This report presents an initial stocktaking of the India-Middle East-Europe Economic Corridor (IMEC) announced in 2023 following a meeting in New Delhi between the leaders of India, the US, the United Arab Emirates, Saudi Arabia, Italy, France, Germany, and the European Commission. Given that the participating economies contribute to almost half of the global GDP, there are many opportunities and challenges associated with the economic corridor. This report highlights the dynamics of the transport corridor (railways), digital connectivity, and energy corridor within the IMEC. It discusses the geopolitical, geoeconomic, and overall geostrategic imperatives of the grouping, presents the potential opportunities and challenges, and highlights some of the future possibilities to assess whether the IMEC can provide a new template for global connectivity and trade facilitation.

Attribution: Navdeep Suri et al., India-Middle East-Europe Economic Corridor: Towards a New Discourse in Global Connectivity, April 2024, Observer Research Foundation.

Setting the Context

The India-Middle East-Europe Economic Corridor (IMEC) was announced in September 2023 following a meeting in New Delhi between the leaders of India, the US, the United Arab Emirates (UAE), Saudi Arabia, Italy, France, Germany, and the European Commission on the sidelines of the G20 Summit. The Israeli port of Haifa is integral to the proposed corridor, but the growing fallout of the unprecedented terror attacks carried out by Hamas in Israel on 7 October 2023 has temporarily cast a shadow over the ambitious plan. Enthusiasm for the plan, however, can be seen from the statement of US President Joe Biden, who described the signing of the memorandum of understanding to establish the corridor as a “real big deal,” one that would include transport, data, renewable electricity grids, and clean hydrogen pipelines.[1]

Geopolitical and geoeconomic considerations underpin the rationale for the IMEC. The proposal emerged from the womb of the 2020 Abraham Accords and the I2U2 grouping, which added India to the US-Israel-UAE grouping in October 2021. The first virtual summit of the I2U2 in July 2022 suggested that its focus areas would include strategic transport links. Saudi Arabia was crucial for the project, and it was brought into the equation just as the US-led efforts to drive a possible establishment of diplomatic ties between Riyadh and Tel Aviv were gathering momentum. These elements were at play when the National Security Advisors of India, the US, UAE, and Saudi Arabia met in Riyadh in May 2023. Israel was an early and enthusiastic advocate of the project, with one former Israeli minister describing the transport link as a “peace train” that would foster peace and prosperity in the region.

However, most of this optimism was predicated on the assumption that the conflict-resolution process among the major countries in West Asia witnessed in recent years would continue or, at the very least, the countries could manage their differences more effectively. These positive trends were evident in the way the Arab quartet of Egypt, Saudi Arabia, the UAE, and Bahrain buried the hatchet with Qatar; the normalisation of Türkiye’s ties with Saudi Arabia and the UAE; the flowering of relations between Israel and the UAE; and the restoration of diplomatic relations between Iran and Saudi Arabia.

The chain reaction following the 7 October 2023 attacks has temporarily derailed this process, and some old fissures are again coming to the fore. Israel’s massive retaliatory attacks on Gaza are widely seen as excessive and disproportionate and have triggered a wave of anger in the Arab world. The incendiary rhetoric emerging from Israeli Prime Minister Benjamin Netanyahu and a range of Israeli politicians and the manifest unwillingness or inability of the Biden administration to push for an early ceasefire have also led to increasingly sharp criticism from Riyadh and Abu Dhabi. Amid rising anti-US sentiment in the region, there is now a genuine concern that the war could drag on and even widen into a regional conflict with accompanying collateral damage on the political front.

A regional dimension of the conflict has already emerged due to the attacks being launched by Houthi militias in Yemen on shipping with presumed Israeli links as it traverses the narrow Bab al Mandab Strait that connects the Arabian Sea to the Red Sea and onwards with the Suez Canal. The Red Sea is one of the major arteries of global trade, accounting for an estimated 30 percent of container volumes and 12 percent of international trade.[2] Its criticality for global supply chains had already become apparent in March 2021 when just one stranded ship led to a week-long closure of the Suez Canal. The situation caused by repeated missile, drone, helicopter, and boat-mounted attacks by Houthi forces since 21 November 2023 has made the situation much worse than the temporary blockage in 2021. The world’s five largest shipping companies have declared the passage too risky for operations and are re-routing container ships and tankers bound from Asia to Europe and the US via the Cape of Good Hope. The lengthy detour adds about 3,500 nautical miles (6,482 km) to the journeys, which now takes an additional week or longer and typically adds US$1 million in fuel costs for a round trip from Shanghai (China) to Rotterdam (Netherlands).[3] Apart from a significant increase in insurance premiums, the longer journey time curtails global shipping capacity by 20 percent, leading to higher prices and supply chain disruptions. According to one report, it will impact the shipment of about 24 percent of chemicals, 22 percent of flat-rolled steels used in the automotive industry, and 22 percent of insulated wires and batteries for automobiles.[4]

This matters for India because virtually all its exports to its two largest markets, Europe and the US, pass through this single channel. India’s integration into global value chains is set to increase as improved infrastructure brings down the cost of logistics, and manufacturing gets a boost from the production-linked incentives (PLI) programmes. The European Union (EU) is India’s largest trading partner, with bilateral trade touching an estimated US$136 billion in 2022-23.[5] It is also India’s second-largest export market, with exports crossing US$61 billion. The US is India’s second-largest trading partner but the largest destination of exports at US$78.5 billion in 2022-23.[6] As India’s trade with Europe and the US grows, it would be in India’s strategic interest to promote the IMEC as an alternate corridor that lends a degree of redundancy to the existing trade route.

Notably, from a geopolitical perspective, the prevailing situation is not conducive to the kind of active cooperation between Israel, Jordan, Saudi Arabia, and the UAE envisaged in the IMEC. It also plays into geoeconomic concerns in Cairo and Ankara that the proposed corridor is bypassing them. Egypt sees it as an unnecessary competitor for its lucrative Suez Canal monopoly, while Türkiye believes that a rail corridor from Basra through Iraq is not only more viable but also reinforces its position as a bridge between Asia and Europe.

Key features of the IMEC

According to initial reports, the IMEC will have an eastern leg that would take container traffic from India to the UAE on the well-established shipping routes from India’s west coast, joining the corridor’s land route. The goods would move by rail from the UAE to Israel’s Haifa port on the Mediterranean coast after transiting through Saudi Arabia and Jordan.

The western leg of the corridor would put the containers back on ships in Haifa and take them to European ports across the European Union, France, Italy, and Germany for onward transmission by European rail networks to their final destinations. The attraction of the two-way transport link lies in reducing the dependence on the Suez Canal and creating a route that could be 40 percent faster because high-speed freight trains would travel at 120 kmph, which is about four times faster than the pace of ships.[7]

Some commentators have compared the corridor to China’s Belt and Road Initiative (BRI), but there is a crucial difference.[8] As an economic corridor, the IMEC is not limited to trade in goods alone. Given the growing imperative of cyber security, a secure, high-speed data pipeline that could potentially facilitate the export of India’s IT services to Europe and West Asia is also proposed.

The inclusion of electricity grids in the corridor framework is also particularly significant from an Indian perspective. As part of its leadership of the International Solar Alliance, India has already promoted the ‘One Sun, One World, One Grid’ initiative, an ambitious attempt to connect the world’s vital regional grids into a common green grid that can transfer renewable energy from one region to another. It would leverage different time zones to maximise the use of solar power and reduce the need for expensive energy storage systems.

