Emerging technologies, private capital, and startups are reshaping US defence planning, as AI, autonomy, and software redefine modern military power

Emerging technologies are now at the heart of modern geopolitics and defence planning. The race for dominance is most evident between the United States (US) and China, with both regarding Artificial Intelligence (AI) and autonomy as elements in future conflicts. While the US Air Force Secretary Frank Kendall has described it as a technology-driven arms race, a 2024 Department of Defence (DOD) report to Congress and a Congressional Research Service study on emerging military technologies note that China has already made significant gains in AI and autonomous systems. This has sharpened the urgency for the US to maintain an edge.

This growth is less about a sudden surge and more about how private innovation is aligning with state priorities, fueling the broader US-China technology rivalry.

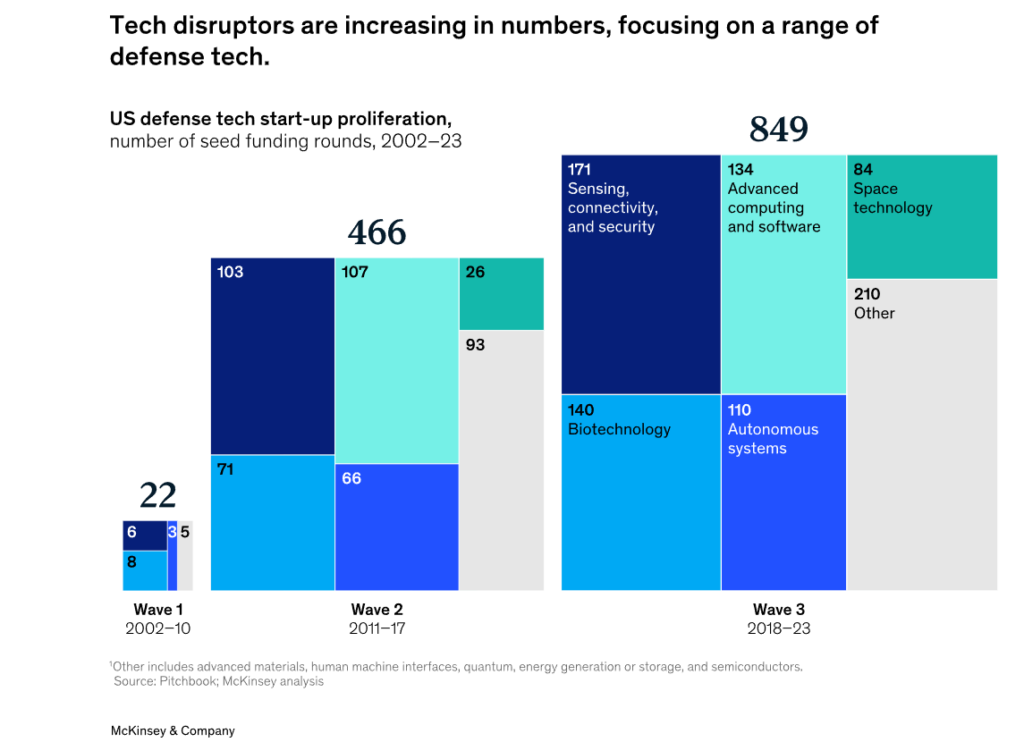

The private sector is also deeply involved in this competition. While the private sector’s engagement in defence is not new, the scale and focus have shifted. For example, in the US, the number of startups working on autonomous systems alone has grown to 110, start-ups working on space technology to 84, and start-ups in Advanced computing and software to 134 in 2023. This growth is less about a sudden surge and more about how private innovation is aligning with state priorities, fueling the broader US-China technology rivalry.

