If public statements are any indication of future policy direction, US Energy Secretary Chris Wright’s recent call to promote uranium production and ignite a “nuclear energy renaissance”—particularly in the wake of rising AI adoption—offers a strong signal of where the region’s and its international partnerships energy focus may be headed. Energy cooperation was a clear focus for Secretary Wright’s recent visit to the United Arab Emirates, Saudi Arabia, and Qatar in April, and will remain a key priority for President Trump’s upcoming trip to the region in May 2025.

Over the past few years, artificial intelligence (AI) products and services have evolved from being marketing buzzwords to becoming crucial strategic agenda items for all major economies of the world. In 2025, AI development is no longer limited to the global tech sector and has come to occupy a central position in geopolitical and security discussions, across industries and governments alike. A defining factor for success or failure in scaling AI for any economy is the ability to leverage energy infrastructure to meet the demands of data centres necessary for training and deploying AI.

According to a report by the International Energy Agency, global electricity consumption by data centres amounted to about 1.5 percent (415 TWh) of the total global electricity consumption in 2024. The report states that electricity consumption by data centres has increased 12 percent per year over the last five years and may increase up to 945-1260 TWh by 2030 amidst the race to develop increasingly powerful AIs. Another report suggests an increase of 160-165 percent in data centre energy demand by 2030 from 2023 levels.

Rethinking the Energy Mix

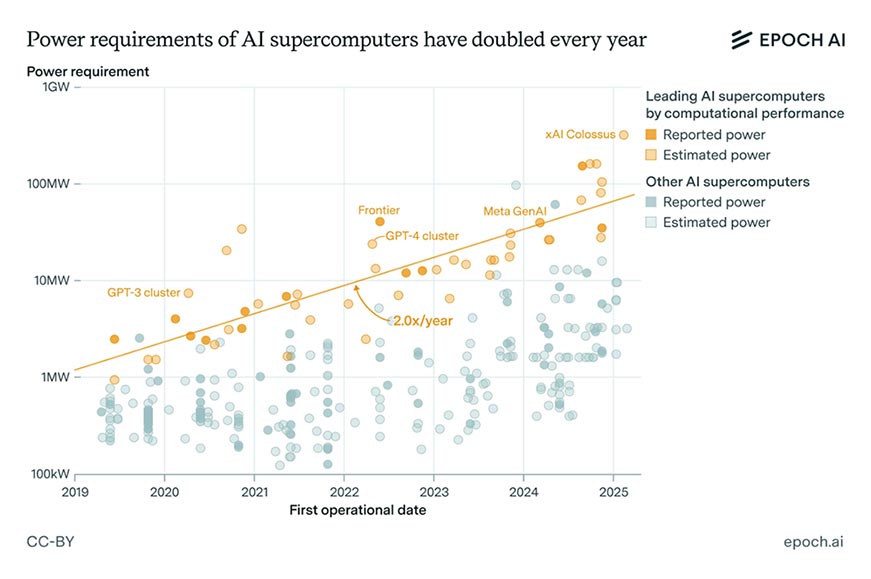

Data centres are energy guzzlers. Historically, marginal advancements in AI development and application significantly lowered the computational costs, kicking in efficiency gains which balanced the energy demand. However, due to the AI hype of recent years causing a surge in the demand for increasingly powerful AI foundational models along with AI development acquiring geopolitical and strategic importance, efficiency gains are likely to further compound the demand for AI products and services. On the supply side, Anthropic CEO Dario Amodei argues that even with innovations in algorithmic distillation and model architectures, “gains in cost efficiency end up entirely devoted to training smarter models.” The demand and development for increasingly smarter AI and data centres are putting immense pressure on the current electricity system.

