Libya’s headline growth hides a zombie economy—propped up by oil, crippled by fake currency, and stalled by deep political fractures

Over a year has passed since Libya’s acute institutional rupture of August 2024, when the struggle for control of the Central Bank of Libya (CBL) nearly severed the nation’s financial lifeline. The subsequent appointment of Naji Mohamed Issa Belqasem as Governor was hailed as a technocratic triumph, but is it a diplomatic containment strategy designed to freeze the conflict or resolve it?

The most serious issue remains the large-scale circulation of counterfeit currency that threatens the Dinar.

As of November 2025, the macroeconomic data suggest a resounding recovery. The International Monetary Fund (IMF) projects real Gross Domestic Product (GDP) growth at a staggering 15.6 percent, and oil production has stabilised to approximately 1.3 million barrels per day (bpd). Yet, the subtext reveals a far more fragile reality. While Libya’s spreadsheets show a boom, its streets tell a different story. This growth is entirely rent seeking. The non-oil economy remains dormant, with hydrocarbons driving 90 percent of government fiscal revenue. Furthermore, the lack of liquidity has led to long queues outside banks, and the central bank has printed US$11 billion in currency to address the cash shortages. However, the most serious issue remains the large-scale circulation of counterfeit currency that threatens the Dinar.

The 2024 Central Bank Crisis

To understand the current situation, one must recall the mechanics of the 2024 crisis. This crisis saw a tussle between two rival factions: the internationally recognised government in the West, led by Prime Minister (PM) Abdul Hamid Dbeibeh, which controls the spending ministries and the rival administration in the East, backed by General Haftar, which controls the revenue-generating oil fields. The Central Bank of Libya (CBL), then governed by Sadiq al-Kabir, sat in the middle. The conflict began as PM Dbeibah wanted to increase spending, but Al-Kabir refused, accusing the government of corruption. In August 2024, the western government unilaterally fired al-Kabir and installed a new governor. The East saw this takeover of the bank as a theft of the national treasury by their rivals and used their physical control over the ground to shut down the oil fields. The crisis froze the Libyan economy. The clearing system was halted, impacting payments and the country was cut off from the global financial system. Finally, in September 2025, the two rival factions compromised and agreed to appoint Naji Mohamed Issa Belqasem—a technocrat— as the new Governor.

The mandate for Governor Issa was clear: unify the board, stabilise the Dinar and ensure equitable revenue distribution. However, a year later, the results illustrate the severe limitations of placing a technocrat in charge of a politicised rentier economy.

The 2025 Report Card

It is important to assess the performance of the Libyan economy and the CBL under the new governor, which offers a qualitative report card on the viability of this technocratic peace.