Equally forward-looking is the plan to incorporate clean hydrogen pipelines into the corridor. There is a strong belief that clean hydrogen could be the most effective long-term alternative to fossil fuels, and the Indian government has already allocated US$2.5 billion to promote the country’s emergence as a green hydrogen hub. Several of India’s most prominent business groups, including Reliance Industries, the Adani Group, Larsen & Toubro Limited, and ReNew Energy Global, have announced multibillion-dollar investments to develop their own green hydrogen projects, as have corridor members like the UAE and Saudi Arabia. Prices of electrolysers are expected to lower significantly as production ramps up, and green hydrogen using renewable energy may well follow the same price curve as for solar and wind energy. However, scepticism also remains over the viability of hydrogen as an alternative mass fuel and the available technologies to transport it safely and economically worldwide.[9]

Political Will and Geoeconomic Gains

These plans may appear futuristic, but the first steps to develop intercontinental green transit corridors linking Asia and Europe are underway. A sense of urgency was also reflected in the announcement in New Delhi that a high-level meeting would be convened within 60 days to commit the participating countries “to develop and commit to an action plan with relevant timetables.”

The political will and resolve of participating countries will be tested as they start coordinating to meet the array of challenges. Each vertical integral to the corridor will pose a distinct and separate set of hurdles. A starting point will be addressing the issues of technology, finance, and commercial viability for the physical infrastructure in terms of railway links, clean hydrogen pipelines, and electricity and data cables. At the same time, problems of soft infrastructure related to harmonising standards for ports, railways, and customs will also need to be addressed.

The challenges are real, as are the opportunities that could emerge from a project that is based on trendlines and projections to 2030 and beyond. It takes advantage of a geopolitical and geoeconomics paradigm that did not exist a decade ago. Without the rapidly falling prices of renewable energy, the idea of green hydrogen and interconnected electricity grids would have been impossible. However, for the present—and at least for the near future—the IMEC project must deal with the realities of the emerging situation in West Asia. At the time of writing this paper, the contours of a resolution are decidedly indistinct. The outrage in the Arab world is real and is bound to have a chilling effect on a high-profile project that proposes active cooperation with Israel.

Amid the prevailing gloom in West Asia, it is essential to note that the proposed corridor is a long-term connectivity project. It will likely be several years before the detailed project reports and financing options are finalised. A lot can change during this period, and in the shifting sands of West Asia, that should provide some impetus for the preparatory work to continue.

This report highlights three key connectivity verticals (transport, digital, energy), their geostrategic drivers, and considerations by highlighting the critical work areas in the initial stages. It also includes an overview of the future opportunities created by the IMEC.

Transport Connectivity

The IMEC is the latest of several connectivity projects mobilised over the past two decades. These corridors demand immense economic and political capital from participating states to see them towards fruition. The announcement of the IMEC on the sidelines of the G20 Summit in New Delhi was seen as a new era of cooperation between India, West Asia (Middle East), and Europe, bound together through their partnerships with the US.

Intra-continental transport projects are complex, long-term initiatives. New Delhi’s experiences with the North-South Transportation Corridor, conceptualised in 2000 and inked in 2003 and designed to connect and bridge economic gaps between India and Russia using Central Asia (more specifically Iran and Azerbaijan), offers a good glimpse into the number of opportunities and the equal (if not greater) number of challenges associated with such big-ticket projects. While India’s experience with the Chabahar Port does not infuse confidence in the integrity of such projects, such initiatives are becoming increasingly popular, mainly due to the global sense of urgency to diversify supply chains out of China.

The Railways Link

From India’s transportation perspective, the IMEC primarily focuses on shipping routes. Ports on the country’s Western coast, such as Mumbai, Kandla, Mangalore, Mormugao, and Kochi, are already major transit points. Trade with the Gulf states, particularly the UAE, is already a major area of bilateral cooperation between New Delhi and Abu Dhabi. This preexisting ecosystem between the two IMEC partners offers a convenient economic route to tap into without requiring any further immediate large-scale infrastructure development. While ports in the UAE, such as Jabel Ali in Dubai, are being touted as an ideal destination for their geographic and economic positioning, marketing the port in Fujairah, on the Gulf of Oman on the UAE’s eastern seaboard, could also make more geopolitical sense as it removes the contentious waterways of the Strait of Hormuz from the equation.

Figure 1: The UAE Rail Network

Source: The National[10]

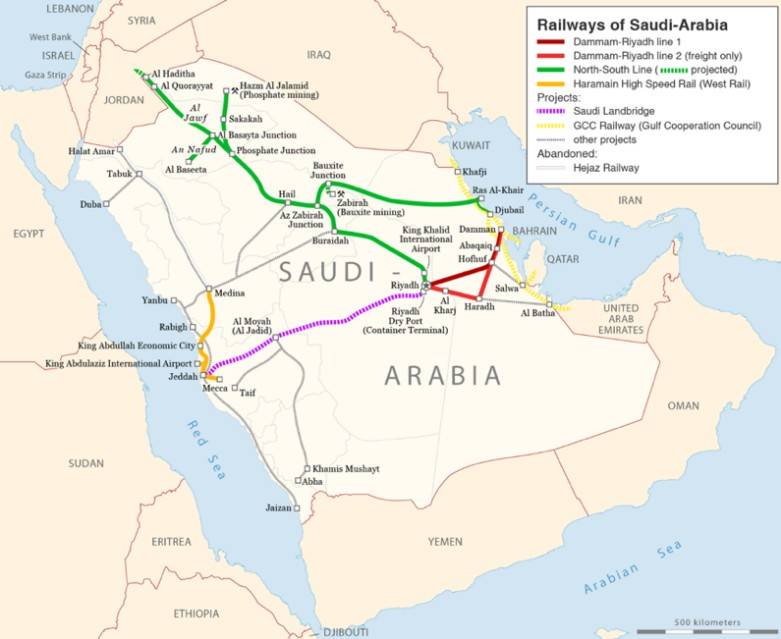

With port facilities in India already available, the focus will be on the IMEC’s above-land designs, specifically in West Asia. The participating countries in the region are not known for their rail networks, and while some functioning lines, the integration will take time. The UAE’s Etihad Rail network is expected to cover the country’s Western coast, including the Jebel Ali and Khalifa ports, up to Ghuweifat next to the Saudi border (see Figure 1). On the Saudi side, the rail networks are improving rapidly, even as the reliance on trucks to move goods remains significant. Like the UAE, Saudi Arabia also plans for a much more extensive rail network in the coming years. Rail lines connecting Saudi borders with Jordan, such as Al Haditha and Al Quorayat, are also complete or close to completion (see Figure 2). While the network is small, the plans aim to cover the most significant ports and economic zones by rail.[11]

Figure 2: The Saudi Rail Network

Source: Maximillian Dorrbecker[12]

The centrality of the UAE and Saudi Arabia for the over-land movement of freight will likely feed into the smaller neighbouring states that are planned to be part of the IMEC, such as Jordan and Israel. For example, the intra-link rail deal between the UAE and Oman (the country is not part of the IMEC) could be a good blueprint for other countries to follow if they aim to join the corridor project.[13]

Regulatory Landscape

While the centrality of rail links and feeding into localised infrastructure programmes such as Saudi Arabia’s ‘Vision 2030’ and its National Transport and Logistics Strategy (NTLS) is important, the other challenge is to synchronise the movement of logistics and build a standard tariff and taxation regime that can be operationalised in parallel to the local tariff policies of individual states. Best practices on this front, already employed by multilateral systems such as the EU and ASEAN, can serve as good examples to build upon for a workable regulatory framework for the IMEC.

However, the growing economic rivalry between Saudi Arabia and the UAE will present some challenges. Saudi Arabia is now aiming to become a “leading business and transportation centre,” challenging the UAE’s dominance on this front.[14] In 2021, Saudi Arabia imposed new tariffs for its neighbours in the Gulf Cooperation Council (GCC), targeting goods[a] from “free zones” that offer preferential tax and customs treatments. This includes the port region of Jebel Ali and its accompanying port infrastructure. These moves are seen as part of Saudi Crown Prince Mohammed bin Salman’s grand economic plans to transform the kingdom into a regional market power like the UAE, but at a grander scale.[15] This rivalry and Saudi Arabia’s efforts to attract investment away from other GCC states make building an overarching common tariff regime complex. Indeed, bureaucratic issues within and among countries that are part of the IMEC will make it challenging to promote the corridor.

