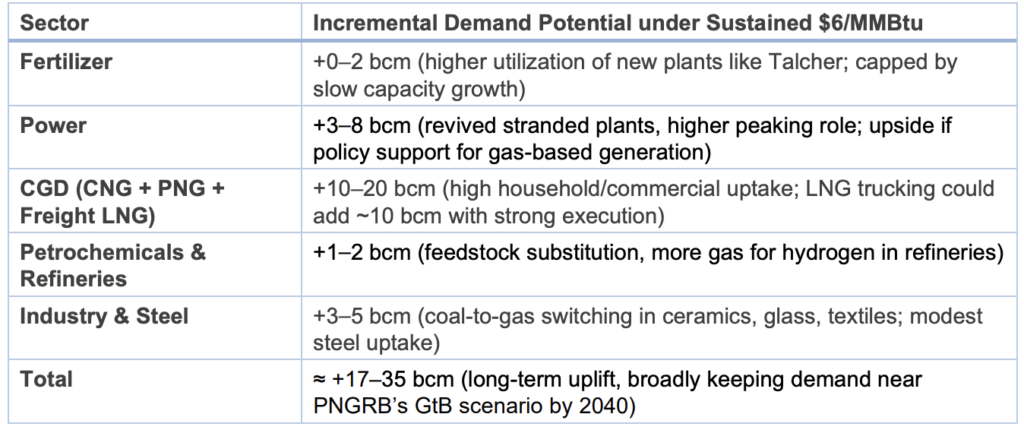

Long-Term Sectoral Demand Outcomes in a Sustained US$6 LNG Scenario

Source: Author’s creation

1. Fertiliser: Stability Gains Without Volume Upside

India’s fertiliser sector already relies almost entirely on natural gas as feedstock and has been a key driver of LNG imports in recent years. In a sustained US$6 LNG environment, lower prices influence the sector primarily through stabilisation rather than expansion.

Sustained low prices ease the government’s subsidy burden, improving the economics of existing plants and supporting high utilisation levels, while also ensuring that older or less efficient units remain viable on gas rather than reverting to naphtha or shutting down. Although some facilities retain technical fuel-switching capability, such switching is now rare and discouraged by policy. As a result, lower prices do not create incremental gas demand but instead lock in existing consumption.

Over the longer term, gas could face competition from hydrogen-based alternatives. However, fossil-gas-based urea and ammonia retain a strong cost advantage through the 2030s, suggesting that any displacement of gas demand in fertilisers is likely to remain marginal over this period.

In effect, a sustained US$6 gas environment secures full utilisation of the fertiliser sector’s gas allocation on a more permanent basis, without materially expanding volumes.

2. Power: From Stranded Capacity to System Balancer

With LNG stabilising around US$6 per MMBtu, gas-based power generation would become structurally more competitive than at any point over the past decade. At this price level, delivered fuel costs fall enough to allow India’s large fleet of underutilised gas-fired plants to operate at meaningfully higher utilisation than today, reversing years of near-idling driven by high fuel costs.

Gas is unlikely to displace coal in baseload generation. Instead, its role as a flexible complement to coal and renewables strengthens materially under a sustained US$6 regime. Most of the long-term upside lies in reactivating India’s existing stranded gas-fired capacity rather than in new builds. That said, prolonged affordability combined with targeted policy support such as capacity payments, GST rationalisation, or future carbon pricing could improve the economics of combined-cycle gas plants as replacements for ageing coal units over the 2030s.

Gas is unlikely to displace coal in baseload generation. Instead, its role as a flexible complement to coal and renewables strengthens materially under a sustained US$6 regime.

Importantly, cheaper gas is unlikely to derail India’s clean energy trajectory. Utility-scale solar and onshore wind remain the lowest-cost sources of bulk electricity on a levelised basis and continue to receive policy priority. Instead, gas can complement renewables by providing relatively low-cost balancing power, reducing curtailment and easing integration during periods of low solar and wind output. In this role, gas may partially substitute for storage in the near to medium term, while supporting higher renewable penetration overall.

On balance, a prolonged US$6 LNG environment would anchor a larger and more stable role for gas in India’s power system, not as a baseload fuel but as a system stabiliser. This outcome aligns with the Petroleum and Natural Gas Regulatory Board’s (PNGRB) long-term outlook, where even under higher gas scenarios, renewable capacity continues to expand while gas grows in a supporting, rather than dominant, role.

