The United Arab Emirates (UAE) is an economy defined by ambition. Its growth story is inextricably linked to world-class human capital that is enabling the UAE to spearhead global initiatives in Artificial Intelligence (AI) and sustainable energy to cement its status as a premier hub for finance and tourism. However, in a region undergoing rapid transformation, how can we move beyond broad narratives to truly understand the nuances of labour demand?

To answer this, the authors’ conducted a novel analysis that provided an initial, yet highly detailed, snapshot of the UAE’s formal labour market. This was based on proprietary, in-house research developed by the Egyptian Center for Economic Studies over two years, representing the first phase of an ongoing research initiative. Drawing on a high-frequency dataset of 23,739 unique online job postings from June and July 2025 that was collated and classified using an AI-driven ISCO-08 methodology.

The data reveals a story not of a single, monolithic economy, but of a complex, dual-engine system grappling with a significant talent paradox. An economy that carries a simultaneous thirst for both high-end strategic talent and vast numbers of service-oriented professionals, with critical frictions appearing at both ends. This analysis maps the labour demand landscape and identifies the precise pressure points where talent shortages and mismatches occur, laying the essential groundwork for understanding the impending impact of AI.

The Anatomy of Demand: A High-Skill, Hyper-Centralised Engine

Three macro trends immediately stand out, painting a picture of a sophisticated and geographically concentrated market.

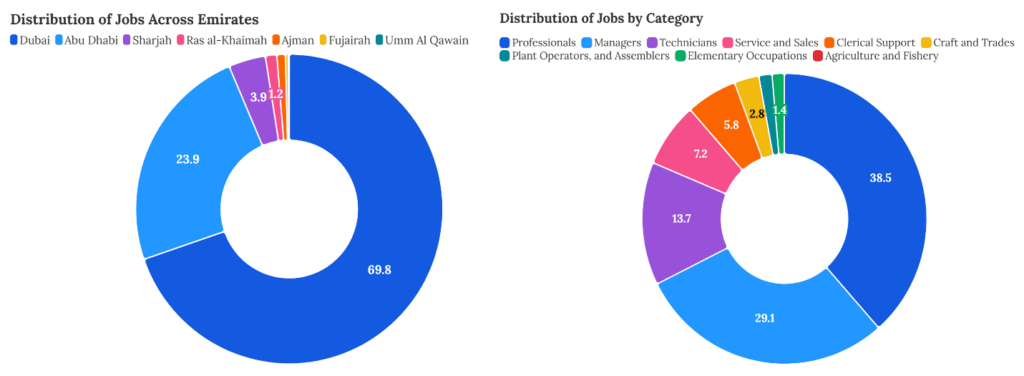

First, the UAE’s economic activity is extraordinarily centralised. Accounting for a staggering 70 percent of all job postings, Dubai is the undisputed epicenter of demand, according to The Distribution of Jobs Across Emirates chart. Abu Dhabi follows at a distant 24 percent. Together, these two emirates account for nearly 94 percent of the country’s advertised formal job openings, underscoring their immense economic gravity and the national challenge of fostering diversified growth opportunities.

Second, this is overwhelmingly a market for high-skilled professionals. The Distribution of Jobs by Category chart shows that Professionals (38.5 percent) and Managers (29 percent) together constitute over two-thirds of the overall demand. In stark contrast, elementary occupations make up just 2.5 percent of listings. This distribution is the hallmark of a mature, knowledge-based economy where value is created through expertise and strategy, rather than primary production or basic labour.

Source: Author’s analysis of 23,739 job postings collected in June and July 2025.