Given that good infrastructure (in the form of roads and ports, although the rail networks need to be strengthened) already exists in the participating countries, the priority will be to establish conducive policies and regulatory frameworks for a thriving transportation corridor.

Furthering connectivity

Prioritise regulatory frameworks to make the corridor an attractive proposition for businesses from day one, calculating from a container loaded in Mumbai and off-loaded on the Mediterranean coast of Europe. Pivot towards the centrality of economic and political security of land routes in West Asia. This will be critical, specifically after the ongoing crisis in Gaza. Framework of financing corridor projects for transportation requirements over the next decade along with American and European partners. Put forward India’s experience in freight railways in building regulatory and management plans. Offset Indian human talent against the Western technological edge. Annual consultation roundtable to secure land-based transport and regulatory systems between all members. The first such meeting should be mobilised in the first half of 2024.

Digital Connectivity

Digital connectivity is a critical component of the corridor. Once completed, it promises high speed and a secure flow of information and data, which is crucial for economic growth and regional integration. There are three potential building blocks for the IMEC’s digital connectivity: an undersea data cable, a telecommunications network, and digital payment ecosystems. With its significant technology footprint, India can contribute substantially to these digital initiatives.

The IMEC’s promise of digital connectivity hinges on the thriving digital connectivity among its partners through a web of undersea data cables that dot the region. Several data cables currently connect parts of Asia, the Persian Gulf, and European countries (see Table 1).

Table 1: Major data cables connecting Asia, the Persian Gulf, and Europe

| Undersea cable project | Major countries Involved | Cost | Undersea cable project | Major countries Involved |

| PEACE | Egypt, Somalia, Djibouti, Malta, Pakistan, France, Somalia, Kenya, Seychelles, Cyprus | 425 | China-ASEAN Information Harbor, PEACE Cable International Network, Telecom Egypt | 192 |

| Gulf Bridge International Cable System | Qatar, Bahrain, Saudi Arabia, Oman, Iran, Iraq, UAE, Kuwait, India | 445 | Gulf Bridge International, Inc. | 51.2 |

| Flag Europe Asia | Egypt, Jordan, Spain, UAE, Saudi Arabia, China, Japan, India, Italy, UK, Thailand, Malaysia | 720 | Global Cloud Xchange | 0.5 |

| SEA-ME-WE-4 | India, Bangladesh, Djibouti, Maldives, Pakistan, France, Sri Lanka, Italy, Malaysia, Egypt, Singapore, Saudi Arabia | 600 | Algerie Telecom, Bangladesh Submarine Cable Company, Bharti Airtel Limited, CAT Telecom, Du, FT, Pakistan Telecommunication Company Limited, Saudi Telecom Company, Sri Lanka Telecom Limited, TATA Communications, Telekom Malaysia Berhad, Tunisie Telecom, Verizon | 12.8 |

| Falcon | Yemen, Saudi Arabia, Kuwait, Oman, Iraq, Iran, Qatar, India, Sudan, Egypt, Bahrain | 900 | Global Supply Exchange | 2.56 |

| Europe India Gateway | Egypt, UK, UAE, Gibraltar, Saudi Arabia, Monaco, India, Oman, Portugal, Libya | 700 | SubCom LLC | 28 |

| AAE-1 | Egypt, Yemen, Oman, Italy, Greece, Djibouti, Qatar, UAE, China, Saudi Arabia, Pakistan, Malaysia, France, India, Myanmar, Thailand, Cambodia, Vietnam | 800 | China Unicom, CIL, Djibouti Telecom, Etisalat, GT5L, HKT (PCCW Global), Mobily, Omantel, Ooredoo, OTE Globe, PCCW Global, PTCL, Reliance Jio Infocomm Limited, Retelit, Telecom Egypt, Telecom Yemen, TOT Public Co Ltd., Viettel | 80 |

Source: Submarine Cable Almanac[16]

These high-capacity network links and several terrestrial cables are critical in expanding the internet bandwidth in the region and connecting more people online. China’s HMN Tech company has a significant presence in some of these data cables. Notably, the firm expanded its market share from a mere 7 percent of total undersea cable projects in 2012 to 20 percent by 2019.[17] Its flagship project is the PEACE Cable, which starts in Pakistan and ends in France, connecting Europe, Africa, and Asia,[18] and has a carrying capacity of 192 terabytes per second.

The IMEC is looking to disrupt this Chinese corporations-dominated market by proposing to lay down a high-speed data cable along the east corridor (connecting India to the Arabian Gulf) and the northern corridor (connecting the Arabian Gulf to Europe).[19] Given the strategic purpose that this cable will serve for the corridor, IMEC partners must aim to build a super-capacity data pipeline. This will benefit the partner countries and the African continent, where HMN Tech has occasionally sought a more significant market share under China’s Digital Silk Road (DSR) initiative.[20]

The IMEC partners can leverage their technological capabilities and financial heft to establish a strategic presence in this domain. This will require substantial investments from the US, India, the UAE, and Germany and the continued engagement of their tech, telecoms, and undersea cable companies in the project. The successful execution of this project will offer the partner countries an opportunity to create their own regulatory and cybersecurity frameworks to secure undersea cables, which can then be applied to other cable projects in the region.

Telecommunications network

Telecommunications connectivity is the backbone of the regional economies’ advance into the digital sphere. Consequently, many IMEC partners are upgrading their telecom networks from legacy 3G/4G to 5G wireless systems. However, this upgrade is not cheap; one estimate suggests an average baseline cost of between US$3 billion to US$8 billion for a national 5G rollout per country, with an additional 20-35 percent investment required to expand coverage.[21]

Like undersea cables, the 5G market is dominated by Chinese telecom companies such as Huawei, Zhong Xing Telecommunication Equipment (ZTE), and China Unicom. Huawei has acquired 29 percent and ZTE 11 percent of global 5G revenues by aggressively offering 5G technology cheaper than Western firms.[22] Notably, they are not only capturing new markets but also aiming to replace the existing standards ecosystem, as seen from Huawei’s proposal in 2020 to replace the current Transmission Control Protocol/Internet Protocol (IP) with a new IP standard that it claims is faster.[23]

The IMEC partner countries must take a strategic view of the telecom networks in their region and halt the further onslaught of Chinese companies. Regional governments can procure secure and trustworthy telecom hardware and potentially provide financial incentives to the region’s low- and middle-income countries to enable them to purchase such hardware. To operationalise this, as an initial effort, the IMEC countries must constitute a task force or working group on telecom technologies that rallies not just the government agencies but also telecom firms and the technical community to promote cooperation.

Digital payment ecosystems

At the heart of deeper economic and commercial exchanges lies the greater integration of the digital payment ecosystems. While greater internet penetration will enable people and businesses to efficiently manage trade and investments across the IMEC, the development of interoperability between payment systems will catalyse convenience in payments and remittances. Currently, SWIFT (Society for Worldwide Interbank Financial Telecommunication) is the widely accepted system for cross-border interbank settlements. However, retail payments for low-value transactions remain a pain point.

India has aggressively promoted its Unified Payments Interface (UPI) for cross-border payments and remittances. Among the IMEC partners, Saudi Arabia, the UAE, and France have allowed UPI to be used for fund transfers and remittance payments. UPI is the ideal option for an integrated payments ecosystem among IMEC partners. However, to achieve this, the National Payments Corporation of India must secure UPI from financial frauds and cybercrimes, devise more significant incentives for financial institutions to participate, make its Application Programming Interface genuinely open source, and develop greater linkages with international payment networks. In addition, it must traverse divergent payment system regulations across the IMEC partners.