Source: Epoch AI

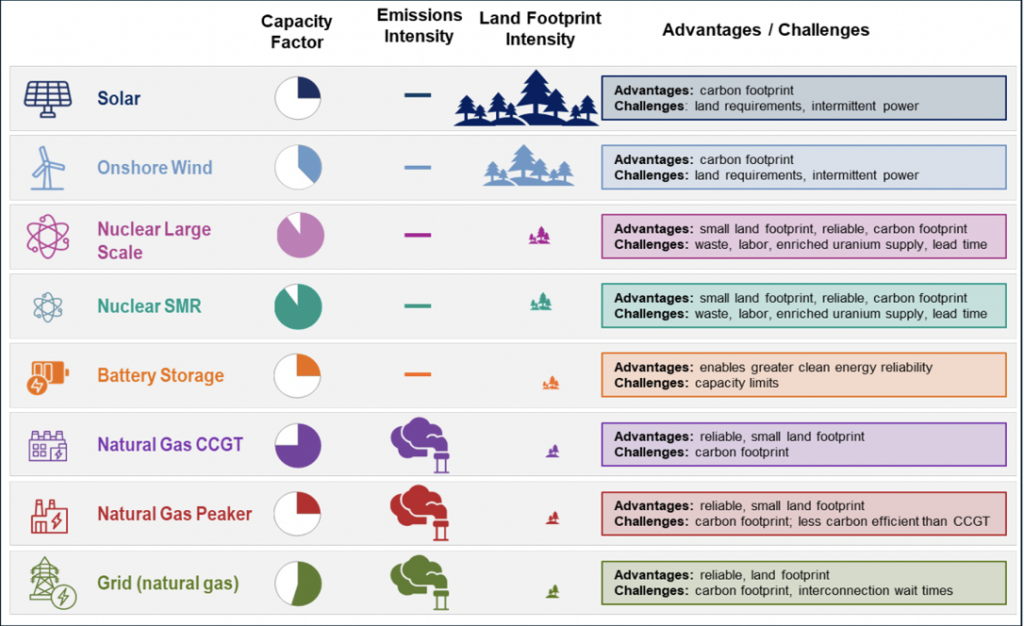

Maintaining the rising energy demand from data centres calls for a diversified, reliable and sustainable energy mix. Almost half of the global growth in data centre energy demand is met by renewables, along with storage and the electricity grid. Despite the growing economic competitiveness of renewable production to meet data centre demand, renewables are limited by their intermittent nature, land density, high infrastructure costs and grid over-dependence. While renewables as well as natural gas will come to serve a crucial role in the short to medium term, a growing recognition and political momentum is steering towards geothermal and nuclear technologies as the long-term, low-carbon and reliable source for high-density, always-on energy demand by data centres.

Graph: Relative Trade-offs of technologies which can provide capacity for new data centre-driven power demand

Source: Goldman Sachs Global Investment Research

A Nuclear Renaissance

The AI-nuclear nexus demands our immediate attention. Nuclear energy and small modular nuclear reactors (SMR), particularly for on-site power generation, are being explored as viable resources to meet the strategic imperative of feeding gluttonous data centres.

Though traditional nuclear power plants may be constrained by high cost, political complexity and longer lead time, SMRs are getting increasingly popularised as the compact alternative owing to faster deployment, smaller land footprints, and on-site generation potential for data centres. Their proximity to data centres can save energy providers and operators substantial costs by eliminating the need for transmission infrastructure, particularly when electricity grids are already under significant strain. The IEA report notes that 20 percent of the planned data centre projects could be delayed due to grid constraints—new transmission lines take up to four to eight years to build in advanced economies alone. At the same time, the wait times for critical grid components have also doubled in the past three years. SMRs can help circumvent such delays, ease the grid burden, and reduce reliance on fossil fuels, without compromising other national priorities such as rapid electrification and energy security.

The Investment Landscape and Early Movers

Recently, the World Nuclear Association announced that Google, Meta and Amazon—among other energy companies—have signed a pledge to triple global nuclear capacity by 2050 to meet energy demand for AI development. Furthermore, partnerships are emerging between tech firms and nuclear energy providers, for instance, between Microsoft and Constellation, Google and Kairos Power and Amazon with Dominion Energy.

Regarding public sector investments, major economies across the West and the Global South are moving to tap nuclear energy to realise their AI ambitions. During the 2025 Paris AI Action Summit (PAIAS), France signed an MoU with UK-based Fluidstack and committed 10 billion EUR for an AI supercomputer facility that will leverage France’s nuclear energy infrastructure. The PAIAS also catalysed the development of tech alliances between regions, such as with a framework accord between France and the UAE for building an AI-specific 1 GW data centre that will see an investment of 30-50 billion USD. The agreement represented yet another major investment by the UAE, which has been an early adopter and investor in AI technologies.