3. City Gas Distribution: Lock-In Effects and Structural Growth

City Gas Distribution (CGD) is well-positioned to be one of the largest long-term beneficiaries of sustained low LNG prices. At around US$6 per MMBtu, retail Compressed Natural Gas (CNG) and Piped Natural Gas (PNG) remain strongly competitive against gasoline, diesel, and liquefied petroleum gas (LPG), reinforcing gas’s appeal across urban households, commercial users, and transport.

Prolonged affordability encourages higher and more consistent utilisation of PNG connections, keeping gas competitive with subsidised LPG for households and economically attractive for small commercial and light-industrial users. Sustained low prices help stabilise network utilisation and improve the economics of recent CGD investments.

Once vehicles convert or households connect, demand becomes relatively sticky, creating a structural lock-in effect that distinguishes CGD from more price-responsive industrial demand.

Low LNG prices also strengthen CNG economics, supporting wider adoption across private vehicles, taxis, and bus fleets. Once vehicles convert or households connect, demand becomes relatively sticky, creating a structural lock-in effect that distinguishes CGD from more price-responsive industrial demand. That said, execution risks remain, including uneven rollout of recently awarded geographical areas, tax and levy pass-through, and rising electric vehicle penetration in segments such as urban mobility.

If supported by effective execution and complementary policy measures, the sector could account for a steadily rising share of national gas consumption over time, making it pivotal to India’s long-term gas trajectory in a low-price environment.

4. Petrochemicals and Refineries: Durability Over Scale

Sustained low LNG prices would reinforce the role of gas across India’s petrochemical and refining sectors by ensuring that it outperforms alternative fuels such as fuel oil and naphtha, both on cost and environmental grounds. For refineries, cheaper gas strengthens incentives to maximise its use in hydrogen production through steam methane reforming, as well as in heaters and boilers, displacing more carbon- and sulphur-intensive residual fuels.

In petrochemicals, particularly in methanol production and selected fertiliser intermediates, reliable low-cost gas improves the economics of feedstock substitution away from naphtha and supports higher utilisation of existing gas-fed plants. These effects are most pronounced at coastal and pipeline-connected sites with regular access to regasified LNG.

The upside, however, is unlikely to be transformational. Most large refineries and petrochemical complexes already prioritise gas use when it is available and affordable. A sustained US$6 LNG environment therefore works less by creating entirely new demand and more by locking in gas usage through cycles, reducing the tendency to revert to fuel oil during downturns.

Overall, the impact is best characterised as incremental but durable. Sustained affordability anchors gas more firmly in refinery hydrogen systems and process heat, supporting steady long-term demand rather than a step change in volumes.

5. Industry and Other Uses: Structural Embedding with Clear Limits

Across the broader industrial segment, sustained low gas prices could support a gradual but more durable shift away from coal and liquid fuels in selected sub-sectors. Industries such as ceramics, glass, food processing, and textiles are particularly well positioned to migrate boilers and furnaces toward natural gas where pipeline connectivity exists.

At around US$6 per MMBtu, gas can be cost-competitive with furnace oil and, in some cases, with coal, once pollution-control requirements, operational flexibility, and handling costs are taken into account. For smaller and medium-sized industries that currently rely on truck-delivered coal or fuel oil, reliably cheap gas improves not only fuel economics but also operational convenience, reducing incentives to revert during periods of price volatility.

However, this structural embedding remains uneven. Energy-intensive and coal-anchored processes, particularly in cement and primary steelmaking, face higher technical and economic barriers to gas substitution. As a result, long-term gas uptake in industry is likely to concentrate in heat-intensive but fuel-flexible segments rather than across the industrial base as a whole.

Overall, in a sustained US$6 LNG environment, industrial gas use shifts from short-term, price-driven rebounds toward more persistent demand in selected clusters. The outcome is a structurally firmer, but inherently bounded, expansion of gas use in industry rather than a wholesale transformation.