Establishing digital connectivity for the IMEC is not without challenges, especially given the recent re-emergence of geopolitical faultlines in West Asia. However, the buildout process can be boosted if partners understand the mutual trade and tech imperatives guiding their participation. The IMEC’s projects offer a potentially viable counter to the Chinese companies’ dominance under the DSR and give India a prominent position in the emerging arc of prosperity. The next big opportunity, beyond digital, for the IMEC is energy and energy security. The task of energy transition is also intertwined with digital technologies, from production to consumption.

The Energy Corridor

Emerging economies such as India are faced with the trilemma of ensuring energy access and affordability while trying to achieve a transition to green energy. Moreover, the transition towards green energy will impact the environment, energy security, and geopolitical relationships. The shift to newer forms of energy will bring newer supply chains for these green technologies and a change in the power dynamics related to energy. For India and much of the emerging world, this is an opportunity to rethink energy security at home and become a more prominent node in the global energy landscape. Integrating energy corridors as a focal point within the IMEC can be a crucial facilitator for resolving the energy trilemma. It also offers India a means to bolster its leadership in the green energy transition. Two critical priority areas have been identified as part of the IMEC efforts to enable cooperation around energy.

Interconnected Grids for Renewable Energy

The intermittent nature of renewable energy presents the most significant hurdle to its expansion. Providing round-the-clock renewable energy currently depends upon the availability of storage technologies, particularly battery storage. However, utility-scale battery storage is costly, estimated at around US$345 per kWh for lithium ion-based battery storage systems in 2020 and projected to decrease to only US$143 per kWh by 2030, even in the most optimistic scenarios.[24] Emerging economies such as India are already struggling to access finance for the energy transition. Currently, India’s annual finance flow to green sectors is only one-fourth of the amount needed to achieve its nationally determined contributions.[25] A renewable energy expansion pathway that relies on battery storage will substantially increase the energy transition cost.

The interconnected grid project, part of the IMEC, provides an alternate pathway for reliable renewable energy supply. In 2023, India held talks with the UAE and Saudi Arabia on grid interconnectivity.[26] The IMEC will span regions with the highest potential for renewable energy, particularly solar. West Asia, in particular, has some of the highest solar irradiance worldwide.

India can benefit from the corridor as an exporter and import of green energy. On the import side, drawing power from the interconnected grid system when renewable energy generation is low can reduce the need to build newer battery storage infrastructure. This will be particularly important in improving the share of renewable energy generation, which is currently only around 25 percent on average.[27] On the export side, India’s ambitious renewable targets mean that at certain times of the day, many states will produce excess solar energy that may not be evacuated and integrated into the grid. The cross-border transfer of this excess capacity will aid in the better utilisation of renewable energy infrastructure, thereby improving the profitability of renewable energy generators.

The interconnected grid can also provide an essential fillip to the growth of renewable energy in West Asia. While this region has among the highest potential for solar power, the development of renewable energy continues to lag behind other areas. For example, the UAE, Saudi Arabia, and Israel are among the top 20 countries with the maximum solar potential,[28] but the share of renewable energy in the power mix remains below 10 percent in these countries. By providing access to a broader market, the interconnected grid can increase the sources of demand for renewable energy from this region and act as a fillip for more significant investment.

Most importantly, the interconnected grid is a unique opportunity for India to demonstrate its credentials as a leader in the green energy transition. As part of its leadership of the International Solar Alliance, India has floated the India of ‘One Sun, One World, One Grid’ to create a common grid that can transfer renewable energy across different parts of the world. The IMEC power corridor can be the first example of translating intent into action, providing a template for further projects.

Green Hydrogen Corridor

Hydrogen, mainly green hydrogen produced using renewable energy, is expected to be a crucial future fuel for deep decarbonisation. Given its high energy density, hydrogen is essential for decarbonising hard-to-abate sectors, such as heavy industries and long-distance transport, where other forms of fuel may not be well suited.

India already has strong ambitions to grow its green hydrogen infrastructure. The central government has already approved an incentive plan of US$2.1 billion to create green hydrogen production infrastructure to produce 5 million metric tonnes by 2030. The private sector has also identified green hydrogen as a priority area, with companies such as Reliance Industries, Adani Enterprises, and JSW Energy setting up a green hydrogen manufacturing capacity of a cumulative 3.5 million metric tons. Similarly, other countries in the IMEC, such as the UAE and Saudi Arabia, have strong plans for green hydrogen expansion.

The proposed green hydrogen corridor can boost green hydrogen growth in the whole region. One significant hurdle to green hydrogen expansion is the lack of demand from industries that may be unwilling to shift their production processes to use green hydrogen. The IMEC can be an essential step in resolving this problem by creating an export corridor for green hydrogen and expanding the available market beyond domestic borders.

The second most significant impediment to green hydrogen growth remains the high cost of production. Currently, the cost of green hydrogen is as high as US$6-8 per kg.[29] The price will have to reduce substantially for widespread adoption to around US$1 per kg. This will hinge on technology development and the ability to produce and utilise cheap and effective electrolysers. In addition to physical infrastructure, the green hydrogen corridor can act as a technological corridor. This can lead to the co-development of green hydrogen technologies across countries that are part of the corridor by transferring technical and human resources. Eventually, this can speed up the development of green hydrogen technology and could be essential for countries in this region to become leaders in the global green hydrogen economy.

The inclusion of energy as a vital part of the IMEC is an acceptance that cooperation will be essential to ensure an ambitious and equitable energy transition. In particular, the focus on interconnected grids and green hydrogen can prove instrumental in resolving some of the critical bottlenecks that can impede the energy transition in the future. While there will be many challenges to implementing this corridor, particularly related to mobilising the finance to build the physical infrastructure and harmonising standards and regulations across different countries, the IMEC announcement is an essential first step towards establishing an effective green transit corridor that connects Asia and Europe.

The IMEC: Facilitating a New Era of Connectivity and Trade?

The IMEC is ambitious but not the result of capricious thinking. It is grounded in reality, cognisant of the benefits and costs, undertaken based on the long-term vision of the various advantages to be reaped by the participating economies, and, most importantly, will redefine the regional geoeconomic order.

The agreement on the principles for the IMEC presents a blueprint to boost economic growth among the participating economies by connecting the two continents of Asia and Europe. With the participating economies accounting for US$47 trillion—or about half the global GDP—the formidability of the IMEC as an economic force is undeniable.[30]

The IMEC underscores the importance of enhancing global connections and forming new trade routes. A vital component of the project’s two main corridors—the eastern corridor linking India with the Arabian Gulf and the northern corridor connecting the Arabian Gulf to Europe—is a railway system, which is envisaged as a consistent and economical cross-border ship-to-rail transit solution that complements current maritime and road routes, facilitating the movement of goods and services among India, the UAE, Saudi Arabia, Jordan, Israel, and Europe. In tandem with the railways, there are plans to develop electric cables, digital infrastructure, and hydrogen pipelines. While symbolising a fresh approach to global collaboration and a redefined perspective on globalisation, the IMEC has the potential to usher in a new era of globalisation, not merely based on an ideological or security pact but a collective effort to foster a brighter future for all participating nations. Still, several aspects related to the corridor require further exploration:

Supply Chain Resilience

Economic corridors are crucial for supply-chain resilience. In recent years, supply chain shocks have become more frequent due to factors such as the pandemic, conflicts and war conditions, and economies’ insulating tendencies.[31] While international economic corridors have garnered substantial attention in global discussions due to their ability to promote trade and exploit complementarities, their importance in combating systemic supply chain shocks is often understated.

How can the IMEC help ensure supply chain resilience in the participating nations? A significant component of improving resilience is reducing the ‘transaction costs’ of trading. Transport costs and regulatory differences among countries are estimated to account for between 29 percent and 16 percent of the overall trade cost.[32] The high transaction cost arising through these avenues indicates that a more enhanced and comprehensive approach to supply chain connectivity, encompassing border and transport infrastructure and policies, is needed.