In the UAE, interest in AI is also spurring investment and R&D in SMRs and micro-reactors from enterprises like Emirates Nuclear Energy Co. (ENEC), which is planning investments in the US and the UK to meet the growing data centre demand.

Sovereign Wealth Funds in the region are also actively foraging into AI and digital infrastructure. Saudi Arabia’s Public Investment Fund, in partnership with Google, will launch a 100 billion US$ AI hub, and the Kingdom has also attracted investment from Amazon Web Services for US$5.3 billion to build data centres. Abu Dhabi’s G42, an AI holding company, has received the commitment of up to US$ 1.5 billion from Microsoft. Meanwhile, Qatar’s National AI Strategy is prioritising investments in AI-powered cloud infrastructure.

The Gulf region’s stable and abundant electricity supply, supportive regulatory environments, proactive government policies, land availability and commitment towards cleaner energy sources make it a favourable destination for data centre development. Nuclear energy, particularly SMRs, can help accelerate the region’s shift towards clean energy, with the UAE and Saudi Arabia leading the pack. Other countries in the MENA region, including Morocco, Bahrain, Qatar, and Egypt, are also exploring SMR development to join this emerging shift.

India, too, is emerging as a strong player in the global AI value chain with an ambitious plan of developing a domestic supply chain that integrates semiconductor fabs, data centres, foundation AI models, along with a nuclear energy supply of 100 GW by 2047 to fuel the AI stack. Across the Global North and South, the drive for winning the AI race is having the downstream effect of rekindling interest in nuclear energy.

The experiences of early movers will be key in shaping policy frameworks and defining the contours of the emerging AI-Nuclear synergy.

Policy Recommendations

- AI-Nuclear Integration Hubs

Gulf countries like the UAE are positioning themselves as major players in the AI race while also making strides in nuclear energy generation with the Barakah Nuclear Energy Plant now set to cover a quarter of the country’s energy requirements. To strengthen the UAE’s position in the AI race, regulators should include the projected energy demands of the AI sector in the future iterations of the UAE Energy Strategy 2050. For the larger Gulf region, direct power purchase agreements (PPAs) between data centres and nuclear power plants should be considered to strengthen the region’s commitment towards clean energy. Furthermore, to prevent data centers from adding pressure to local grids—a pressing concern for the AI leaders like the US—regulators should incentivise data centres to be set up in special economic zones or integration hubs which lie at the intersection of city peripheries and energy infrastructure particularly where co-location of power plants (nuclear or otherwise) and AI data centres is feasible until SMRs reach scale.

- International Cooperation

International cooperation is crucial to scaling nuclear expansion, minimising costs and ensuring its long-term competitiveness. Much like the current global scramble we see for critical minerals, uranium—a key ingredient for nuclear energy—is increasingly concentrated.

Three key processes are required to supply nuclear feedstock: Uranium production, Uranium Conversion and Uranium Enrichment. These processes are rarely co-located, necessitating cross-border transportation and coordination. Currently, Europe and the Americas account for 30 percent of uranium production, 56 percent of uranium conversion capacity, and 41% of uranium enrichment capacity. In contrast, China, Russia and Kazakhstan, collectively control around 46 percent of the uranium supply, 44 percent of the uranium conversion capacity and 59 percent of the uranium enrichment capacity. To strengthen the future nuclear energy supply chain, international cooperation is paramount—streamlining regulatory, governance and licensing frameworks; fostering capacity building and knowledge-sharing; and setting up nuclear institutions ensuring harmonised deployment and governance of nuclear technologies, and promoting security, accountability, and resilience as the cornerstone of the nuclear energy system.

Although 50 percent of the world’s internet users are in emerging and developing economies besides China, they hold less than 10 percent of global data centre capacity. The future is becoming increasingly AI-driven, and the countries that house data centres will gain disproportionate geopolitical and economic influence. Energy and digital futures are increasingly converging, and emerging economies must strengthen investments and international cooperation to harness the AI-Nuclear nexus and secure their place in the evolving global order.

Mannat Jaspal is the Director and Fellow of Climate and Energy, Observer Research Foundation Middle East.

Siddharth Yadav is a Fellow in Technology, Observer Research Foundation Middle East.