Figure 1: Defence Tech Start-up Proliferation

Source: McKinsey & Company

Understanding the New Defence Tech Landscape

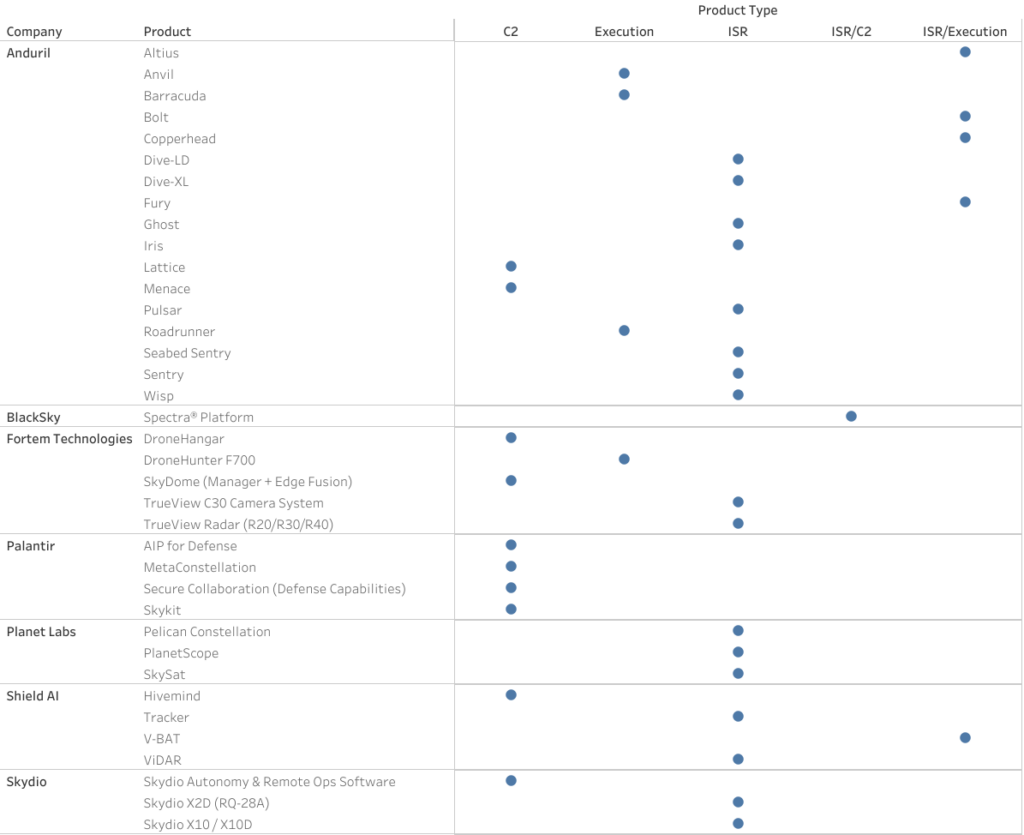

Figure 2 below compiles a catalogue of products developed by some of the leading US-based defence tech companies. These products are categorised by their primary functions, such as command and control, communications, or execution. Products with multiple roles are also highlighted to reflect their cross-functional capabilities.

Figure 2: Catalogue of Products by New Defence Tech Companies and their Categorisation

Source. Author’s compilation

Three focus areas emerge for the weapon systems from the above figure:

- Dominance of Intelligence, Surveillance, and Reconnaissance (ISR) and Multi-Function Platforms: Emphasis on persistent sensing, surveillance, and intelligence with overlapping roles in command or execution. Prominent firms include Anduril, BlackSky, Planet Labs, and Hawkeye 360.

- Rise of Software-Defined Command and Control: Emergence of cloud native, Scalable, AI-enabled command platforms that shorten decision cycles. Major firms in this domain include Palantir, Anduril’s Lattice, and Shield AI Hivemind

- Tactical Edge AI and Autonomy Focus: Frontline autonomous systems and AI at the tactical edge. Prominent firms include Shield AI, Skydio, Anduril, and Dedrone.

These patterns also highlight how defence innovation is converging on a new design logic rather than isolated products.

Towards this, companies are prioritising three interconnected principles:

Modularity: These systems are designed to ensure individual parts can be upgraded or replaced without redesigning the entire platform. This approach, which the Pentagon refers to as the Modular Open Systems Approach (MOSA), facilitates easier technology upgradation, reduces costs over the life of a programme, and brings in multiple suppliers to compete on different parts of the system.

Scalability: Platforms can scale from small-unit missions to theatre-level deployments, allowing militaries to expand capacity without redesigning core systems.

Network Centricity: Every product is built to plug into wider digital networks, enabling seamless data sharing and coordinated operations across services and allies.

Furthermore, the products are designed not only for military missions but also for dual-use commercial use-cases and humanitarian assistance and disaster relief (HADR) operations. This reflects a broader trend where commercial-grade innovation and cost-effective modularity are increasingly displacing traditional, purpose-built defence hardware, enabling faster adaptation and broader operational relevance across sectors.