An economic corridor that caters to the needs of the factor and product markets and ensures their constant supply and demand helps create a certain amount of resilience in the new supply chain created within the corridor. This insulates the system from shocks in other parts of the world. The IMEC can do precisely that. It will help the participating nations exploit India’s affordable human capital and abundant natural capital that classify the factor market, thereby creating a resilient supply side while also helping cater to the needs of an already developed product market in the high-income economies of the US, EU, West Asia and India’s growing western and southern parts.

BRI vs the IMEC: A Comparison

Some commentators have termed the IMEC as a response to China’s BRI. The BRI is a result of China’s shift to a ‘consumption-led growth’ approach; China’s 13th five-year plan (2016-2020) explicitly pledged to promote “consumption-led growth” by enhancing domestic purchasing power. Given the unstable nature of the external sector, which relies on volatile international trade and finance, China needed a reliable growth engine within the domestic economy as a protective measure. This prompted notable increases in wages and labour expenses in the country over the past ten years. Concerned that their exports could become less competitive, Chinese decision-makers thought about moving components of the production process to regions with abundant and affordable labour and natural resources. The BRI is, therefore, an initiative to access the ‘factor’ markets in Africa and South Asia, as well as the ‘product’ markets in the EU, West Asia, and the US.

While explicitly promoting Beijing’s strategic objectives, the BRI has attracted significant debate and scrutiny.[33] By launching projects of dubious merit to ensure and expand Chinese access to resources and local markets, the BRI has been characterised as an instrument of Beijing’s ‘debt-trap diplomacy’. It showcases China’s ambition to extend its influence worldwide, resulting in substantial debt challenges for several susceptible economies. Examples include Sri Lanka’s Hambantota port and the 22 African nations grappling with financial difficulties. The China-Pakistan Economic Corridor is another example of Beijing pushing its strategic development agenda.[34] This is akin to ‘market imperialism’.

The IMEC, on the other hand, is more a project of mutual respect and partnership to take advantage of the existing complementarities. The opportunity to meet the aspirations of over 6 billion people in the developing world and not just the top 1 billion population of the developed world can be served by the IMEC, which provides a replicable framework[35] for other such plurilateral frameworks in different regions. Establishing a trade and connectivity corridor involving India, West Asia, and Africa, as well as connectivity links to Africa and subsequently to South America, will be pioneering initiatives that can be outcomes of this process.

Holistic trade facilitation through the IMEC

It is imperative to recognise the synergistic relationship between transport connectivity, which encompasses physical infrastructure and international regulations, and trade facilitation, which involves customs procedures and infrastructure at the border. Although the value of both aspects in augmenting trade is unquestionable, the link between transport and trade facilitation is not always clear in policy dialogues. A recent report[36] identified four conditions that should be satisfied for trade facilitations: enhanced coordination, unified policy approach, inclusion and sustainability, and digital advancements. These are some of the issues that the IMEC should consider:

- Enhanced Coordination: The IMEC’s biggest challenge will be maintaining continuity in cooperation and coordination between the participant countries. The rail-route construction will require about US$20 billion in funding, likely coming from West Asia.[37] In addition, the IMEC plans to build power lines and pipelines for green energy transport, which will incur huge costs. This will require investments from both governmental and private sources. Therefore, external and internal policy coordination is essential for developing trade infrastructure for efficient trade and transport facilitation. Often, transport connectivity and customs facilities are disjointed, leading to inefficiencies.

- Unified Policy Approach: Regional trade policies should integrate trade facilitation and transport cooperation. The IMEC is expected to do this for the corridor to be thriving.

- Inclusion and Sustainability: There is an inherent need for inclusivity and climate change considerations. The IMEC has already taken climate considerations into account, given its emphasis on renewables and green hydrogen. However, sustainable procurement and production mechanisms need to be built into the framework for infrastructure development.

- Digital Advancements: The pandemic highlighted the importance of digital trade facilitation. Adopting frameworks like the United Nations agreement on cross-border paperless trade can address supply chain disruptions and promote resilient, sustainable, and inclusive trade. The IMEC’s focus on digital connectivity as a critical component covers this aspect.

The IMEC and India: The Way Ahead

The convergence of several enabling factors from India’s business ecosystem—from the demand and supply sides and system-wide—has enabled the economy to emerge as one of the brightest spots in the global arena, with India touted as the “next great economic power”.[38] The demand arises from the ‘consumer boom’ phenomenon depicted by the vast population base of 1.42 billion, with real incomes predicted to grow at 4.6 percent; context-appropriate innovation by Indian corporations and firms operating in India by understanding the aspirations of the middle class; and the new source of demand emerging from the country’s urgent need for a green transition. Conversely, a robust supply ecosystem is created by the demographic dividend, access to finance, and extensive physical capital and infrastructure development, including the digital space that has taken the incarnate of digital public goods. Added to these demand and supply drivers are facilitating factors like domestic policy reforms that are bringing in certain robustness in the existing regulatory statutes and are reducing the transaction costs of doing business, the geopolitical sweet spot that India is presently occupying, and the dividend that the economy is drawing from its extensive diaspora.

Notably, India’s trade facilitation activities are both outcomes and enabling factors of good geopolitics. The IMEC bears ample testimony of this. India’s decision to exit the Regional Comprehensive Economic Partnership (RCEP) drew some criticism of the country’s protectionist outlook. However, since 2021, India has signed numerous trade agreements, such as with the UAE and, more recently, with the European Free Trade Association.[39] The advantage of the IMEC is that it provides a template for the Indian economy to align with the global value chain (GVC). India’s present GVC participation rate is below the worldwide average.[40] With the global pandemic and subsequent crisis in Ukraine bringing about the need for diversification of commodity value chains, GVCs are also undergoing transition. This has presented significant opportunities for newer countries to step up in existing value chains and capture a more substantial market share. Between 2000 and 2018, the share of advanced economies in GVC exports reduced from 78 percent to 72 percent, but it was still higher compared to their share in the global GDP (60 percent) and exports (64 percent).[41] During the same period, the share of emerging economies in GVC exports increased from 14.6 percent to 21 percent, mainly due to China, whose share increased from 3.6 percent to 8 percent.[42]

India has a massive opportunity in this context. So far, India’s inward-looking protectionist policies have impeded fully utilising the opportunities the shift in GVCs offers to attract lead firms. The default policy is undergoing significant changes, accelerating since the pandemic with the introduction of PLIs and the rapid advancement of large-scale infrastructure projects. India has substantial benefits as a production and supply hub, thanks to its strategic location along crucial trade routes linking the Far East and Southeast Asia with Europe, Africa, and West Asia. This advantage is bolstered by its large consumer market, closeness to major Asian manufacturing centres, and an expanding workforce. Nonetheless, further efforts are required to capitalise on these opportunities. Policy literature[43],[44] suggests India’s GVC engagements can be enhanced through free trade agreements, trade facilitation policies, the rationalisation of its customs and trade procedures, and the engagement of its vast MSME sector with global lead firms. The IMEC can serve this purpose. The IMEC creates India’s critical entry linkages with the GCC nations. While the Arab region is among India’s top three trade partners, with trade exceeding US$240 billion during the financial year 2022-23, trade with GCC countries alone amounted to over US$184 billion.[45] Creating a free trade region with the GCC can enhance this trade by another 40 percent, considering a linear extrapolation based on the India-UAE FTA projected figures over the next five years. A recent Computable General Equilibrium analysis[46] based on the Global Trade Analysis Project model suggests that a potential economic integration achieved through the India-GCC FTA can be mutually beneficial and enhance welfare, resulting in a win-win situation.