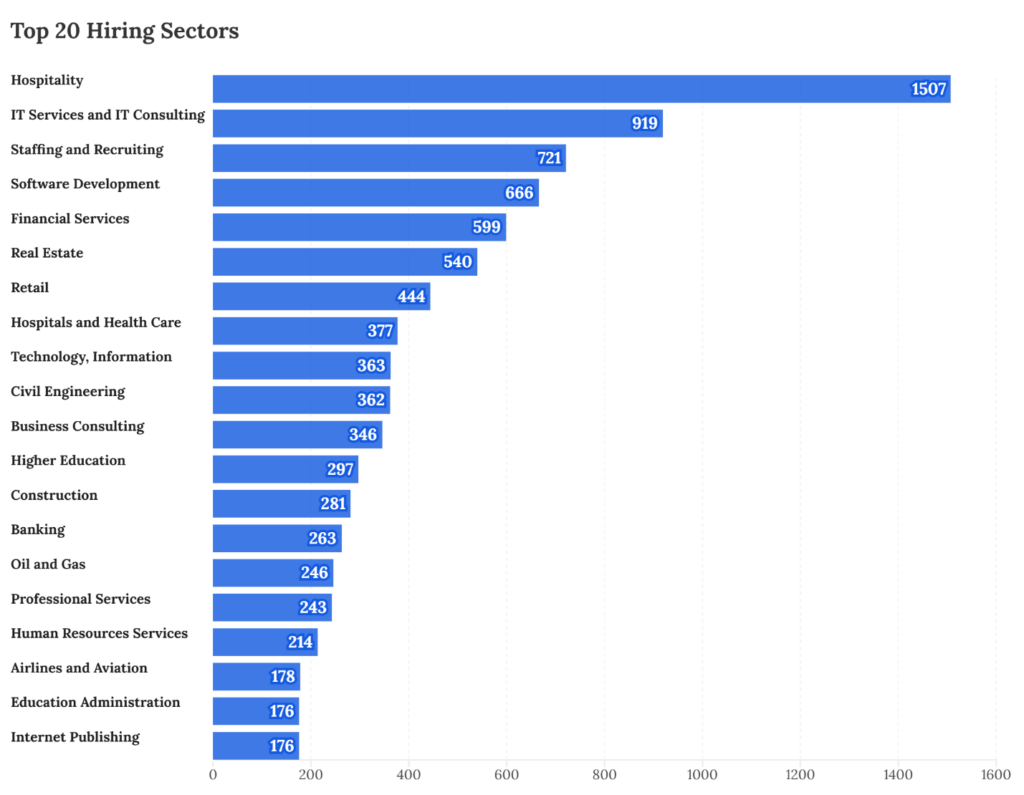

Third, the top hiring sectors reveal the UAE’s dual economic engine in action. The Top 20 Hiring Sectors chart shows hospitality sector leading significantly with over 1,500 postings, confirming its role as a foundational pillar of the economy. Yet, hot on its heels are IT services and IT consulting (919), staffing and recruiting (721), software development (666), and financial services (599). This data confirms that the UAE is not simply an economy of tourism and real estate; it is a dynamic ecosystem where digital transformation, financial innovation, and the strategic management of human capital are paramount.

Source: Author’s analysis of 23,739 job postings collected in June and July 2025.

Frictions and Mismatches: Where the Market Strains

While the big picture points to a robust, high-skill economy, a deeper dive into hiring efficiency uncovers significant frictions—the grit in the gears of the recruitment machine. These frictions reveal where skills are scarcest and where the market is signalling a critical need.

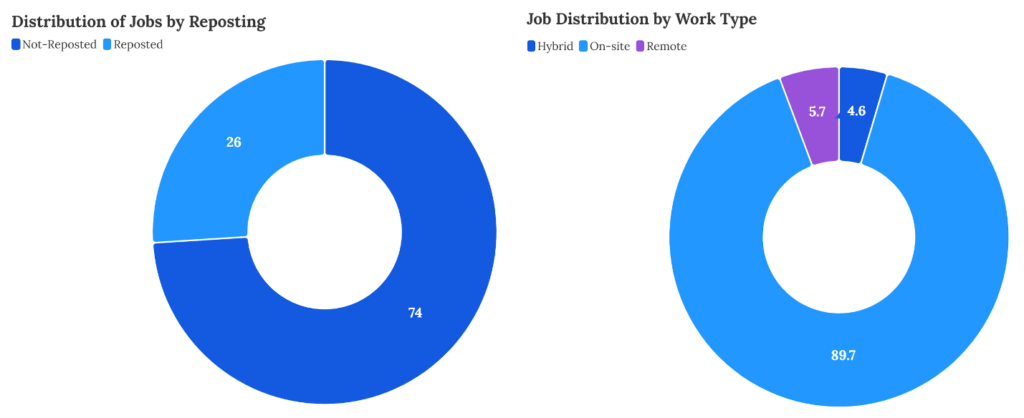

One of the most surprising findings is the striking persistence of traditional work models. In a world still echoing with the rhetoric of remote work, nearly 90 percent of jobs in the UAE are explicitly on-site, as seen in the Job Distribution by Work Type chart. This resistance to remote and hybrid models, especially in a hyper-modern economy, raises profound questions. While partially driven by the hands-on nature of the dominant hospitality sector, it may also signal a managerial culture that values physical presence. This creates g a potential misalignment with the expectations of global talent that is seeking flexibility.

The sharpest insights, however, come from analysing hiring efficiency. A substantial 26 percent of all job postings are reposted, indicating that companies failed to find a suitable candidate the first time around. This represents a significant hidden cost in time and resources. Cross-referencing with applicant data brings the talent paradox into sharp focus.

Source: Author’s analysis of 23,739 job postings collected in June and July 2025.