Institutional Shift in Defence Tech Philosophy

Initiatives such as the Defence Innovation Unit (DIU) and AFWERX exemplify the US DOD’s pivot toward rapid prototyping, dual-use innovation, and direct collaboration with startups. According to their official website, DIU exists to “rapidly prototype and field dual-use capabilities that solve operational challenges at speed and scale,” enabling commercial technology to move into military use on short timelines. The Replicator Initiative under DIU aims to deploy thousands of autonomous systems within 18 to 24 months—a pace that challenges traditional DOD timelines.

Embedded within the Air Force Research Laboratory, AFWERX combines its Ventures, Spark, Prime, and SpaceWERX divisions into a single innovation pipeline that connects emerging companies to Air Force and Space Force missions. These elements reduce the procurement timeline to as little as 12 weeks and drive over 10,400 contracts totalling over US$7.24 billion since 2019. Concepts of Mosaic Warfare and Joint All-Domain Command and Control (JADC2) are reshaping force structure. Mosaic Warfare envisions combat systems as disaggregated, interoperable tiles rather than centralised platforms, enabling resilience and adaptability. JADC2 envisions integration of military capability across domains into a real-time, AI-powered decision network.

JADC2 integrates land, air, sea, space, and cyber domains into a unified network, utilising AI and real-time data to provide commanders with a comprehensive view of the battlefield and facilitate faster, more accurate decision-making.

Concepts of Mosaic Warfare and JADC2 are reshaping force structure. The term “mosaic” reflects how smaller force structure elements can be rearranged into many different configurations or force presentations, and Mosaic Warfare envisions combat systems as disaggregated, interoperable tiles rather than centralised platforms, enabling resilience and adaptability. JADC2 integrates land, air, sea, space, and cyber domains into a unified network, utilising AI and real-time data to provide commanders with a comprehensive view of the battlefield and facilitate faster, more accurate decision-making.

A notable development is the creation of the Executive Innovation Corps, a new US Army Reserve unit launched to embed senior technology leaders part-time and remotely into defence modernisation efforts. Commissioned on 13 June 2025, the unit’s initial members include Shyam Sankar (CTO of Palantir), Andrew “Boz” Bosworth (CTO of Meta), Kevin Weil (Chief Product Officer at OpenAI), and Bob McGrew (former OpenAI Chief Research Officer). Bringing experienced leaders from major technology firms directly into military modernisation gives the Army access to cutting-edge expertise and commercial best practices without requiring full-time service. This helps bridge the gap between rapidly evolving civilian technology and slower defence acquisition cycles, accelerating the adoption of AI, data, and software-driven capabilities in military operations.

Venture Capital Engagements and Lobbying

The venture capital community is increasingly aware of the rise of defence technology, which is why many firms are focusing on recruiting experts from the field to strengthen their credibility and access. These firms are embedding themselves within the Pentagon and congressional network. Venture Capitalists hire veterans and ex-DOD officials not only for insight into battlefield challenges but also for their access and credibility in competitive acquisition processes. Shield Capital has recruited several high-profile former defence officials to strengthen its ties to national security. Its National Security Advisors Board is filled with former national security officials. Shield Capital also hosts national security hackathons in collaboration with DIU, SOCOM, and the Chief Digital and Artificial Intelligence Office, positioning itself at the intersection of policy and innovation.

The integration of intelligence, speed, and adaptability into defence platforms is no longer a future ambition but is becoming an active reality.

Other major VC firms, such as Founders Fund and Andreessen Horowitz, have also similarly drawn talent from within the military and defence community, signalling a growing preference for leadership with operational defence experience. These firms are also leveraging media narratives and advisory roles to align Pentagon agendas with Silicon Valley’s interests, effectively creating a new lobbying class that merges venture capital with national security policy.

Conclusion

The rise of software-defined, AI-integrated, and modular defence systems signals a fundamental shift in how military power is being reimagined. The integration of intelligence, speed, and adaptability into defence platforms is no longer a future ambition but is becoming an active reality. For India, this evolution offers important cues. Programmes such as IDeX, DAIC, and DAIPA show that early steps have been taken to support innovation and AI integration in defence. However, as global players move toward more adaptive and integrated systems, there is a growing need for India to keep pace by enabling faster development cycles, closer collaboration between users and innovators, and a stronger focus on technologies suited to its own strategic needs. The priority should be to build systems aligned with India’s unique operational requirements, particularly across domains such as space, edge autonomy, and real-time command platforms. As the architecture of modern warfare continues to evolve, India’s ability to adapt, absorb, and innovate at scale will be crucial in shaping its strategic autonomy and defence resilience.

This commentary originally appeared in Observer Research Foundation.