The current IMEC design is an ideal template for India-GCC trade and the creation of regional value chains, but it has more significant implications. For India, the Arab region can provide a product market, while India is the factor market. Again, the complementarities created between India and the GCC make it a perfect factor market catering to the needs of the broader EU and US markets. India intends to develop its ports for its maritime trade, which perfectly complements Saudi Arabia’s plans for developing special economic zones. The GCC is also interested in developing food parks and investing in agro-based industries in India. Specifically, Saudi Arabian business houses could potentially invest in areas like renewable energy generation projects, energy storage, electricity transmission and green hydrogen, which are covered under the IMEC. The IMEC, therefore, is an ideal template that can be replicated in many other cases to attract foreign direct investment. However, India must work on reducing the transaction costs of doing business within its economy.

With the depletion of oil reserves, the GCC countries are already diversifying their economies towards other services, including those in the financial domains. As trade and investment in the India-GCC region increase, there will be a bigger need for risk management and hedging. This will necessitate the development of either a sovereign fund or even adequate risk management institutions. Therefore, India and the GCC also need to think of uniform financial regulatory mechanisms for hedging the risks arising from a volatile geoeconomic environment that percolates into price risk. This will also necessitate substantial regulatory reforms from the Indian side, including removing the commodity transaction tax, bringing in more sophisticated trading instruments, and enabling conditions for the cross-border fungibility of financial products.

The creation of a risk financing system by the IMEC countries, perhaps in the form of a sovereign fund catering to this need and some other fiscal mechanisms (such as tax holidays or PLI equivalent schemes), can encourage Indian companies to partner with other corporations (outside India but part of the corridor) or move on their own to take advantage of the corridor through ancillary opportunities that emerge from it. A 50:50 principle of resource-sharing may work here, where the economies through which the corridor will pass can access financing and partner with Indian businesses.

Financing the IMEC

The take-off, continuity, and flourishing of the IMEC are contingent upon several factors, the most critical of which is finance. Initial estimates suggest that the cost of each of the routes in the transport corridor can range anywhere between US$3 billion to US$8 billion. Securing the funding for this capital expenditure is not easy. Projects in economic corridors require the cooperation of diverse actors across nations and are, therefore, subject to substantial risks. Exploring effective and low-risk strategies for funding these ventures is becoming increasingly important to attract private investments that are looking for a stable risk-adjusted return. However, the risk premiums that financial institutions encounter while investing in transborder transport or economic corridors often act as a significant barrier for banks and financial institutions to place their investible funds. Even the strong creditworthiness that esteemed multinational companies bring to these initiatives is frequently insufficient to overcome the concerns of high corruption and political instability that are common in many nations.

However, the IMEC declaration can hinge upon the G7’s June 2023 commitment to mobilise US$600 billion in funding from private and public sources over five years.[47] This initiative seeks to finance infrastructure development in emerging economies, serving as a strategic counter to the BRI. According to statements made by US President Joe Biden, this move exemplifies the practical advantages of establishing partnerships with democratic entities.[48] Furthermore, the ambitions of the IMEC to enhance the logistics of hydrogen energy are congruent with the strategic priorities of both the US and the EU, focusing on transitioning Europe’s energy reliance away from Russian fossil energy sources. Hence, the EU and the US will have substantial interest in financing the capital expenditure associated with the corridor.

From a European lens, the IMEC shines with layered significance. It is not just talk, but Europe’s chance to walk the walk, turning those grand visions and proclamations into tangible reality. This corridor could weave into the EU’s Global Gateway initiative, acting as a powerful ally in hitting its targets of fostering sustainable growth, boosting infrastructure investment, and tightening diplomatic bonds with countries along its path. Moreover, the EU has a hefty treasure chest—around US$300 billion earmarked for the Global Gateway[49]—ready to bankroll the bricks and mortar needed for IMEC-inspired projects.

At the same time, investments must also pour in from Saudi Arabia and the UAE. Saudi Arabia has already committed US$20 billion for the corridor. However, what becomes crucial in this context is to introduce innovative financing instruments as the capex for IMEC may have high gestation periods, and returns might take time to flow. This brings in the roles of Islamic financial products from the Arab economies. This will encourage interest-free loans from the Arab economies, which will help the cause of capital expenditure, and offer their banking and the financial system the necessary stake in the project with a share of the profits.

For both the UAE and Saudi Arabia, India is a major destination for investment due to its massive potential in terms of its demographic dividend, natural capital, green energy, and digital potential. In October 2023, the UAE declared its intention to invest US$75 billion in India over time, while Saudi Arabia put forth a US$100 billion investment objective.[50] The recent financial commitments came from the largest sovereign wealth fund in the UAE, the Abu Dhabi Investment Authority (ADIA), which has allocated about US$5 billion in funds for investments in India. The ADIA has received the green signal for its operation through the tax-neutral GIFT City finance hub in India’s Gujarat.[51]

Table 2: FDI Equity Inflow from UAE and Saudi Arabia into India

| Country | FDI Equity Inflow (in US$ million) | Percentage of total FDI Inflow |

| UAE | 18008 | 2.70 |

| Saudi Arabia | 3224 | 0.48 |

Source: Department for Promotion of Industry and Internal Trade[52]

The tables in the Appendix list the major investors, both private and sovereign, from these two economies.

Conclusion

It is imperative to recognise the synergistic relationship between transport connectivity, which encompasses physical infrastructure and international regulations, and trade facilitation, which involves customs procedures and infrastructure at the border. Although the value of both aspects in augmenting trade is unquestionable, the link between transport and trade facilitation is not always clear in policy dialogues. The IMEC is the template of this synergy.

The IMEC presents significant opportunities and substantial challenges. It can potentially boost commerce between India and Europe and transform the trade dynamics between Asia and Europe, predominantly through the Suez Canal.

Despite its immense potential, the IMEC confronts challenges stemming from the need to maintain collaborative spirits across multiple states with varying ambitions. Unlike the BRI, which is singularly financed and overseen by China, the aspirations of the various IMEC economies with economic and social heterogeneities need to be reconciled for a single goal. Furthermore, the trade route must be designed to align with market conditions to ensure its long-term viability. At the same time, events such as the 7 October attacks in Israel could slow down the ambitious plan.

For India, the IMEC counters the criticism it faced regarding its protectionist policies after its exit from the RCEP. It will enable India and other participating states to exploit complementarities, allow Indian MSMEs to be integrated with the GVC, enhance the consumer and producer surpluses (or benefits), boost the competitiveness of Indian corporations, and promote overall economic well-being. As such, the IMEC sets a new template for global connectivity and trade facilitation, but only time will tell how it unfolds.

Appendix: Major Investments from Saudi Arabia and the UAE in India

Table 1: Major Investors from Saudi Arabia in India

| Investor | Project Outlook |

| Saudi Aramco | Saudi Aramco and Abu Dhabi National Oil Company (ADNOC) have partnered with Indian public oil giants, Indian Oil Corporation (IOC), Bharat Petroleum Corporation (BPCL), and Hindustan Petroleum Corporation (HPCL), to form a joint venture, acquiring a 50% share in Ratnagiri Refinery and Petrochemicals (RRPCL). Additionally, Aramco Asia India is discussing potential business growth with India’s private refineries, like Reliance Industries. |

| SABIC | SABIC has invested over US$100 million in its Bengaluru technology and innovation centre, a major investment by a Saudi company in India. This move aims to boost research capabilities to address rising market needs in India and globally. SABIC currently operates in several Indian cities, including Bengaluru, Mumbai, Delhi-NCR, Chennai, Pune, and Vadodara. |

| Alfanar Energy | Alfanar Energy entered the Indian market in 2016, inaugurating a 50 MW wind project in Gujarat with Suzlon-supplied turbines. It also won a 300 MW bid in the Solar Corporation of India’s (SECI) 2,000 MW wind auction in February 2018, aiming to develop this project in Bhuj, Gujarat. These projects represent a significant investment of nearly US$600 million by Alfanar. Additionally, the company is expanding its presence in India’s solar sector, with projects started in 2018 steadily advancing. |

| Public Investment Fund (PIF) | Saudi Arabia’s Public Investment Fund (PIF) has acquired a 2.04% stake in Reliance Retail, valued at US$1.3 billion, and a 2.32% stake in Reliance Jio, valued at US$1.5 billion, alongside additional investments in various other ventures. |

| Zamil Air Conditioners India Private Limited | Zamil Air Conditioners India Private Limited (ZAC India), a subsidiary of Saudi Arabia’s Zamil Industrial Investment Company, entered the Indian Air Conditioner Industry in 2013. Between March 2019 and December 2020, Zamil invested approximately US$15 million in the manufacture of air conditioners. |

| Saudi Aramco and ADNOC | Saudi Aramco, UAE-based ADNOC, and the state of Maharashtra are collaborating to establish a mega oil refinery worth US$44 billion. |

| Maaden | The Saudi Arabian Mining Company (Maaden) has signed two MoUs with Indian firms IPL Co and KRIBHCO, amounting to US$2 billion. These agreements involve the transfer of five million tonnes of phosphate fertilisers from Saudi Arabia to India. |

| Ministry of Investment, Saudi Arabia | The Ministry of Investment in Saudi Arabia has signed an agreement to produce specialised agricultural chemicals within the Kingdom with the Indian company UPL Limited. The value at stake is US$1 billion. |