Unsteady Management of the Monetary Policy

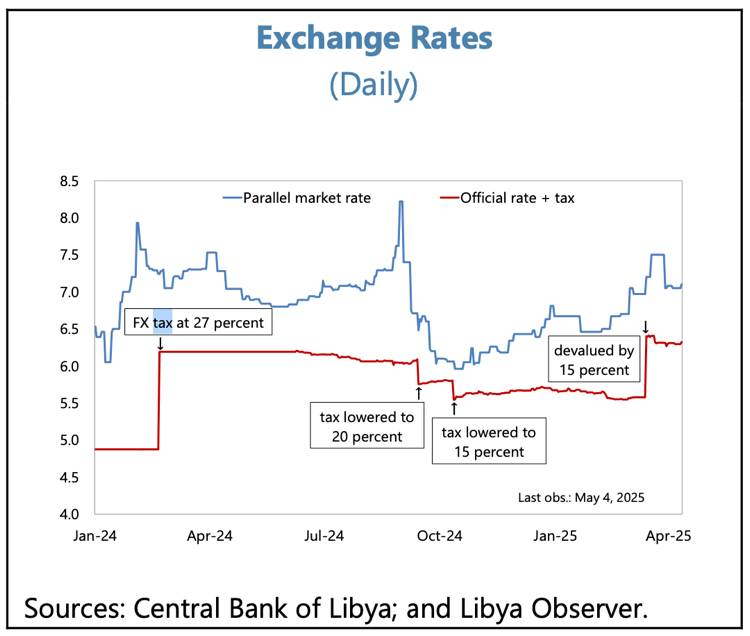

Governor Issa inherited a wide gap between the official exchange rate and the parallel market, as evidenced by Table 1. To counter this, his primary policy tool has been the Foreign Exchange Tax, a surcharge on the purchase of foreign currency (US$) that acts as a ‘soft devaluation’, effectively making dollars more expensive to buy officially to curb demand. While this tax was reduced from 27 percent in November 2024, it continues to remain high at 15 percent. This policy was intended to limit the pressure on foreign exchange reserves in the short term, but it has created economic distortions and has forced reliance on the parallel market. Furthermore, this policy is perilous for a country that relies on imports for about 90 percent of its cereal consumption, making it hyper-sensitive to FX pricing. The policy has also faced legal challenges, creating further uncertainty. More worryingly, the parallel rate remains stubbornly high, reflecting a fundamental lack of trust in the CBL’s ability to defend the peg.

Table 1: Exchange Rate in Libya

Critical Failure of Banking Sector Integrity

This is the most alarming development of late 2025. The CBL has faced significant challenges in managing the repercussions of the counterfeit notes crisis, which is widely believed to have been orchestrated in Russia for the benefit of the Eastern administration. While CBL withdrew these notes in 2025, the bank has officially acknowledged that this withdrawal “doubled the challenges and increased pressure on the Central Bank of Libya and the banking sector”. These notes represent a shadow money supply. This shadow currency drives the demand for hard currency in the black market, undermining every monetary policy tool Governor Issa attempts to deploy. The CBL cannot control inflation or the exchange rate when a rival authority can unilaterally expand the money supply.

The Chronic Liquidity Crisis

Despite the economy’s statistical recovery, ordinary Libyans face a difficult daily reality: the inability to access their own salaries. The liquidity crisis has persisted with a vengeance. Banks have limited withdrawals, forcing citizens to buy cash from brokers at a premium. The issue stems from a rational lack of trust, as wealthy depositors are hoarding cash outside the banking system due to fears about their ability to withdraw it later. While Governor Issa’s push for electronic payments has improved transparency, it faces immense cultural and infrastructural resistance. The system remains blocked.

The CBL cannot control inflation or the exchange rate when a rival authority can unilaterally expand the money supply.

Need to Decouple Fiscal and Monetary Functions

The central lesson of the post-2024 period is that a central bank cannot function as a substitute for a functional finance ministry. Naji Issa has performed well as a cashier, ensuring that state salaries are paid through the Instant Salary system and letters of credit are issued. However, he has fared questionably as a governor because he lacks the political cover to enforce structural discipline. The “East-West” divide has not yet been bridged. There have not been significant policies to prevent the East from printing new shadow currency and threatening oil blockades to secure off-budget funding or to prevent the West from using state contracts to buy loyalty.

Furthermore, while atypical for Central Bankers, Governors in Libya have also been tasked to distribute revenues across governments due to a lack of a unified budget, thereby managing the country’s fiscal policy. Without Central Bank independence, monetary instruments can be used for artificially inflating fiscal gains. The fiscal improvements can become an accounting trick: devaluing the currency and taxing FX sales, the CBL has simply printed more Dinars for every Dollar earned, effectively taxing the population’s purchasing power to balance the state’s books.

The projected 15.6 percent GDP growth is not a sign of health; it is the fever chart of an economy running hot on borrowed time and printed money.

As a result, the Libyan economy in November 2025 is a Zombie Rentier. It is animated solely by the flow of petrodollars, but its internal organs, in the form of the banking system, the foreign exchange mechanism, and the fiscal contract, are lifeless. The projected 15.6 percent GDP growth is not a sign of health; it is the fever chart of an economy running hot on borrowed time and printed money.

Samriddhi Vij is an Associate Fellow at the Observer Research Foundation – Middle East.