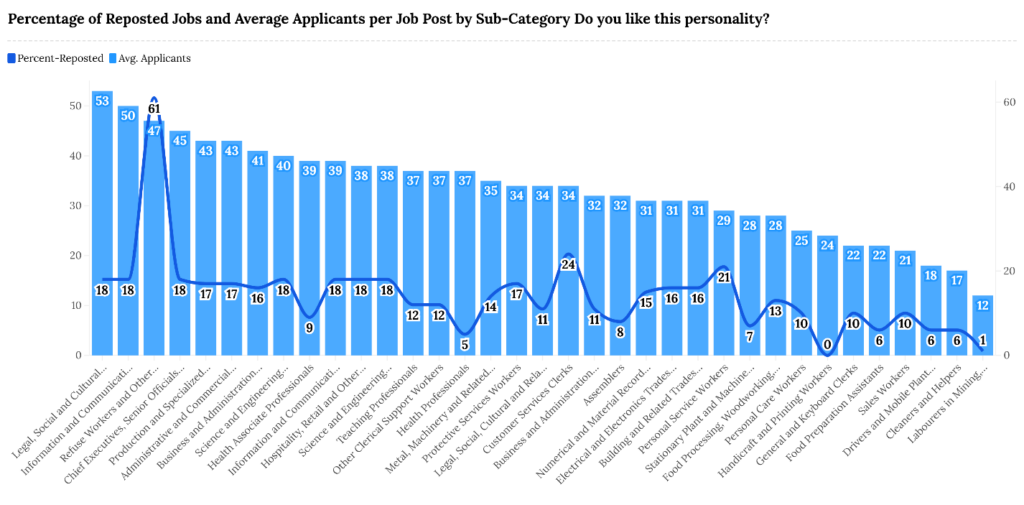

The problem is not a simple lack of people, but a mismatch of profiles, as the Percentage of Reposted Jobs and Average Applicants per Job Post by Category chart shows.

- High-Level Scarcity: Job posts receive a high volume of 31 applicants on average, yet suffer a 19 percent repost rate, as per the data by the Clerical Support Workers category. A review of job descriptions reveals these are not generic administrative roles, but overwhelmingly front-line hospitality positions such as front office agents, receptionists, and guest relations trainees. While many people can apply for a “clerical” job, few possess the specific blend of a hospitality degree, strong interpersonal skills, a customer-first mindset, and often, specific language proficiencies (such as German or Russian) that luxury brands demand. The market is saturated with applicants, but starved of the right talent profile.

- Strategic Bottlenecks: The most striking bottleneck emerges at the operational base. Postings for “Refuse Workers and Other Elementary Workers” face an astonishing 61 percent repost rate, despite being inundated with an average of 47 applications per post. The friction here is not a “viability gap” but a profound profile mismatch. The jobs are not municipal labour but front-line roles like “Lobby Host,” “Bellman,” and “Runner” in the ultra-luxury hospitality sector. The formal requirements are basic (high-school diploma), but the implicit requirements are exceptionally high, such as fluency in English, impeccable personal presentation, and the sophisticated soft skills needed to be the face of a global luxury brand. Employers are seeking the polish of a service professional for the tasks of an elementary worker, creating a needle-in-a-haystack recruitment problem.

Source: Author’s analysis of 23,739 job postings collected in June and July 2025.

Posing the AI Question: From Diagnosis to Foresight

This high-level overview of the UAE’s labour demand serves as a vital baseline for the ultimate question: How will AI reshape this landscape? The specific patterns of friction identified allow us to move beyond generic predictions and formulate precise, data-driven hypotheses about AI’s role in augmentation, disruption, and insulation of the labour market.

- Amplifying High-Value Expertise – The significant demand for professionals (38.5 percent) and managers (29 percent) points to a clear need for high-level strategic and technical skills. These roles are prime candidates for AI-driven augmentation. If the market struggles to source enough top-tier strategists and analysts, AI tools can amplify the capabilities of the existing ones, enabling the next generation of leadership to leverage AI for decision-making, financial modelling, and complex project management.

- Automating the Front Desk – The high repost rate (19 percent) and profile mismatch for customer-facing clerical support roles create a powerful economic incentive for AI-driven disruption. The market’s inefficiency in finding the right human profile accelerates the business case for automation. AI-powered chatbots, intelligent voice response (IVR) systems, and automated check-in/out kiosks are direct solutions to this clearly identified market pain point.

- The Irreplaceable Human Touch – According to our data, the roles with the most extreme hiring friction—the front-line elementary worker”positions in luxury hospitality (with 61 percent repost rate)—are paradoxically the mostinsulated from AI. The very quality that makes them so difficult to hire for is what protects them, which is the uniquely human ability to provide high-touch, empathetic, and physically present service. AI cannot yet replicate the warm, intuitive behaviourof a lobby host. The “polish” the market demands is precisely what AI cannot (yet) provide, making these roles a critical bastion of human-centric service.

By moving from a high-level overview to a granular analysis of market frictions, the authors have laid the groundwork for a more nuanced understanding of AI’s impending impact. This is where the next phase of the analysis—quantifying the AI impact through a purpose-built AI Index—will be especially valuable.

The UAE’s labour market is not waiting passively; it is actively signalling its needs, shortages, and vulnerabilities. The challenge now is to listen to these signals and build the policies, educational pathways, and corporate strategies that will allow the nation to not just navigate the AI revolution, but to lead it.

A Note on the Data: This analysis is part of an ongoing research endeavour. The insights presented in this article are based on a preliminary dataset of 23,739 job postings collected from LinkedIn, Gulf Talent, Dubizzle, and Bayt during June–July 2025 using a proprietary methodology developed by the Egyptian Center for Economic Studies.

Ahmed Dawoud is an Economist and the Head of the Data Analytics Unit at the Egyptian Center for Economic Studies (ECES).

Ahmed Wael Ahmed Habashy is an AI Engineer at the Egyptian Center for Economic Studies (ECES), specialising in the development of intelligent systems for labour market and economic analysis.