Source: Invest India[53]

Table 2: Major Investors from UAE in India

| Investor | Project Outlook |

| DP World | DP World, a global supply chain solutions firm, has a portfolio of 78 operating marine and inland terminals supported by over 50 related businesses in 40 countries across six continents. In India, DP World operates terminals in Kochi, Mundra, and JNPT with investments in ICDs. |

| Sharaf Group | The UAE-based conglomerate is active in shipping and logistics, retail, travel and tourism, IT, industrial, hospitality and real estate, and financial services sectors. It has two subsidiaries operating in the shipping and logistics sector in India: Hind Terminals Private Limited and Samsara Shipping Private Limited |

| Lulu Group | It is one of the largest retail companies in the UAE. The company’s presence in India includes the Lulu International Convention Centre and Hotel in Thrissur, Kerala, and a Hypermarket in Kochi. |

| Emaar Properties | Emaar is one of the largest real estate developers in West Asia. In India, it has created a portfolio of properties in Gurugram, Delhi, Mohali, Lucknow, Jaipur, Indore, and Chennai. The company has developed over 11,500 residential and commercial units, with 8,500 units currently under development. |

Source: Invest India[54]

Endnotes

[a] The targeted goods also included those with Israeli commercial inputs.

[1] S Ronendra Singh, “”This is a real big deal,” says Joe Biden, announcing India-Middle East-Europe economic corridor”, Business Line, September 9, 2023, https://www.thehindubusinessline.com/news/this-is-a-real-big-deal-says-joe-biden-announcing-india-middle-east-europe-economic-corridor/article67289032.ece

[2] “Red Sea shipping disruption hits 5-month mark: Adverse impact of trade will be visible in the new fiscal”, Global Trade Research Initiative, March 2024, pp. 3, https://gtri.co.in/gtriFlagshipReportsd.asp?ID=37

[3] Susan Stigant, “Houthi attacks in the Red Sea disupt global supply chains”, United States Institute of Peace, December 22, 2023, https://www.usip.org/publications/2023/12/houthi-attacks-red-sea-disrupt-global-supply-chains

[4] Kenji Asada and Kaori Yoshida, “Red Sea attacks threaten to cut global shipping capacity 20%”, Nikkei Asia, December 23, 2023, https://asia.nikkei.com/Spotlight/Supply-Chain/Red-Sea-attacks-threaten-to-cut-global-shipping-capacity-20#:~:text=NEW%20YORK%20%2D%2D%20The%20series,that%20could%20reignite%20inflationary%20pressures.

[5] Sushma Ramachandran, “India – EU FTA is a win-win for both economies”, Deccan Herald, December 14, 2023, https://www.deccanherald.com/opinion/india-eu-fta-is-a-win-win-for-both-economies-2810694

[6] Ibid.

[7] Michael Tanchum, “India’s Arab-Mediterranean Corridor: A Paradigm Shift in Strategic Connectivity to Europe”, National University of Singapore, South Asia Scan, August 2021, pp 4 https://www.isas.nus.edu.sg/papers/indias-arab-mediterranean-corridor-a-paradigm-shift-in-strategic-connectivity-to-europe/

[8] Maroof Raza, “IMEC vs BRI: What’s the future?”, The Financial Express, October 1, 2023, https://www.financialexpress.com/business/defence-the-imec-versus-the-bri-whats-the-future-3259961/

[9] Adam Tooze, “Hydrogen is the future – or a complete mirage”, Foreign Policy, July 14, 2023, https://foreignpolicy.com/2023/07/14/hydrogen-is-the-future-or-a-complete-mirage/

[10] Tom Evans, “Etihad Rail: What’s next for mega project after first passenger journey?”, The National, January 26, 2024, https://www.thenationalnews.com/uae/transport/2024/01/26/etihad-rail-map-route-explained/

[11] “Looming risks may derail Gulf Railways project”, Economist Intelligence Unit, September 21, 2023, https://www.eiu.com/n/looming-risks-may-derail-gulf-railway-project/

[12] WikiMaps – https://en.wikipedia.org/wiki/List_of_railway_stations_in_Saudi_Arabia#/media/File:Rail_transport_map_of_Saudi_Arabia.png

[13] Syed Sadain Gardazi, “Oman and Etihad Rail signs $3 billion agreement for UAE – Oman network”, Forbes, February 21, 2023, https://www.forbesmiddleeast.com/industry/transport/oman-and-etihad-rail-signs-%243b-agreement-with-mubadala-for-uae-oman-network

[14] David Ottaway, “Saudi Arabia and the United Arab Emirates turn rival allies”, Wilson Centre, July 20, 2021, https://www.wilsoncenter.org/article/saudi-arabia-and-united-arab-emirates-turn-rival-allies

[15] “Saudi customs tariff rules target UAE free zones”, Economist Intelligence Unit, July 7, 2021, https://www.eiu.com/n/saudi-customs-tariff-rules-target-uae-free-zones/

[16] Wayne Nielsen, “Submarine Cable Almanac,” November 2023, https://subtelforum.com/almanac/.

[17] Joe Brock, “U.S. and China Wage War beneath the Waves – over Internet Cables,” Reuters, March 24, 2023, https://www.reuters.com/investigates/special-report/us-china-tech-cables/.

[18] “About Us,” PEACE Cable International Network CO, http://www.peacecable.net.

[19] “Memorandum of Understanding on the Principles of an India – Middle East – Europe Economic Corridor,” Ministry of External Affairs Government of India, September 9, 2023, https://www.mea.gov.in/Images/CPV/Project-Gateway-Multilateral-MOU.pdf.

[20] Joe Brock, “U.S. and China wage war beneath the waves – over internet cables,” Reuters, March 24, 2023, https://www.reuters.com/investigates/special-report/us-china-tech-cables/.

[21] ET Bureau, “India’s 5G rollout cost to be highest among 15 emerging nations: study”, The Economic Times, November 26, 2022, https://economictimes.indiatimes.com/industry/telecom/telecom-news/indias-5g-rollout-cost-to-be-highest-among-15-emerging-nations-study/articleshow/95773987.cms.

[22] Bevin Fletcher, “Huawei still dominates telecom equipment market”, Fierce Wireless, December 16, 2021, https://www.fiercewireless.com/wireless/huawei-still-dominates-telecom-equipment-market.

[23] Anna Gross and Madhumita Murgia, “China and Huawei propose reinvention of the internet,” The Financial Times, March 28, 2020, https://www.ft.com/content/c78be2cf-a1a1-40b1-8ab7-904d7095e0f2.