Where India’s Long-Term Gas Demand Could Settle

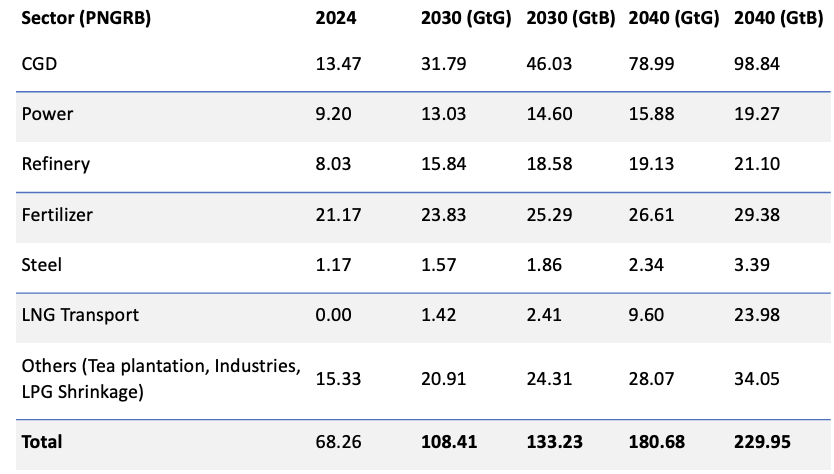

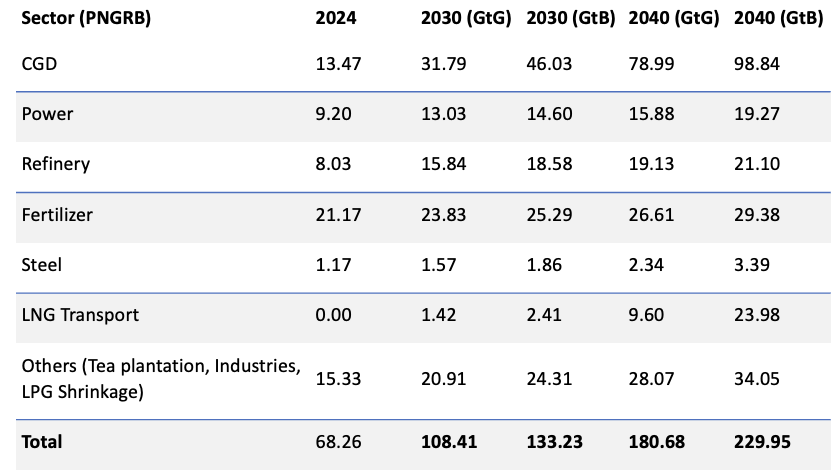

Long-term projections for India’s gas demand already span a wide range. The PNGRB’s Good-to-Be (GtB) scenario represents the most ambitious pathway, projecting demand of around 133 bcm (billion cubic meters) by 2030 and 230 bcm by 2040. These levels sit well above other outlooks, including those from the OIES (124 bcm) and the International Energy Agency’s World Energy Outlook (149 bcm), which envisage more moderate expansion over the same period.

Source: Author’s creation, using PNGRB data

Importantly, the GtB scenario assumes accelerated progress on infrastructure rollout, policy reform, and investment execution, but does not explicitly require a prolonged period of ultra-low global gas prices. If LNG prices stabilise around US$6/MMBtu, this would act as a powerful tailwind, pushing realised demand outcomes toward the upper end of existing projections rather than creating an entirely new demand path.

Source: Author’s creation, using OIES data

The magnitude of this effect becomes clearer when comparing short- and long-term price responses. In the short term, India’s demand response to lower prices is estimated at around 4.6–11 bcm. Sustained affordability could lift long-term demand by 17–35 bcm by the late 2030s, narrowing the gap between moderate and high-growth pathways.

While India’s gas demand is highly responsive to affordability, the infrastructure required to support higher volumes, including LNG terminals, pipelines, CGD networks, and gas-based generation and industrial assets, is capital-intensive.

Such an outcome would place realised demand decisively above the Good-to-Go (GtG) trajectory, while remaining below the most optimistic GtB case. Progress toward the 15 percent gas-share ambition would be more plausible under sustained affordability than in a higher-price environment.

That said, price alone is not sufficient. While India’s gas demand is highly responsive to affordability, the infrastructure required to support higher volumes, including LNG terminals, pipelines, CGD networks, and gas-based generation and industrial assets, is capital-intensive. Without clear offtake visibility, supportive regulation, and credible policy signals, investment momentum could lag even in a favourable price environment.

Conclusion: A Necessary Tailwind, Not a Guarantee

Taken together, a sustained US$6/MMBtu LNG world through the 2030s has the potential to embed natural gas more deeply within India’s energy system, lifting long-term demand outcomes toward the upper end of today’s scenario envelopes. The largest and most durable gains would likely emerge in CGD, including freight LNG, with more measured but persistent growth in power generation and selected industrial segments.

Realising this upside, however, will depend on the alignment of price signals with infrastructure expansion and policy execution. Where these elements reinforce each other, the low-price dividend could translate into a structurally higher gas demand trajectory by 2040. Where they do not, even sustained affordability may prove insufficient to deliver the most optimistic outcomes.

Parul Bakshi is Fellow – Energy and Climate at the Observer Research Foundation (ORF) Middle East.

This analysis draws on the author’s contribution to the OIES report, The Global Outlook for Gas Demand in a $6 World. The full report can be accessed here.