[24] Wesley Cole, A. Will Frazier, and Chad Augustine, “Cost Projections for Utility-Scale

Battery Storage: 2021 Update,” National Renewable Energy Laboratory, June 2021, https://www.nrel.gov/docs/fy21osti/79236.pdf

[25] Neha Khanna, Dhruba Purkayastha, and Shreyans Jain, “Landscape of Green Finance in India 2022,” Climate Policy Initiative, August 2022, https://www.climatepolicyinitiative.org/publication/landscape-of-green-finance-in-india-2022/

[26] Shipla Samant, “India, UAE hold talks to link grids through sub-sea cables”, The Economic Times, June 16, 2023, https://economictimes.indiatimes.com/news/india/india-uae-hold-talks-to-link-grids-through-subsea-cables/articleshow/101027556.cms?from=mdr

[27] “Electricity and Carbon Tracker”, Centre for Social and Economic Progress, January 2023, https://carbontracker.in/

[28] “Global Photovoltaic Power Potential by Country”, Centre for Social and Economic Progress, 2023, https://globalsolaratlas.info/global-pv-potential-study

[29] Soroush Basirat, “Hydrogen unleashed: Opportunities and challenges in the evolving H2-DRI-EAF pathway beyond 2024,” Institute for Energy Economics and Financial Analysis, February 2024, https://ieefa.org/resources/hydrogen-unleashed-opportunities-and-challenges-evolving-h2-dri-eaf-pathway-beyond2024#:~:text=The%20hydrogen%20development%20sector%20is%20also%20grappling%20with,to%20decline%20to%20USD2.5%2Fkg%20to%20USD4.0%2Fkg%20towards%202030.

[30] Mohammad Shahnawaz, “Strategic crossroads: Exploring the geopolitical dimensions of the India-Middle East-Europe Economic Corridor, The Financial Express, September 14, 2023, https://www.financialexpress.com/business/defence-strategic-crossroads-exploring-the-geopolitical-dimensions-of-the-india-middle-east-europe-economic-corridor-3243568/

[31] Anshu Siripurapu and Noah Berman, “The contentious US – China trade relationship”, Council on Foreign Relations, September 2023, https://www.cfr.org/backgrounder/contentious-us-china-trade-relationship

[32] Stela Rubinova and Mehdi Sebti, “The WTO trade cost index and and its determinants”, World Trade Organisation, January 2021, https://www.wto.org/english/res_e/reser_e/ersd202106_e.htm#:~:text=We%20show%20that%20transport%20and,accounting%20for%20at%20least%2014%25

[33] Anthea Mulakala, “India’s Approach to Development Cooperation”, The Palgrave Handbook of Development Cooperation for Achieving the 2030 Agenda, 2019, Palgrave Macmillan, pp. 10

[34] Soumya Bhowmick, “Forgotten promises: The China-Pakistan Economic Corridor”, Observer Research Foundation, June 15, 2023, https://www.orfme.org/dev/expert-speak/forgotten-promises-the-china-pakistan-economic-corridor

[35] Samir Saran and Gautam Chikermane, “Globalisation gone rogue: Is IMEEC the way forward?”, Observer Research Foundation, September 11, 2023, https://www.eurasiareview.com/11092023-globalization-gone-rogue-is-imeec-the-way-forward-oped/

[36] “Integrated approaches to trade and transport facilities: Measuring readiness for sustainable, inclusive, and resilient trade”, Asian Development Bank, December 2022, https://www.adb.org/sites/default/files/publication/850146/integrated-approach-trade-transport-facilitation.pdf?utm_source=blog-hyperlink&utm_medium=referral&utm_campaign=blog-rci&utm_id=blog-trade-resilience

[37] Ram Singh, “A Corridor of Immense Promise”, BusinessLine, September 11, 2023, www.thehindubusinessline.com/opinion/a-corridor-of-immense-promise/article67296263.ece.

[38] Bhaskar Chakravorti and Gaurav Dalmia, “Is India the world’s next great economic power?”, Harvard Business Review, September 6, 2023, https://hbr.org/2023/09/is-india-the-worlds-next-great-economic-power

[39] “India and EFTA sign trade and economic partnership agreement”, EFTA, March 10, 2024, https://www.efta.int/Free-Trade/news/EFTA-and-India-sign-Trade-and-Economic-Partnership-Agreement-540631

[40] Koushan Das, “Integrating with global value chains: Sector opportunities and challenges in India”, India Briefing, February 6, 2023, https://www.india-briefing.com/news/how-india-can-integrate-with-global-value-chains-sector-opportunities-foreign-investment-27130.html/

[41] Das, “Integrating with global value chains”

[42] Das, “Integrating with global value chains”

[43] Nilanjan Ghosh. “Regional Comprehensive Economic Partnership: Issues and Concerns for India”, in Raychaudhury, A., P De, and S Gupta (eds.) World Trade and India: Multilateralism, Progress and Policy Response. New Delhi: Sage Publishers. 2020, pp. 81-102, https://www.researchgate.net/publication/344951357_Regional_Comprehensive_Economic_Partnership_Issues_and_Concerns_for_India

[44] Saon Ray and Smita Miglani, “India’s GVC integration: An analysis of upgrading efforts and facilitation of lead firms”, ICRIER, February 2020, https://icrier.org/pdf/Working_Paper_386.pdf

[45] “Hope India – GCC Free Trade Agreement becomes a reality very soon: Official”, Press Trust of India, July 12, 2023, https://www.ndtvprofit.com/economy-finance/hope-india-gcc-free-trade-agreement-becomes-a-reality-very-soon-official#:~:text=The%20Arab%20region%20is%20the,(Rs%2015.14%20lakh%20crore).

[46] Saba Ismail and Shahid Ahmed. “Economic Effects of Tariff Liberalization of Prospective India-GCC FTA: A Computable General Equilibrium Analysis,” Foreign Trade Review, vol. 54(3), August.2019, pp. 224-252, https://journals.sagepub.com/doi/10.1177/0015732519854934

[47] Squire Patton Boggs, “The India-Middle East-Europe Economic Corridor (IMEC): What We Know and What Comes Next,” Lexology, September 21, 2023, https://www.lexology.com/library/detail.aspx?g=7d3eb6d2-94fa-4f4d-be2a-37b01ea03cb4#:~:text=The%20IMEC%20announcement%20builds%20on,partnering%20with%20democracies.%E2%80%9D%20IMEC’s%20objective

[48] Jean-Loup Samaan, “The India-Middle East Corridor: a Biden Road Initiative?,” The Atlantic Council, October 6, 2023, https://www.atlanticcouncil.org/blogs/the-india-middle-east-corridor-a-biden-road-initiative/

[49] Chloe Teevan and San Bilal, “The Global Gateway at Two: Implementing EU strategic ambitions,” ECDPM Briefing Note No. 173, November 2023, https://ecdpm.org/application/files/3317/0106/6016/Global-Gateway-At-Two-Implementing-EU-Strategic-Ambitions-ECDPM-Briefing-Note-173-2023.pdf

[50] Archana Rao, “Outlook for Sovereign Wealth Fund Investments in India,” India Briefing, March 4, 2024. https://www.india-briefing.com/news/sovereign-wealth-fund-investments-india-outlook-2024-31398.html/

[51] “UAE wealth fund plans $4-5 billion in investments via India’s new finance hub: Sources,” The Economic Times, February 7, 2024, https://economictimes.indiatimes.com/industry/banking/finance/uae-wealth-fund-plans-4-5-billion-in-investments-via-indias-new-finance-hub-sources/articleshow/107487482.cms?from=mdr.

[52] Department for Promotion of Industry and Internal Trade, Government of India, “Quarterly Fact Sheet: Fact Sheet on Foreign Direct Investment (FDI) Inflow From April, 2000 To December, 2023,” https://dpiit.gov.in/sites/default/files/Fact%20Sheet%20December%202023_1.pdf

[53] “Saudi Arabia”, Invest India, https://www.investindia.gov.in/country/saudi-arabia

[54] “United Arab Emirates”, Invest India, https://www.investindia.gov.in/country/united-arab-emirates